With a rocky road ahead for their core offerings, triple play operators are having to weaponise customer care in order to keep a hold on their revenues. Traditional OSS/BSS offerings are not up to the job, which has given rise to a new breed of vendors, focused on improving QoS and customer experiences with household-level analytics.

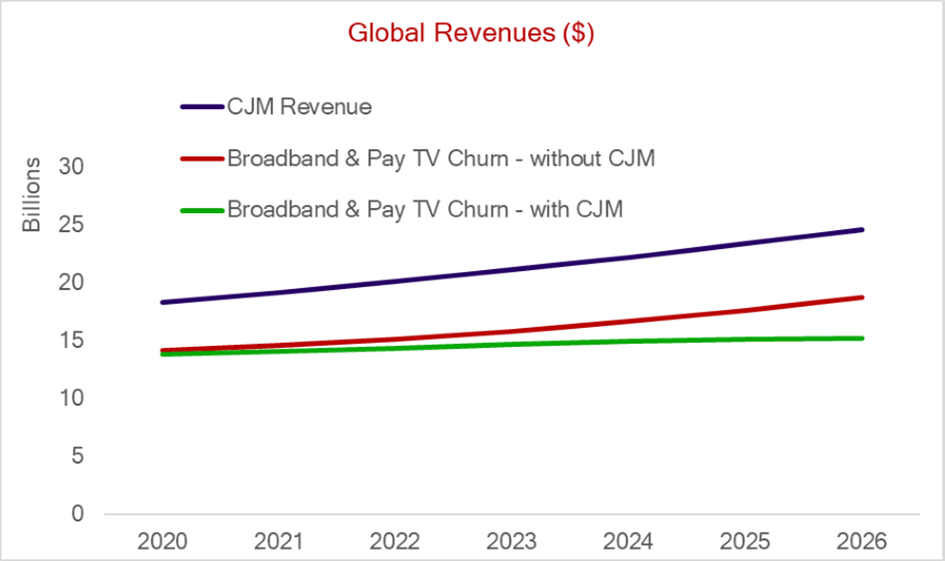

Rethink TV has grouped these vendors under a new umbrella term it has coined called ‘Customer Journey Management’ (CJM), and the company forecasts that this market will grow to $24.6 billion(€20.05 billion) by 2026 – across the Broadband and Pay TV segments. Through the forecast period, this will save operators $10.5 billion(€8.56billion) in churning revenues, as high-level, granular analytics allow operators to improve their QoS at a household level.

This growth of CJM offerings is rooted in wider market pressures that are fuelling rising churn rates. In Pay TV, the rise of over the top (OTT) players, and the subsequent wave of cord cutting, has made understanding customer content needs essential, in order to retain their interest. In Broadband, the widespread availability of the service, with ever more entrants into the market, has rendered it a utility – where prices get competitive quickly. Ensuring a high quality of service is the best way for operators to retain customers here.

With increased exposure to more data points, AI-assisted CJM offerings will see increasingly better impressive. By 2026, CJM offerings will reduce Pay TV churn by 12.61%, a saving of $1.6 billion (€1.30 billion) globally. This reduction is even greater in the Broadband sector, says Rethink, where CJM offerings will reduce churn by 26.26% in 2026, saving operators $1.9 billion (€1.55 billion).

The cloud-based and modular nature of CJM offerings means that they are generally priced flat across the world, and as such, the monetary value of this market is in stark contrast to many forecasts in the triple play world. Populous regions with low ARPU, such as Asia Pacific, will see operators spend the same on CJM offerings on a per subscriber basis, meaning that by 2026, Asia Pacific spends $11.8 billion (€9.62 billion) of CJM revenue – 48% of global spend.