Even in 2017, it’s not always possible to describe typical digital interactions as “intelligent”. Certain online retailers have their act together, recommending products based on previous purchases and offering discounts either in real-time or during relevant times via email or social media.

Banks send reminders to pay credit cards on time, but aside from a consistent experience on their online banking portal, that is pretty much it. All these experiences are effective, and all of the interactions are fairly seamless, but it begs the questions: What exactly IS an “intelligent digital engagement,” what makes it intelligent, and where is it the most relevant?, says Paul Hughes, director, Strategy at Netcracker Technology.

An intelligent digital engagement is an interaction, or set of interactions, where the service provider and the user are proactively aligned around the provision and receipt of product or service, and that interaction that can morph in real-time based on a specific circumstance. That may sound like a mouthful, but it’s just describing the most proactive and flexible of customer experiences.

An intelligent engagement cannot actually be “intelligent” without three key principles that work seamlessly together.

- First, the business has to be able to analyse service, system and customer data to gain a real-time perspective on the effectiveness of each individual engagement. These data sources need to be reviewed for patterns, organised for effectiveness and used to determine the root causes of service successes and failures.

- Secondly, the business must engage effectively, building the most appropriate relationships with customers based on service usage and consumption endpoint, inclusive of real-time customers, all while proactively interacting with customers across external and internal sources, from social media to emails and surveys.

- Third, the business must have the capability to personalise the engagement to create a targeted customer experience that satisfies a customer or group of customers based on demographics, preferences and behavior.

Nowhere is intelligent digital engagement more relevant than in the communications service provider community. Whereas customers typically don’t change banks unless absolutely necessary, the ability to change service providers takes all of five minutes at a retail store or via a quick swap of SIM cards.

Unlike online retailers or banks, who typically have more cemented customer relationships, the CSP needs differentiation in its constant battle against like competitors, outside forces, and yes, even themselves.

With new customers few and far between, the only way to drive business is through the launch of new, innovative services, and through a broader engagement strategy with the existing customer base. That engagement, however, can’t succeed without a comprehensive digital engagement strategy that uses all available data sources to achieve the best possible outcome.

While each of these steps to an effective and intelligent digital engagement may seem simple on its own, all three must be combined using a cohesive IT strategy and avoiding the tactical methods of the past.

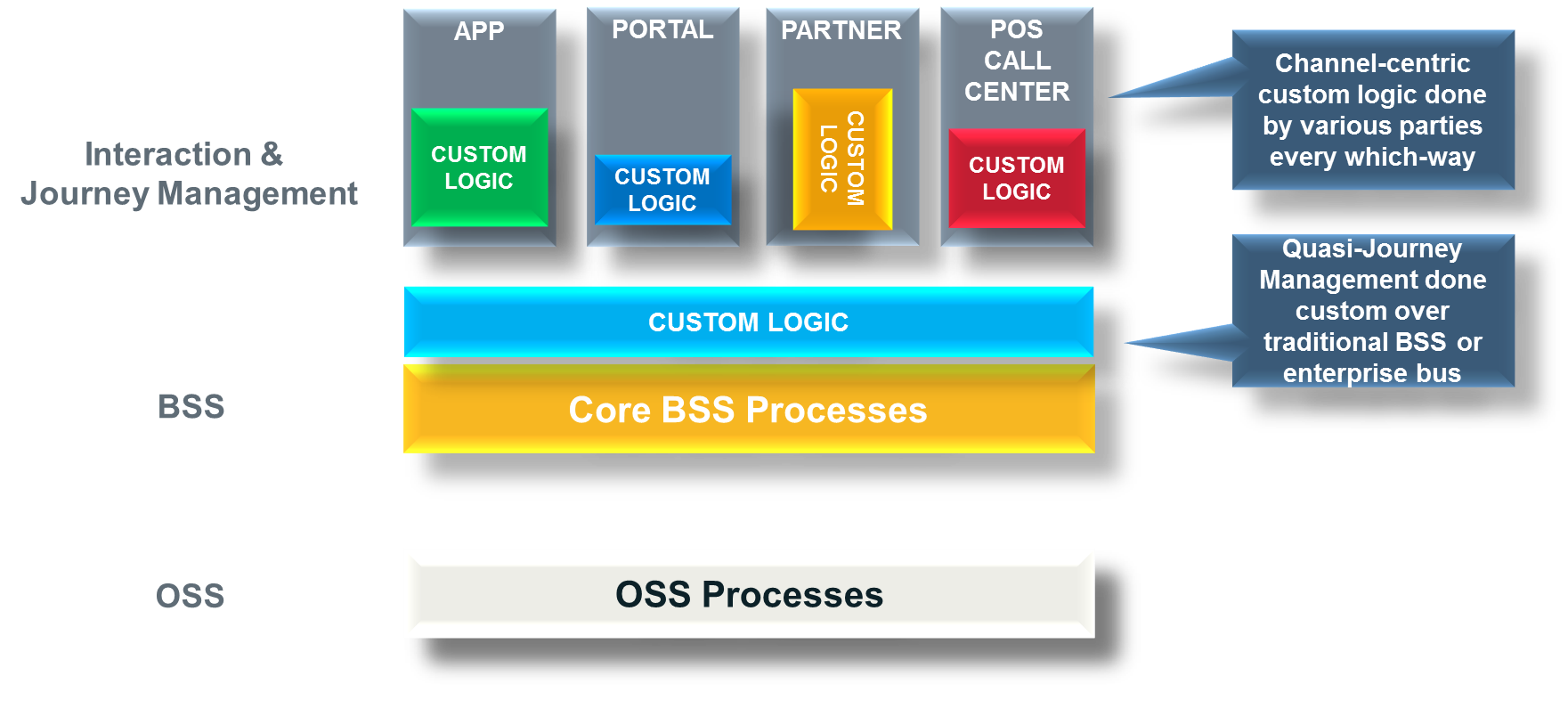

For most CSPs, digital engagement has been a piecemeal process of interaction seen in Figure 1, with customers coming in via a web portal, phone app, call centre or retail store, each with their own custom logic that may work for one channel but not another. Drop down to the BSS layer, and typically one will find more custom logic to link billing and related data to each of the above customer facing interfaces. Again, this works, but it is not efficient or intelligent.

Figure 1. Tacitical approach to digital engagement

Source: Netcracker Technology

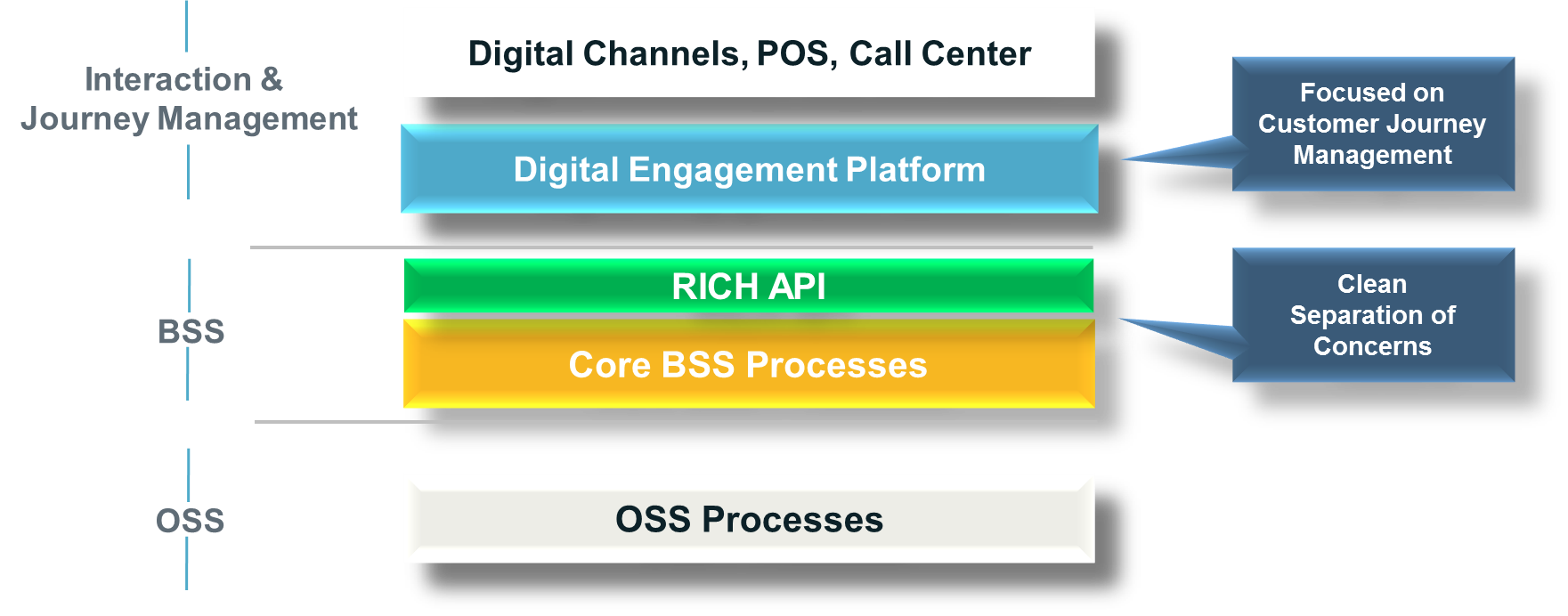

Figure 2 shows an architecture that allows for intelligent digital engagements. Through the use of a digital engagement platform, there is no need for any custom coding or data management processes across the customer facing aspect of the CSP’s business.

A single architectural layer becomes the link to the CSP’s customer-facing systems and centralises all relevant data to create a unified approach to data management. This in turn facilitates the focus on the customer journey by uniting the data sources together, determining relevance and increasing the effectiveness of personalisation.

Figure 2: Strategy approach to intelligent digital engagement

The BSS layer benefits from a single, rich API that allows direct linkage between the BSS and Digital Engagement layer, again, simplifying the data management process.

This strategic approach to an updated order-to-cash-to-care architecture becomes the foundation for what will enable an intelligent digital engagement.

CSPs will benefit from the ability to:

- Design, execute and dynamically change customer journeys across channels, something that becomes a significant benefit for management of high value—but high churn— oriented customers that constantly look for the next best offer or related need

- Deliver the right content at the right time through the right channel to the customer. This is increasingly important in today’s 4G and tomorrow’s 5G and fibre centric world, where the lack of bandwidth restrictions will allow CSPs to get creative with both internally-sourced and partner-sourced content

- Engage customers proactively, to promote services that the CSP knows they are interested in based on the new unified data management processes, and be able to change the role of the service provider from passive to truly active in the relationship

- Make informed decisions by tracking a variety of KPIs across journeys, customers and channels, adding new levels of efficiency and profitability to the business thanks to more direct and unified processes up and down the IT stack

- Integrate seamlessly to existing IT systems, using technology layers that do not disrupt the customer or business facing layers, but act to link them together more effectively, thus actually increasing the life of existing revenue and customer management systems.

The move to intelligent digital engagement for any CSP ultimately brings a new solutions approach to expanding the customer engagement to new revenue potential and increased ARPU.

The end goal, strategically, will be a newly efficient order-to-cash-to-care process where the CSP can seamlessly transition from being a transaction-driven provider to a service “visionary” that can agilely deliver the right services at the right time, and deliver a rich proactive customer experience. The end result could potentially increase the permanence of a CSP in the user’s mind, much the way they perceive their bank. For any CSP, that end result would be a resoundingly positive one.

The author of this blog is Paul Hughes, director, Strategy at Netcracker Technology

Comment on this article below or via Twitter: @ VanillaPlus OR @jcvplus