Carriers in SE Asia face a particularly challenging 2018 in the face of twin challenges. The familiar issues of increasing revenues and market share in a fiercely competitive landscape remain to the fore, with pressures to reduce costs and find ways to win new and retain existing customers front of mind today.

At the same time, says Keith Brody, head of Communications at DigitalRoute, the challenge of readying for digitisation is the forefront. All this means a demanding year for those running BSS and OSS.

The obvious answer to improving revenue generation lies in service innovation; becoming more attractive to customers by offering the enhanced services users want. But as networks, service delivery mechanisms, and services themselves rapidly evolve, this becomes more complex because an enhanced IT infrastructure is required to deliver them. More and more, legacy IT is no longer fit-for-purpose.

CSPs are working in a landscape that is slowly becoming more complex. 5th Generation mobile represents one manifestation of a new digital world in which they are increasingly operating; the Internet of Things, the Cloud, and APIs are others. These evolutions afford new opportunities to innovate but taking advantage is not a matter of ‘plug and play’.

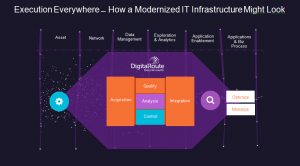

Thus, while opportunities for revenue generation are many, delivering the infrastructure required to enable them to be exploited commercially is not straightforward. Still, telcos have little choice but to adapt. The reality is that CIOs must integrate new functional capabilities at speed, and without disruption to existing business in order to deliver new service (business) models. They must identify new avenues of value creation, sometimes involving unfamiliar open ecosystems that demand digital agility, impact network-effect technologies and enable access to new sources of revenue.

The impact of taking these steps will be felt on the bottom line both immediately and in the long-term. A fit-for-purpose enabling infrastructure opens the door to increasing market share by putting the CSP in APAC in position to both better understand customer needs and to deliver the required services.

The present status quo, where CSPs’ legacy operational and business model infrastructures are constraining their pursuit of new sources of revenue (due to the limited scope of transformation efforts to replace unsuitable legacy architectures), is not sustainable.

Despite this leading analyst firm, Gartner, reports that only a small number of CSPs are proactively transforming their networks, IT and applications to meet the requirements of the evolving market. The majority know that change is necessary but are unclear exactly how to make it happen. As a result, many short-term CSP strategies tend to reflect pushing ‘bandage’ technologies into the core of products and services instead of being long-term, supporting or enabling components.

This, clearly, is not a long-term recipe for success and has to change. Change means that IT-related activities able to accelerate the route to new revenue sources are critical. In fact, Gartner argues that 2018 planned levels of average investment in digital initiatives – around 35% – must be accelerated and more closely aligned to strategic business outcomes as a matter of priority. In the APAC market, where competition is particularly fierce, this is a priority.

The vexing question, as noted already, is ‘how?’ For CSP technology leaders, responsible for modernising IT operations and networks to support the quest for enhanced revenue streams, there are a number of clear and immediate priorities.

Foremost among these are:

- The adoption of digital friendly platforms, programmable networks, artificial intelligence and open-source components through business process re-engineering, architectural and organisational changes.

- A structured approach to utilising technology as an essential ingredient of future operating and business models. This will require telcos taking a ‘broader’ perspective on infrastructure development and design than ever previously required. They must think outside existing operational siloes.

Despite being on the edge of opportunity, by 2023 it is projected that only 1% of CSPs will be able to boost revenue from innovative services. This is largely because legacy enabling infrastructures cannot translate innovation potential into income.

Specifically, the situation is commercially unsustainable. To counteract it and design effective solutions to support new network architectures and service delivery mechanisms, addressing questions of integration will be the bedrock of future success. This is because innovation demands far greater and more complex integrations than ever before.

Examples of this include:

- Interaction through platforms.

- Orchestration for efficiencies.

- Intelligence for automation.

- Adapting to deliver flexibility.

- Enabling digital operations.

To position themselves to commercially leverage new commercial opportunities, telcos urgently need to renovate their core legacy application infrastructures to enable them to better facilitate customer engagement and enterprise productivity. They must do this in the face of a landscape where, on average, 16% of their applications are more than 15 years old and change means addressing the complex, spaghetti-like integrations they have built over many years.

I believe that this means new investments have to be architected with open platforms and open APIs in mind, enabling interoperability to allow for a successful participation in the emergent long-term digital ecosystem that will come to the fore over the next twenty-four months.

The author of this blog is Keith Brody, head of Communications at DigitalRoute

About the author:

The author, Keith Brody, has worked in telecoms BSS/OSS for almost 20 years as a journalist, analyst and marketing and communications expert for Financial Times Telecoms, Ovum, MetraTech and DigitalRoute among others. His writing has appeared in numerous publications, books and newsletters on subjects including telecoms and beyond. He is presently head of Communications at DigitalRoute.

Comment on this article below or via Twitter: @ VanillaPlus OR @jcvplus