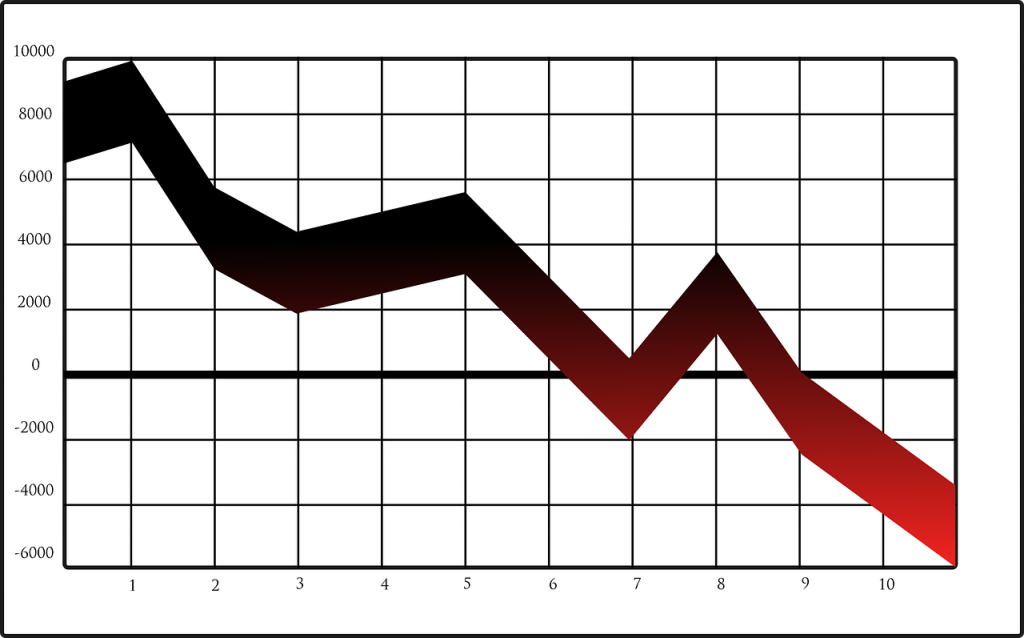

Telco revenue continues to be on the decline, but business technology journalist, Antony Savvas says developments are afoot to help alleviate the pain.

According to technology industry analyst Research and Markets, global telco revenues dropped by 6.6% year-on-year in the third quarter ending September 2022, reaching a total of US$435 billion (€401.6 billion). The fall was the fourth consecutive slump in the industry and surpassed the second quarter’s 6.2% decline.

Widescale decline

The “Telecommunications Network Operators: 3Q22 Market Review” report continued to track revenue, CapEx (capital expenditure) and employee numbers across 140 major telcos globally, and for 80 of them, it also looks at labour costs, operating expenditure (OpEx) and operating profit trends.

Research and Markets says inflationary pressures, slow economic growth and energy prices in particular have impacted many telcos. While some individual telcos did increase their sales in the quarter, no telcos among the top 20 operators by annualised revenues were able to post double-digit growth rates.

The analyst added that actual growth seen at some operators was mostly down to non-service revenues, as these have grown with 5G device sales in many markets.

“Telcos now hope the 5G-enabled devices already deployed will help to generate new revenue streams in 2023 and beyond,” says Research and Markets.

Telco investments also declined for the first time since the fourth quarter of 2020, by 5% on a Year-on-Year (YoY) basis, to total $77 billion (€71 billion) in the third quarter of 2022.

Job cuts

The telco industry’s headcount was 4.59 million in 3Q22, down from 4.70 million a year ago. The analyst expects headcount reductions to continue, heading towards 4.12 million by 2027.

Labour costs continue to be on the rise though on a per-person basis. Even as telcos cut headcount, they recognise how key their workforce is to success. Labour’s share of OpEx will, therefore, remain “relatively steady” as the average employee becomes costlier.

As total headcount comes down, Research and Markets says telcos will revamp their processes, investing in digital transformation, and adopting more automation. Strategic cost optimisation measures that telcos will pursue over the next 2-3 years will include core network sharing, network slicing and partnerships with cloud hyperscalers, it adds.

Making up the slack

While enterprise services business has been a key focus for telcos over many years, it is believed that the small to medium-sized business (SMB) sector could be an increasingly important one for telcos when it comes to reversing the sales slump.

Tech and telecoms analyst firm, Analysys Mason has released its predictions for the SMB technology market in 2023 and suggests spending will grow 6.3% annually to $1.45 trillion (€1.34 trillion) worldwide. It also predicts a “shake-up” in how vendors, resellers and telecoms operators will sell to the SMB market.

The analyst says SMB behaviour has “shifted significantly”, resulting in more demand for cloud-based and as-a-service solutions. In response, it says providers will consider SMBs as “enterprise-lite” accounts that will need greater levels of service and support.

SMBs’ IT spending through MSPs (managed service providers) is expected to grow by 11% year-on-year, and expenditure on cyber security solutions will increase from $69 billion (€63.7 billion) in 2022 to $77 billion (€71 billion) in 2023.

Illustrating the rising telco opportunity, Analysys Mason says SMBs will spend over $66 billion (€60.9 billion) on IT solutions from telecom operators.

“SMBs will increasingly look to telecom providers for IT advice, support and services,” says the analyst. It adds, “80% of SMBs would consider taking IT services from telcos, who are creating targeted IT service bundles for SMBs, and partnering with software/service providers to help them reach a broader SMB market.”

Taking an advertising slice

US “big tech”, including the likes of Google, Meta/Facebook and Apple, has, up to now, dominated the digital advertising space. A large chunk of those ads are delivered over the networks built by telcos. Now, Deutsche Telekom, Vodafone, Orange and Telefonica are after their own significant slice of the market.

Those big European four are setting up a joint venture to support a new form of targeted digital advertising, based on customer’s network subscriptions and activities.

They have filed for competition clearance from the European Commission to go forward with the venture, who would be seen to be pretty tight in not giving them clearance, considering the ad market advantages and network squatting that Big Tech has enjoyed over the last 20-plus years.

The telcos say they plan to offer a “privacy-led digital identification solution, to support the digital marketing and advertising activities of brands and publishers”.

The platform would allow advertisers and publishers to provide customers with a personalised ad experience on their websites, apps and services, if they have given explicit consent first. The customer targeting would be via a digital token assigned to each user, who would remain anonymous to the advertisers, to help maintain personal data privacy.

It’s a clever initiative from the telcos, who are responding to increasing concern among consumers about how their online activities are tracked and their identifiable data is managed, or mismanaged, by Big Tech.

“Digital advertising is going through a turbulent period and operators will hope to seize a fresh opportunity amid growing economic headwinds,” says Kester Mann, principal analyst at CCS Insight, speaking to industry organisation TM Forum.

He adds: “A fresh and open approach could resonate with the growing number of customers who are becoming increasingly wary about what happens to their personal data and how it is extracted. Taking a user-friendly approach, like enabling control through an online portal to manage consent [which the four telcos are planning to allow], could allay some of these concerns.”

A wider pitch to SMBs, a more understanding approach taken by regulators like the European Commission towards the market difficulties faced by CSPs (communications service providers), and scale-ups towards more services built around 5G and IoT, will help telcos in a tight market no end.

The author is Antony Savvas, a global freelance business technology journalist.

Comment on this article below or via Twitter: @VanillaPlus OR @jcvplus