It’s almost a truism to say that enterprises make their network connectivity purchasing decisions differently than consumers. In addition to having more choices, they have increasingly specific needs, coupled with the ability to deeply analyse the services they purchase, writes Michael Soulakis, the vice president of IP Optical Networking at Ribbon Communications.

This diversity of choices and needs means that for enterprises, many purchasing decisions are based at least in part on the contribution these make to the operational efficiency of the business, and not just on the cost of the service being provided. Most everyday consumers on the other hand – leaving aside those with an almost professional dedication to gaming – are usually focused solely on getting faster connections for lower prices. The result is that, while generating revenues within the consumer market will depend to a large extent on mass market success to deliver economies of scale, the key to unlocking value within enterprise markets runs through targeted specialist services, delivering demonstrable value that relies on the unique capability a 5G network provides.

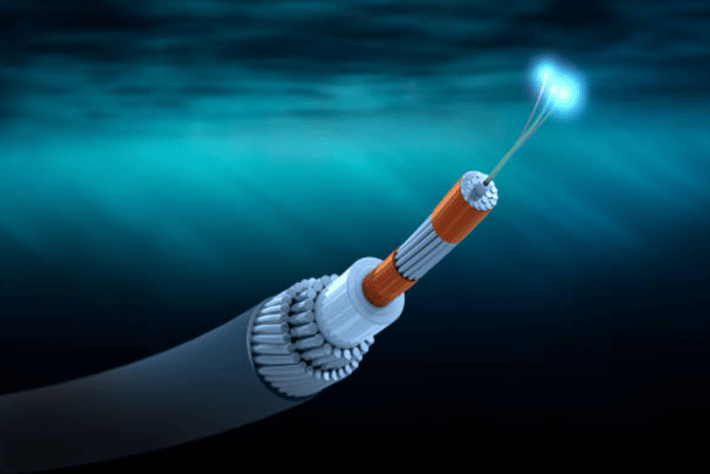

Of course, not all 5G networks are capable of delivering that level of targeted connectivity. Only those 5G networks that have dedicated transport connections will be able to offer this wider range of specialist services. Early 5G deployments, which were built to rely on existing 4G transport infrastructure as their backbone rather than as stand-alone networks, are not equipped to deliver the required variety of guaranteed specialist services end to end. To unlock key 5G features, such as network slicing, and create the lanes that can support these specialist services, communications service providers (CSPs) will need dedication in the optical transport network that can match and sync with the dedication 5G can offer in the radio access network (RAN).

Certainly building these new networks will be a major project, which is most likely to be carried out step-by-step as the networks evolve through 5G and possibly even onto the next 6G network iteration. The catch is of course that the CSPs that wait the longest to overhaul their backbone will be the ones with the smallest market left to address and the least opportunity to reap the rewards thereof.

Follow the money

So, how can CSPs bridge the gap between resource constraints and attain the pot of gold that these enterprise-specific services purport to deliver? Go where the money is – a simple formulation that has stood the test of time. One way to do that is to start by specifically targeting locations where the specialist services will most likely be required with dedicated 5G connectivity. Large manufacturing plants, campus style offices and business parks, major retail or sporting venues are among those likely to provide the highest return on investment for private 5G network link roll-outs.

Of course, the competition is fierce for this pot of gold: not only are rival service providers circling the wagons, enterprises themselves are potentially in the arena – with many of the upcoming 5G services connected to highly sensitive applications, some enterprises see the benefits of going the private route and building their own 5G networks, along with the supporting backbone infrastructure that would enable specialist services to flourish. This is only aided by the trend we see of regulators who are increasingly considering awarding 5G spectrum licences directly to enterprise customers.

Enterprises may choose this approach for a number of reasons, including the option to build a network to their exact speed and latency specifications, while ensuring availability and resilience through techniques such as synchronous data replication across their own private optical backbone.

Does this mean that CSPs are currently caught between a rock and hard place? After all, they are not in a position to overhaul their entire transport and backbone network quickly enough to support full 5G everywhere, and also run the risk of losing lucrative business to enterprise customers who opt for a do-it-yourself approach.

Routes to value

We believe that rather than considering themselves in a bind, CSPs should be thinking that two routes have now opened to reap the rewards of the higher value enterprise 5G market.

First, targeted upgrades of the optical transport layer of their network can be implemented to support the locations of their enterprise customers. Second, enterprises considering private 5G networks are unlikely to have the required resources and skill sets to build those networks themselves. CSPs could therefore adopt a position as the natural partner to design, build and operate the end-to-end private network for enterprise customers through a Network-as-a-Service option.

The key to both these approaches lies not just in 5G and the network technology that will be used; rather it is in the dedication to designing and promoting the services that these technologies can support. CSPs that can demonstrate an understanding of the business and operational requirements of their enterprise customers that could be served by dedicated 5G networks – rather than just an understanding of the technology – will be best positioned to sell those specialist services.

Having sold the services, the only question to answer is what is the most cost-efficient way to deliver it – via a dedicated private network the CSP provides, or via a dedicated share of the public network?

And of course, this isn’t a new question for those customers or indeed for the CSPs. Today, both parties are already making decisions about whether to buy private space within a public cloud provider, or to create their own cloud resource. Taking the same approach to the 5G network is not a big leap and offers a path to success for CSPs and enterprises alike.

Comment on this article below or via Twitter: @VanillaPlus OR @jcvplus