Bristol, UK. 31 January 2022 – According to Rethink Technology Research, authors of the report, Multicast-ABR (Adaptive Bit Rate) Market Forecast 2022-2027, Multicast-ABR seemed poised to explode onto the scene just a few years ago. It promised to significantly reduce the load placed on operator access networks, but now the industry has wildly reset its collective expectations.

Comcast appeared to be the biggest single user of the technology in 2015, giving presentations on the savings that Multicast-ABR would afford in the coming years. However, Comcast never deployed the technology, and that decision seems to have rocked the industry’s confidence.

Multicast-ABR (M-ABR) has been making inroads, particular among operators that cannot simply throw money at their access networks until their bandwidth concerns recede. The prevailing corporate wisdom has been analogous to the old adage about not being fired for purchasing IBM equipment. When compared to investments in the physical network infrastructure, M-ABR looks relatively risky.

There are two main use cases for M-ABR. The first is migrating legacy broadcast television infrastructure into an IP-native format, without relying on using the current approach of unicast HTTP streams for each distinct viewer. M-ABR would serve all manner of devices, unlike the multicast IPTV deployments that can only serve a set top. The second main use case is reducing the burden of unicast OTT streams, both from internal traffic on the operator network, such as its own video service, but also from third-party OTT services that are open to commercial agreements with the operators.

M-ABR will find most success among operators who cannot simply buy more network capacity, or rather, among the ones that realise that M-ABR could be much more cost effective. In broader and longer-term trends, the move away from TCP and toward UDP, as part of work on HTTP/3 and parallel Web 3.0 trend will open more doors for M-ABR, but those extend past the five-year scope of this forecast.

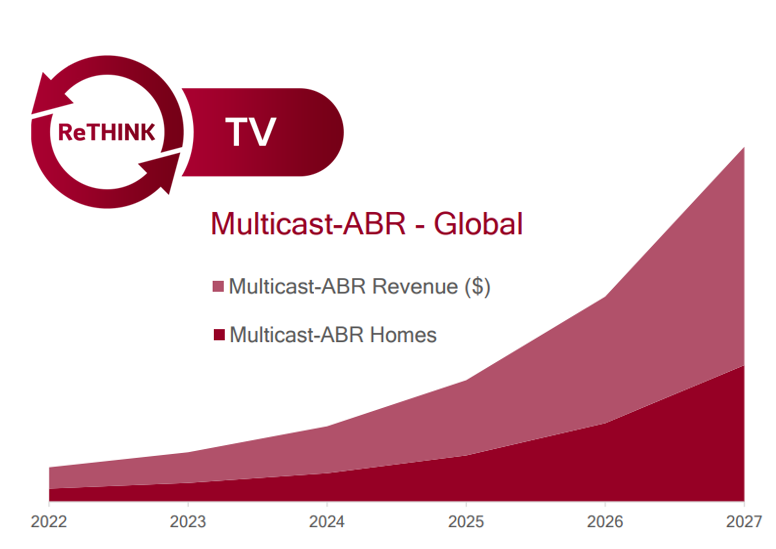

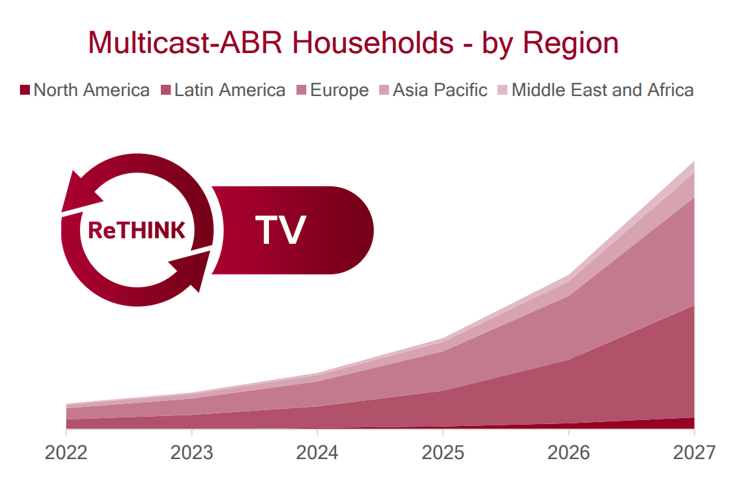

The headline figures for our market assessment of Multicast-ABR among operator deployments are a total footprint of 88.8 million homes in 2027, and annual revenues of $142 million (€125.99 million). Unlike most of our forecasts, North America is the worst performer, but does post the strongest growth once it wakes up to the new potential of the technology.

M-ABR provides a way to provide live video streams in the familiar ABR format, to serve both the TV and other video devices in the home. M-ABR can be deployed on the set top or the home gateway, and is essentially a way to serve an audience in a much more bandwidth efficient manner than sending every viewer a unicast ABR stream. This is also suited to migrating legacy broadcast TV systems, into an IP-native workflow.

Support for M-ABR from vendors is now fairly widespread. Operator CPE is now almost certainly compatible with M-ABR approaches, and M-ABR support is commonly found in the criteria for RFPs. However, what is lacking is enthusiasm from the operators to push forward with M-ABR once those RFPs have been awarded. This is due to the aforementioned preference for network investments, rather than new technology pursuits.

Our current projection is a continuation of this status quo, but there is undoubtedly a chance for major upheaval albeit a slim one. The Covid pandemic placed a short-term strain on the operator access networks, with many pointing to the OTT providers, particularly Netflix, reducing the bitrate of their streams as proof that the network was at capacity.

However, there were no major outages, and operators instead looked to their dark fibre resources as a priority. Lighting up those already-installed network assets became a priority for operators, which will have further reduced their immediate need for M-ABR. Still, there will be some operators that cannot simply spend their way out of such bandwidth holes, and many more that will be evaluating how to move past their legacy broadcast video infrastructure. These are excellent opportunities for M-ABR vendors.

Comment on this article below or via Twitter: @VanillaPlus OR @jcvplus