The World Bank estimates that 1.5bn people within developing countries lack any formal ID and therefore cannot access a range of vital services. Now, the Bank has announced ten principles of ID to support its Identification for Development (ID4D) programme. Here, Steve Polsky, the chief executive and founder of Juvo looks at how mobiles can drive ID and how the application of data science can drive new services and revenues.

With the World Bank and the United Nations turning their attention on the 1.5bn individuals in the developing world without any formal means of identification, the two organisations could do worse than look to the mobile operator community to reduce that number and help fuel engagement and the roll out of new services.

But first, the operators themselves need to do something to tackle their own identity problem. Strikingly, some 77% of the world’s 4.9bn mobile users are also largely undocumented. And there’s also a better than even chance that a very sizable proportion of the World Bank’s 1.5bn people without ID can be found among the 3.7bn anonymous pre-paid mobile phone customers.

But although they may not know exactly who these 3.7bn people are, operators are sitting on a wealth of exact data about each of the individuals concerned. Unlocking that data through the application of data science can help them to learn enough about these customers to help establish digital financial identities that can be the key to a world of new possibilities and services.

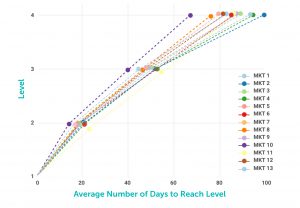

We recently released a study that covered 13 different countries with widely varying GDPs that demonstrated some remarkably consistent returns, as illustrated in Figure 1. With expert analysis of the data that communications service providers (CSPs) can collect, we proved conclusively that it was possible – regardless of the apparent wealth of the individual concerned or the perceived strength of the national economy – to not only create the digital financial identities but also to walk the customers up a pathway of financial services including access to simple credit.

These types of services are typically not available to undocumented or unbanked individuals, but can be reliably introduced when data science has been applied by experts in analysis, modelling and forecasting. We showed that the ability to behave responsibly with credit can be judged accurately based not on income, but on the scientific analysis of our behaviour and the footprint we leave as our digital identity when we use our mobile. Unlocking access to financial services in this way can help the World Bank achieve its ID4D goals and help improve standards of living.

And for the operators prepared to invest in the science of data there’s another immediate benefit. Our report showed that establishing digital financial identities for pre-pay users could reduce churn by as much as 50% and increase ARPU by 10% . The overall effect is to dramatically increase engagement and effectively double for operator the customer lifetime value of each subscriber. In fact, we estimate that using data science to drive mobile financial services could boost global operator prepaid revenues by some $70bn. Properly applied, data science can be not only for a force for real societal change, it can also protect and unlock revenues for operators.