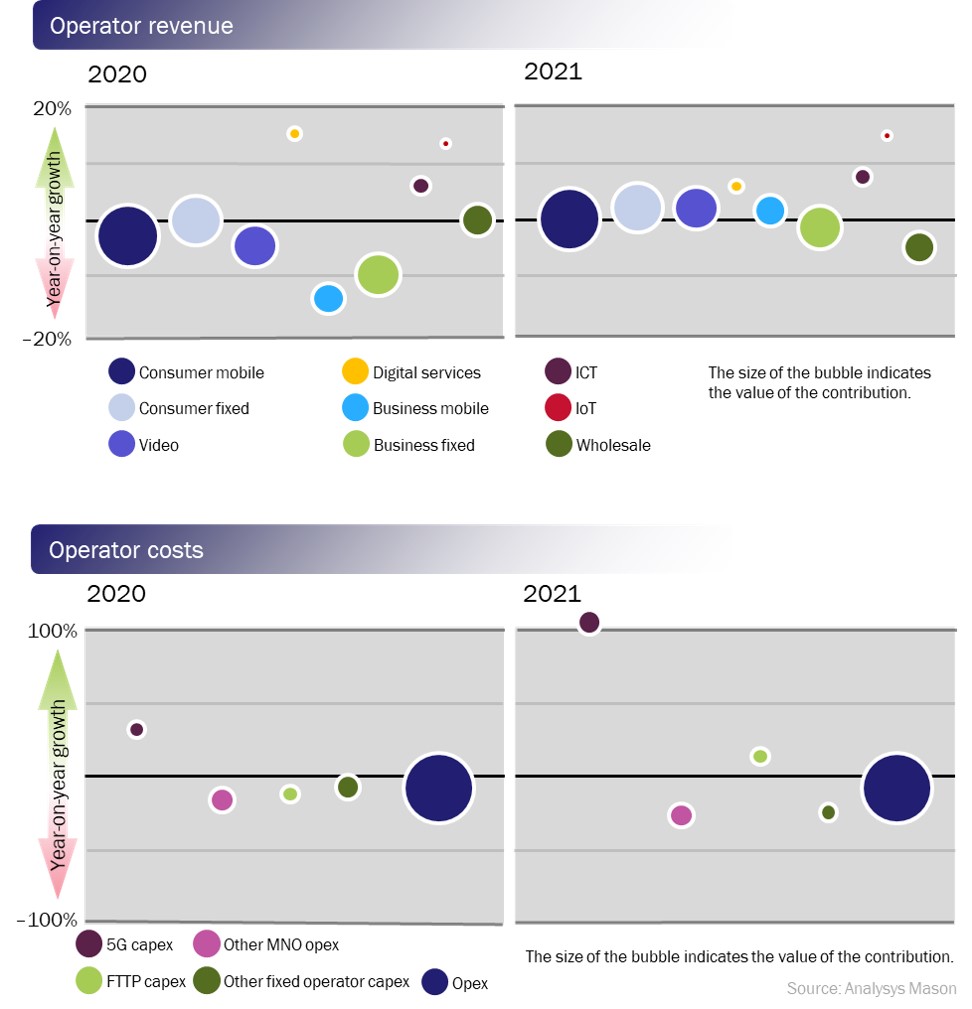

Revenue for telecoms operators will fall by 3.4% in 2020 compared to 2019 due to COVID-19, before returning to growth (0.8%) in 2021. This is according to a new impact assessment report published by Analysys Mason.

The UK-based analyst firm had previously forecast growth of 0.7% in 2020 and 0.8% in 2021. The overall impact for operators in developed economies is ‘lost’ revenue of more than US$40 billion (€36 billion) in each year.

The report argues that telecoms is a relatively resilient sector and will perform ahead of general GDP trends. Analysys Mason expects telecoms to account for 2.0% of GDP in 2020, an increase from 1.9% in 2019.

“Consumer telecoms services, which account for the majority (68%) of telecoms revenue, tend to be relatively resilient during economic downturns,” says Stephen Sale, research director and co-author of the report, “but large increases in unemployment, business closures and the overall decrease in economic activity will cause a sharp decline in business services revenue.”

Operators should be able to limit the impact on profitability. Operator capex is likely to fall in 2020 because of constraints in the ability to build and because of disruption to supply chains. The pandemic will reinforce and accelerate existing downward opex trends rather than introduce new ones. Profits will fall, but we do not expect overall EBITDA margins for the sector to decline by more than 2% points.

“Telecoms should stay healthier than almost any industry in this crisis,” adds Rupert Wood, research director and also co-author of this report. “Telecoms should show some of the strongest post-crisis investment, in part because cashflow is more resilient in the telecoms sector than it is most others, and because some governments will emphasise 5G and fibre in stimulus packages.”

The report, available at www.analysysmason.com/covid-19-operator-revenue-impact, explores and quantifies the impact of COVID-19 on different categories of revenue – consumer mobile, consumer fixed, digital services, pay TV/video, business mobile, business fixed, ICT, IoT, wholesale – and capex and opex spend, also by category.

The impact assessment focuses on aggregate of 32 developed economies across Asia, Europe and North America. It is based on an assumed fall in GDP for these countries of 6% in 2020 followed by an increase of 4.6% in 2021.

Comment on this article below or via Twitter: @VanillaPlus OR @jcvplus