The telecoms industry has undergone a remarkable transformation over the past few decades, evolving from basic voice services to a complex ecosystem of data, content and connectivity.

In the realm of constant evolution, where technology, services and network standards are undergoing

rapid transformations and the core telecoms services are heavily commoditised, the communication

service providers (CSPs) are compelled to cater to dynamic customer expectations in order to stay

competitive while maintaining a constant cost imperative. As such, their strategic focus has shifted

towards helping their customers cruise seamlessly through the buying journeys that bypass the

complexities to deliver exceptional customer experiences, writes Monali Supramanyam, the global

product marketing head for the Monetization Suite at Amdocs

“I think we can all agree that churn is an obsession among CSPs, but I have never heard a provider reference or even consider billing as a churn or retention trigger”

Billing is a pivotal component of this customer-centric approach, an element often underestimated in its impact on overall customer satisfaction.

The fast-paced world of telecoms requires CSPs to be adaptable, agile and proactive. The advent of 5G technology, the Internet of Things (IoT), and the growing demand for third party applications has ushered in an era of unprecedented innovation. New services supported by new and innovative monetisation models entice customers to expect more. Telecoms companies find themselves in a delicate dance, striving to bring in and monetise cutting-edge services while managing the complexities of back-end systems, including billing.

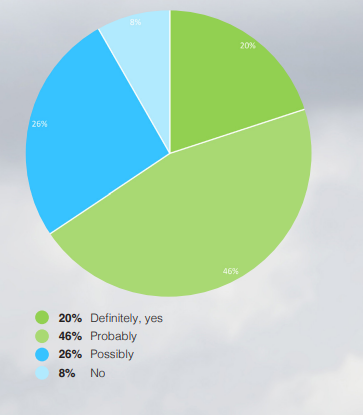

Navigating this telecoms tightrope is not without its challenges. CSPs believe they are on the same page as their customers, confidently introducing new services into the market and striving to keep costs in check. However, as evident in a recent survey conducted by GlobalData in collaboration with Amdocs, the harsh reality paints a different picture. A significant gap exists between what telecoms companies offer today and what consumers truly desire in the new age world. Hence, the telcos must walk the tightrope not across a meadow but a chasm to meet those expectations.

“I think we can all agree that churn is an obsession among CSPs, but I have never heard a provider reference or even consider billing as a churn or retention trigger,” says Emma MohrMcClune, the chief analyst and practice lead – Telecom at GlobaData. “That’s clearly a mistake. The results of this study shows that CSPs need to go back to the drawing board on billing, and potentially rethink this important dimension of their overall proposition.”

So, what are the primary challenges facing telecoms companies as they attempt to bridge this gap and deliver on customer expectations while managing billing complexities?

Does one size fit all?

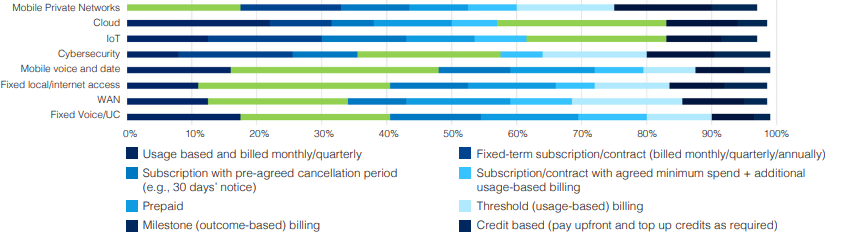

The billing landscape is experiencing a significant shift, with subscription billing becoming increasingly popular across industries. Telecoms service providers are also hopping onto this trend, investing in additional billing systems to facilitate this model. While some CSPs are inclined to believe a ‘one size-fits-all’ subscription model is the future, the recent GlobalData survey suggests a more nuanced reality.

“There’s a notion amongst service providers that all transactional engagement of the future is going to the subscription model,” adds Mohr-McClune. “What our survey responders are clearly telling us here is that subscription is not the only game in town. For certain services, such as gaming, TV or cloud storage, they have a clear preference for other billing models.”

According to the survey, customers want choices when it comes to billing. They favour different pricing and monetisation models for varying services. While subscriptions might be preferred for some services like voice, text and data, customers have opted for pay-as-you-go or tiered pricing for add-on services like streaming, international calling, or premium content and even emerging models like threshold pricing and milestone-based billing options for emerging services like private enterprise networks (PEN) and Industrial IoT

Gary Barton, a research director at GlobalData says: “The respondents we spoke to made it clear that providers need to offer a range of billing options – there is no one size fits all and a failure to offer the right option will result in losing customers.”

So why doesn’t one size fit all? Because every customer is different in their approach and behaviour, and their needs are different too. Some customers are heavy data users who stream video or play online games, while others may primarily use their service for calls and text messages. The early adopters may want the latest 5G or IoT service, while others may be fine with just basic connectivity. Speed and performance are of higher value for some, whereas some prioritise clarity and control.

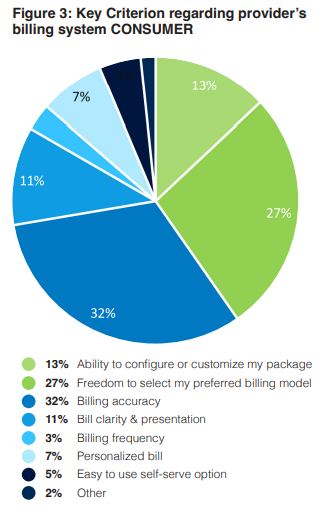

Accuracy versus flexibility

While CSPs may think accuracy is the most important criterion, do their customers feel the same? Telecoms companies have traditionally placed a strong focus on ensuring the accuracy of their billing systems. While accuracy is undoubtedly crucial to maintaining trust and satisfaction, it’s only part of the equation for customers who increasingly desire greater control and adaptability in how they interact with their telecoms services.

So, why do their customers rate flexibility as a higher criterion than accuracy?

According to Barton: “Billing accuracy is a particular challenge for enterprises, a monthly reminder of a service provider’s failing that adds up to a death by a thousand cuts.”

The ‘woke’ customer considers billing accuracy as a fundamental expectation — akin to expecting a refrigerator to cool or preserve food. It’s a given, a basic requirement that’s not applauded but simply anticipated.

The telecoms industry is a hotbed of technological innovation, with new standards and services emerging rapidly. In a world where digital convenience and customisation have become paramount, flexibility and the ability to effortlessly tailor and adapt billing to meet unique preferences stand out as the differentiator, earning CSPs a higher rank in the eyes of the woke customer.

CSPs must strike a delicate balance between enabling these new services and maintaining a billing system that seamlessly accommodates them.

Another aspect that played a role in the B2B sector was accountability. Billing inaccuracy is the responsibility of the CSP, but for employees who manage the bills – having the flexibility to accommodate different business requirements was more critical. Hence, flexibility was the more important criterion as it empowered them to do their jobs better

Billing a catalyst for growth?

For enterprises, the stakes are much higher. They often require complex, tailored services that include a mix of voice, data, and cloud solutions. These organisations are more likely to manage multiple accounts and need the ability to make changes on the fly while managing the complexity of tiered and multi-departmental billing. The survey suggests that these enterprise customers are willing to pay a premium for billing flexibility, allowing them greater control and adaptability in managing their telecoms expenses. This flexibility could be in the form of customisable billing cycles, the ability to allocate costs across various departments, or tiered pricing that scales with usage.

billing system ENTERPRISE

According to Barton, “Enterprises are looking for flexibility when it comes to billing from providers. Flexible billing plans allow enterprises to save money where it needs to and provide compliance with larger enterprise billing cycles.”

And given that 20% of enterprises said billing flexibility would significantly impact their likelihood of purchasing more expensive services, telecom companies, too, have a substantial incentive to offer flexible billing options. Doing so could not only justify tiered price plans but could also encourage enterprises to add on more services, boosting overall revenue.

billing system ENTERPRISE

“For enterprise customers, multiple options for billing is the clear preference, alongside the need for those bills to be accurate – time spent correcting provider bills is time wasted and a headache,” explains Barton.

Even residential customers are not that far off when it comes to the promise of billing flexibility. CSPs can use it as a gateway to upselling additional services. For example, a customer on a basic plan might be more inclined to add a streaming package or international calling if they know their billing structure allows for these services to be added based on usage, and payments can be made based on data or pricing thresholds.

billing system ENTERPRISE

Billing flexibility can thus act as a catalyst, enhancing customer engagement and fostering a climate where consumers are more open to exploring additional services.

In the fiercely competitive telecoms industry, delivering a seamless customer buying journey is paramount. Billing, often overlooked as a back-end process, plays a pivotal role in shaping this experience. Customers have clear expectations regarding billing accuracy, flexibility, subscription plans, and emerging monetisation models.

billing system ENTERPRISE

The one-size-fits-all model is increasingly insufficient in an era where customer needs are as varied as the services offered. As the sector pushes the boundaries of technology — from 5G to IoT — the billing systems must evolve equally to accommodate a more informed and discerning clientele. Flexibility in billing is not just a feature but a strategic asset that can drive both customer satisfaction and revenue growth. Enterprises are willing to invest in services that offer them control and adaptability, while individual consumers seek the freedom to customise and add services as their needs change.

For CSPs, meeting these expectations may be daunting, but retaining customer trust and loyalty is equally essential. Telecoms providers must, therefore, recalibrate their billing systems to be more flexible and diverse, embracing a variety of monetisation models to cater to a broad spectrum of customer preferences. Only by doing so can they successfully navigate this telecoms tightrope, bridging the gap between what they offer and what their customers truly desire

Comment on this article below or via X: @VanillaPlus OR @jcvplus