The multi-access edge computing (MEC) market is expanding in Europe and other regions, although its growth is being impeded by some market conditions. Business technology journalist Antony Savvas considers MEC’s prospects.

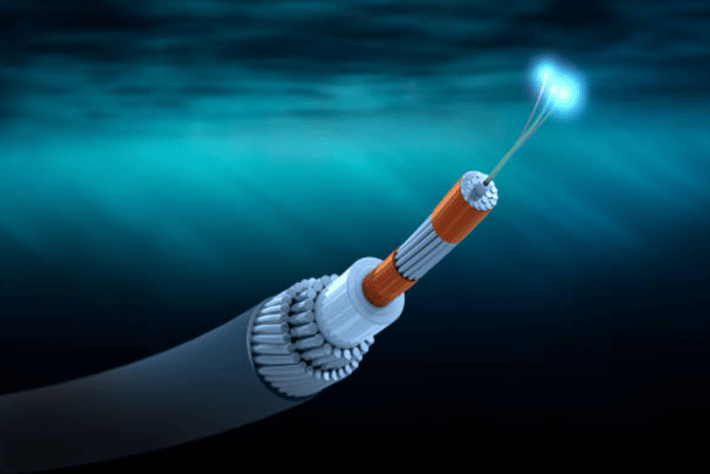

MEC moves cloud-based IT services to the edge of networks, removing latency that would result from multiple hops between aggregation sites and across the internet. In optimum conditions, latency could be as low as single-digit milliseconds between the mobile base station and MEC infrastructure.

And every millisecond is crucial in the provision of seamless, time-sensitive services, such as connected industrial robots, biometric “passwordless” security, autonomous cars, and other Internet of Things (IoT) applications. As a result, MEC is widely seen as a key component for unlocking the full potential of 5G.

Spain

Vodafone has now extended its MEC service to service providers and enterprises in Spain. The service is based on Amazon Web Services’ AWS Wavelength technology. Spain is the latest Vodafone market to embed AWS Wavelength at the edge of its 4G and 5G networks, and joins both Germany and the UK, which initially started to roll out distributed MEC services in early 2021.

Vodafone and AWS have made the pilot Spanish AWS Wavelength Zone available to customers across the province of Andalusia, southern Spain, including the cities of Malaga, Granada, Cordoba, Jaen, Almeria and areas of Seville. The service is already available in London, Manchester, Berlin, Munich and Dortmund.

“5G and edge computing will help our customers transform their industries. Working with AWS, we can deliver applications and IT tools to customers in milliseconds, faster than the human eye or ear can even perceive,” says Jennifer Didoni, head of cloud, edge and mobile private networks at Vodafone Business.

One of the first applications to be tested using distributed MEC in Spain is improved road safety based on Vodafone’s Safer Transport for Europe Platform (STEP). Connecting drivers directly with transport authorities, STEP enables safety information, hazard warnings and traffic updates to be shared in real time, no matter which device or in-vehicle system is being used.

In addition, Vodafone Spain will test MEC with “extended reality”, to provide companies across agriculture, logistics, industry, entertainment, or social health with a 3D digital twin of critical applications. This will allow them to make “near-instant” changes without the need for a physical site visit.

Texas

Vodafone and Amazon, of course, aren’t the only ones going down the MEC path. Amdocs and Microsoft have developed blueprints for edge and IoT services at Amdocs’ Americas 5G Experience Lab in Dallas, Texas.

The solutions being tested are built on the Microsoft Azure private MEC and Azure Private 5G Core technologies, and are designed to address the various needs of smart cities, augmented reality maintenance and training, and other IoT service segments.

The Experience Lab can also be used by enterprises and service providers to experiment in various areas, including private wireless networks, premium 5G services, cloud services, the future of work, Industry 4.0 and security.

The Lab supports OpenRAN and accommodates industry organisations such as the Telecom Infrastructure Project (TIP), 3rd Generation Partnership Project (3GPP), the TM Forum, and others.

System integrators

Global system integrators (GSIs) are also adopting MEC to widen their 5G service offerings. Infosys, for instance, is rolling out its Private 5G as-a-service offering to enterprises worldwide. It delivers a “simple and flexible” pay-as-you-go solution for clients, says the provider, with the on-demand formula allowing enterprises to try private 5G with relatively little up-front cost.

As the Private 5G as-a-service offering incorporates MEC, Infosys promises reduced network lag by minimising the time required for data processing, with it going through the edge instead of relying on distant cloud data centres. “Our 5G expertise and Private Network Management solution ensure high bandwidth, low latency and reliable wireless connectivity for enterprises,” says Infosys.

To reduce the complexity of deployment, Infosys has pre-integrated its 5G stack with multiple product vendors and tested it against different use case requirements.

Fujitsu has also connected its 5G network services technology with Microsoft Azure’s private MEC platform in both Japan and the UK, for instance.

Slowing market

However, despite the promise of the technology, some analysts have tracked a slowing in demand.

According to Dell’Oro Group, the MEC market has “failed to materialise as expected”. It has lowered growth expectations by over 20% for 2023.

“The MEC market is not reaching the potential market as expected initially,” says Dave Bolan, research director at Dell’Oro Group. The big promise for MEC, he says, was addressing the needs of enterprises. But several factors are contributing to a slower uptake.

Bolan says there has been a lack of MEC applications with a “well-defined” return-on-investment (ROI), there has been competition from other cloud services, and some organisations are waiting for the arrival of Wi-Fi 7. “We believe enterprises are evaluating all choices before moving forward with more aggressive MEC deployments, says Bolan.

That says, Dell’Oro still has MEC down for a 31% compound annual growth rate (CAGR) for its five-year market forecast, which is still impressive, albeit from a relatively low base.

MDR

While the industry seeks to carve out new revenues from MEC, other players are looking towards more traditional areas.

NTT Data, a subsidiary of Japan telco NTT, has launched a managed detection and response (MDR) service. The service is first being provided in Japan, and will be gradually rolled out worldwide by the end of March 2024.

With the MDR service, advanced security engineers who have more than 20 years of experience with incident response, will provide support to client companies.

In an incident, engineers will act on behalf of client companies, executing a set of measures to identify the cause, implement emergency response measures, maximise recovery efforts, and prevent recurrence.

At the same time, to develop talent to handle MDR services, the firm is launching a talent development programme for advanced security engineers, with the aim of expanding the structure from the current level of 100 people to about 500 staff globally by the end of March 2026.

Managed security services are now a growing market for telcos, so NTT’s efforts will no doubt be followed by others.

The author is Antony Savvas, a global freelance business technology journalist.

Comment on this article below or via Twitter: @VanillaPlus OR @jcvplus