Communications service providers (CSPs) need to pivot to being hyperscale IoT connectivity providers if they want to thrive on the Internet of Things. That is the conclusion of Transforma Insights’ recent ‘Communications Service Provider IoT Peer Benchmarking 2021’ report. As well as providing deep insights into the approach of a dozen major CSPs, the report examined the ways in which they need to adapt their capabilities and strategies in order to cope with the changing dynamics of IoT. This Analyst Review provides a summary of the key findings of the report, and other key recent research from Transforma Insights on the IoT connectivity market.

The IoT connectivity market is going through a more rapid and significant period of change than it has for many years. New low power wide area (LPWA) networks are bedding in, 5G is starting to become significant – particularly in the form of mobile private networks – a new generation of low earth orbit (LEO) satellites is around the corner, embedded and integrated SIM (eSIM and iSIM), nuSIM and other variants are becoming established and game-changing technologies. In addition, the disaggregation of network hardware from the control layer is heralding an innovative set of new services, and the competitive landscape is being shaken up with increasingly innovative IoT MVNOs and assertive cloud providers. On top of this, we see a pronounced price erosion, trending towards what Transforma Insights refers to as US$1 IoT – a prevailing average revenue per connection of US$1 per year.

In the face of these changes, CSPs also need to adapt their approach to how they deliver IoT connectivity. They need to find new revenue sources and/or ways to more efficiently deliver services.

The quest for new revenue: vertical and horizontal

One simplistic – but not simple – solution is to go up the stack, pursuing vertical solutions such as fleet management, security or retail. Many industry commentators will recommend this as a universal panacea based on the indisputable – but incorrect – logic that 50%-80% of the revenue from an IoT application sits in the application, compared to 5%-10% for the connectivity.

However, it’s not that simple. Vertical solution markets will be almost always highly contested by specialist service providers with years of experience and highly evolved products, channels and go-to-market strategies.

Put up against this, most CSP me-too offerings will sink without trace. Success depends on having a sustainable differentiator, a right to play, which might come from acquiring a solution provider in the space, as KORE, Telia, Verizon and Vodafone have all done in various sectors, or it can come from long-term building of internal capabilities, such as Telefónica in retail. Or possibly it comes from the arrival of new technologies enabling new solutions in markets underserved by existing service providers, which is the case with some of the potential markets addressed by mobile private networks.

As an alternative to emphasising the vertical, CSPs can build up their horizontal capabilities. The appeal here is that such capabilities and offerings are much more scalable than vertical solutions or consulting. Typically, it involves a platform play, providing a common service to multiple IoT clients. Application enablement platform, data analytics and data exchange are the most prominent options but the scale and maturity of the market are not quite there yet to provide sufficient substantive revenue from these areas.

CSPs also have the opportunity to offer additional horizontal support capability spanning pre– and post-sales support, consulting and/or systems integration. This can either be low level – what we term knowhow-as-a-service – or it can be sophisticated consulting and systems integration, or somewhere in between, depending on the capabilities of the CSP.

Cutting costs, retrenching and consolidation

Other strategies focus on making service delivery more efficient. This might include consolidation, of which we have seen a significant amount within the IoT mobile virtual network operators (MVNO) world in the last five years or so. Wireless Logic, for instance, has been on the acquisition trail a lot in recent years, buying up companies such as Arkessa (UK), Com4 (Norway), Data Mobile (Liechtenstein), Matooma (France), and Things Mobile (Italy).

For mobile network operators (MNOs), IoT is too insignificant an element of their revenue for it to be a driver of consolidation. For them, a more likely approach is to rethink the approach to IoT overall, shifting to a model focused on selling purely connectivity, with a large element of that being based on wholesale, such as supporting MVNOs. There is evidence that a number of MNOs, including AT&T, are pursuing just such a strategy of retrenching to a more wholesale approach.

Pivoting to hyperscale connectivity is critical

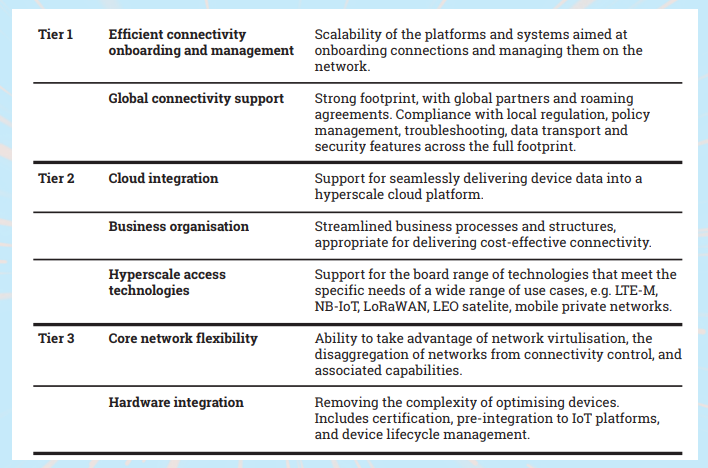

While each of the above offer some mechanisms for bolstering revenue or reducing costs, the most important approach will be to focus on delivering the core business, i.e. IoT connectivity, in as efficient a manner as possible. This is what we at Transforma Insights term hyperscale IoT connectivity, borrowing the hyperscale term from cloud providers such as AWS and Microsoft and applying similar approaches to connectivity. It involves ensuring that systems and technologies are aligned to deliver a highly streamlined and low-touch connectivity. We identify seven key areas where CSPs should focus in order to provide this hyperscale capability as illustrated in Figure 1.

Source: Transforma Insights, 2021

The first is efficient connectivity onboarding and management which relates largely to having an efficient connectivity management platform or platforms. The key is to be able to onboard and manage connections – including activation/ deactivation, billing, rating, network selection and other similar features – in an efficient manner, keeping costs and complexity as low as possible. In our report, we score Deutsche Telekom IoT well here, due to its ability to harness a diverse set of platforms including 1NCE’s low-cost onboarding platform, Ericsson’s IoT Accelerator, the Cisco Control Center and its own Telekom M2M Service Portal. Vodafone also scores well here with its GDSP platform. Scalability is also an important characteristic here, particularly being cloud-native as for instance is Telenor Connexion’s Managed IoT Cloud.

The next major category relates to global connectivity support which deals with a CSP’s ability to support global deployments and all the complexity implicit in them in terms of footprint, regulatory compliance, intra-network troubleshooting, data routing, local break-out and more. Almost every CSP has the ability to support connections in any market, but many do so purely through roaming with little thought for the most efficient or compliant way of achieving it. Increasingly we think there is an opportunity for a more effective transport layer orchestration (TLO) layer, managing the end-to-end delivery of data in a secure, efficient and compliant manner. Such a TLO would deal with end-to-end data flows from device to cloud, policy management, end-to-end security and compliance. Some CSPs are already making strides in delivering some of the required capabilities here, particularly in addressing connectivity in difficult countries such as Brazil, China and India. CSPs with strong footprint and heritage in addressing global deals, such as Vodafone, Deutsche Telekom which spans Europe and the US, KORE and Telenor tend to score well here. Also, operators that have deliberately built their service portfolio to address global requirements such as Telia, in part powered by Aptilo Networks’ IoT Connectivity Control Service, which is a good example of a capability in the TLO layer.

As we move to the second tier of capabilities, the requirements become slightly less critical, but still important. Cloud integration relates not to the CSP’s utilisation of the cloud for its own purposes, which is more covered in the efficient management addressed above. It deals with the CSP being able to better integrate data with AWS, Google Cloud, and Microsoft Azure, as well as other clouds. This takes the form of building sophisticated cloud connectors. Many CSPs, including Telefónica and Verizon have made strong progress in this area.

Not everything is about technology. Switching to being a hyperscale connectivity provider is also about a change of mindset. The approach to product development, go-to-market, sales, customer onboarding and support needs to be radically different from the approach of the parent company. As such the business organisation needs a degree of independence from the parent organisation. This allows them, above all, to streamline processes to reflect the fact that selling and supporting IoT works in a different way from their regular services. IoT MVNOs, such as KORE, are particularly strong here, as are the MNOs which have historically sold connectivity mostly out of footprint, such as Tele2 and Telenor. Telia, via a separate IoT product development process, and Vodafone, for example through harnessing IoT.nxt and shifting product management responsibility into the business unit, have probably done the best job of creating new processes specifically for IoT.

But some things are very definitely about technology. CSPs need access to the hyperscale access technologies that will allow them to deliver low-cost connectivity to the billions of devices that we’re expecting. Addressing the IoT connectivity opportunity often means having a broad range of technologies available, spanning regular cellular networks, LPWA networks – NB-IoT, LTE-M and LoRaWAN, private networks, satellites and more. The biggest challenge is in getting LPWA technologies, of some sort, deployed and optimised, and then striking roaming agreements. Progress here has slowed somewhat in 2021. The other key network topic relates to core network flexibility. In recent years, the technology has evolved, for example through network function virtualisation (NFV), to the point where the software control layer has become separated from the running of the core network infrastructure. One of the key principles of 5G is that the user plane and the control plane are separated. A good comparison in the PC market where decades ago the software development environment, in the form of Windows for example, became separated from building hardware.

The result in PCs was an explosion of creativity. The same is happening in telecoms networks with the creation of new software-based services, independent of building or operating the physical networks. This has created a great opportunity for CSPs, and other competitors, to be much more flexible in how they deliver connectivity and the associated services. For instance, the ability to spin up cloud-based core networks in multiple geographies will offer great benefits in delivering compliant and innovative services.

Finally, and moving off on something of a tangent, comes hardware integration. Integration of hardware has become more important in IoT connectivity. The days of sticking any SIM card in any device and getting more-orless the same performance anywhere in the world are long gone. Today the hardware and connectivity elements are much more closely intertwined. For instance, eSIM and iSIM embed connectivity earlier in the process, and LTE-M and NB-IoT necessitate greater optimisation of device with network. CSPs are not just selling SIM cards any more. We expect in 2022 a much larger proportion of IoT devices to be sold with connectivity baked in, and connectivity to be sold with a device attached, than in previous years. CSPs need to pre-integrate devices (Verizon, Telefónica and Orange have done good work here) and look to handling device lifecycle management (KORE is the stand-out vendor).

Who is doing the best job today?

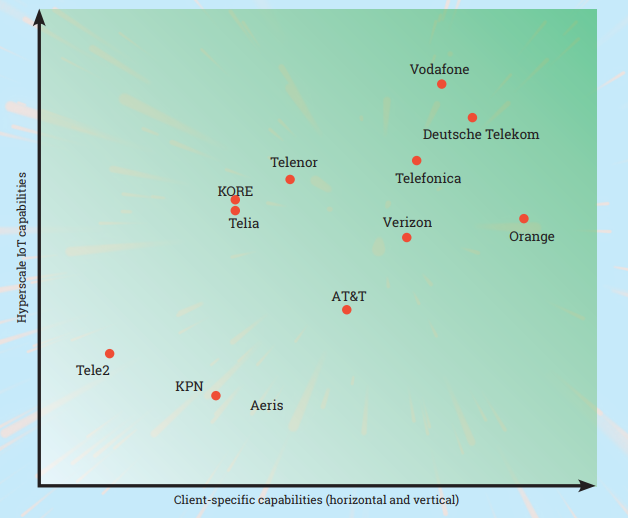

In the CCSP IoT Peer Benchmarking report itself we assessed each of a dozen CSPs (Aeris Communications, AT&T, Deutsche Telekom, KORE, KPN, Orange, Tele2, Telefónica, Telenor, Telia, Verizon and Vodafone) on their capabilities against the seven criteria for being hyperscale IoT connectivity providers. The top scorer is Vodafone, followed by Deutsche Telekom, Telefónica, Telenor, KORE and Telia. We also rated them on their ability to deliver client-specific products and services, including verticalspecific solutions (where Telefónica, Verizon and Vodafone score particularly well) as well as advisory, consulting and systems integration (where Deutsche Telekom and Orange are the top scorers). The overall ranking is presented in Figure 2.

The provision of IoT connectivity, particularly to increasingly demanding global clients, is becoming more complex, more competitive and lower margin. In the face of such significant demands, CSPs need to adapt their offerings to imitate the hyperscale cloud providers. They need to become hyperscale IoT connectivity providers.

Comment on this article below or via Twitter: @ VanillaPlusMag