It can be hard to find investment funding for infrastructure projects in sub-Saharan Africa. It’s doubly hard if you’re looking for private sector investors, says Jeremy Cowan. But there are solutions; here’s some good news from Africa.

Even its backers admit it’s been a well-kept secret, but for the last 15 years governments in four European countries have supported a joint initiative called EAIF to encourage private sector investment in eight infrastructure sectors, including telecommunications, energy generation, transport and agribusiness.

Now, as VanillaPlus finds, if you are looking for investment of up to US$50 million in a communications project (hardware-led initially, but EAIF is now evaluating software-led projects) maybe you should talk to the London-based Emerging Africa Infrastructure Fund (EAIF).

Corporates with high regard for their reputation have often found it hard to raise money for infrastructure projects in Africa. Mainstream banks are too often risk-averse and money from some quarters is best avoided. Choosing your financial allies with care in some parts of Africa is critically important. High corporate and personal standards, financial expertise, integrity and tenacity really matter. So, too, does a genuine desire to make African lives better as you go about your business.

The key for infrastructure development is debt funding, that vital component that allows big, cash-hungry projects to happen. Debt funding for infrastructure has always been hard to come by in many African countries. The need is staggering. It is estimated that Africa needs to see investment of around $90 billion a year for the next 30 years just to get on par with the West.

Fifteen years ago, working in partnership, the governments of the UK, The Netherlands, Switzerland and Sweden saw the need and saw at least part of the answer. They set up EAIF in 2002; it was the first infrastructure debt fund established to help Africa grow. Today, it has commitments that total $815.4 million. EAIF never contributes more than 10% of the funding for a project and invests anywhere between $10 million and $50 million per project.

The fund has become an established player in telco financing in Africa. For example, in May 2017 EAIF was the anchor investor in a $600 million bond issue by Helios Towers Africa. HTA operates approximately 6,500 communications towers in Tanzania, and EAIF supported its acquisition of 700 towers in the Democratic Republic of Congo. Similar investments have also been made in Ghana and Congo-Brazzaville, and in the last 12 months EAIF has also done business in Chad, Mali, Mozambique, Senegal and Sierra Leone.

The fund has become an established player in telco financing in Africa. For example, in May 2017 EAIF was the anchor investor in a $600 million bond issue by Helios Towers Africa. HTA operates approximately 6,500 communications towers in Tanzania, and EAIF supported its acquisition of 700 towers in the Democratic Republic of Congo. Similar investments have also been made in Ghana and Congo-Brazzaville, and in the last 12 months EAIF has also done business in Chad, Mali, Mozambique, Senegal and Sierra Leone.

Fragile states

As the non-executive chairman of EAIF, David White (pictured below), tells VanillaPlus, “Apart from Ghana, these countries are all viewed as fragile states by the international community; countries recovering from armed conflict, famine, disease and natural disaster. Working in fragile states makes EAIF unusual. We are a debt fund, set up to use public money from a number of Western governments to attract and mobilise private sector capital to bring vital infrastructure to Africa.

“As I see it, software systems and applications are becoming as fundamental to the infrastructure of successful economies as power stations, telco networks, trains and airports,” he adds. “Whether it’s moving money or licensing taxis or collecting taxes, software is fundamental to enterprise, job creation and stable public finances.”

White explains that conventional lenders either decline to do business in fragile states or offer terms that significantly increase the cost of private infrastructure development, which makes many projects unviable. “We help make projects viable,” he says.

David White brings 40 years of investment banking experience to his role as EAIF chairman, much of it in Africa. “I am accountable to the governments that fund us and who need to be reassured that public funds are being well spent. My view is that EAIF and the PIDG represent a highly efficient way of using public money to mobilise very large sums of private sector capital. The aim is to stimulate economic development that reduces poverty and gives some of the world’s poorest people hope in the future.”

“It is not charity or hand-outs. It is commercial and business-driven, but with a clear objective of building more stable societies that can grow and prosper,” says White.

Investec Asset Management (IAM) runs the fund on a day-to-day basis. It finds the projects, markets and promotes the fund and takes clients through the entire process from initial talks to financial close.

At critical moments on every deal the EAIF board, which is appointed by the PIDG and its members approved by funding governments, has to give approval to go on with a project and, eventually, approve a loan and its terms. Roland Janssens, a director at IAM is an expert in infrastructure financing in Africa. For more than years, he’s been one of the lead executives working on EAIF projects.

Janssens draws an analogy between EAIF’s pioneering financial support for solar power in Africa and the evolution of the digital world. “We were quick to recognise solar’s ability to transform the delivery of vital services such as domestic power, education and health and stimulate economic activity. Poor people get improved life chances. We have the same mindset when it comes to advanced, large-scale, internet applications. We understand the ability of the digital world to build bigger and more resilient economies. Our challenge is to identify bankable projects promoted and managed by businesses that share our values of commercial success and public good.”

Other funds are available

Funds are, of course, also available from lenders in countries as France, Germany, the USA, and China, but in most of these cases are tied to investment in equipment and services from the lender state. The EAIF is unusual in several respects; its backers are multi-national, it is funded by debt not equity, and has a high success rate (with almost 80 projects undertaken none has defaulted).

EAIF has also invested $50 million in an $800 million bond issued by the Nigerian telecoms tower business, IHS. EAIF and the International Finance Corporation were named anchor investors in the bond issue. IHS will invest at least $50 million of the proceeds of the bond in developing its infrastructure across Nigeria, where urbanisation, population increases and rapidly growing smartphone penetration is straining capacity and forcing up demand. IHS has towers in all 36 of Nigeria’s states, with the majority in densely populated areas.

White believes it is unlikely many of the comms projects backed by EAIF would have happened at all by public investment. Talking exclusively to VanillaPlus he says, “With the support of our four government backers and being administered by a leading asset management fund like Investec, as well as the fact that it is based in the City of London, these factors all build confidence for private investors.”

He adds, “EAIF has developed a sophisticated understanding of the types of companies and the types or projects that make investment sense. Part of the reason for that is that we are focused only on debt funding. That is our speciality, so we are not burdened with offering equity or any other financial products.”

EAIF is a member of the seven-country Private Infrastructure Development Group. PIDG’s chief executive, Philippe Valahu, says: “PIDG works in the riskiest countries, building life-changing infrastructure. In doing so, we catalyse private sector investment in development with public money by blending the two, allowing us to deliver the greatest possible impact in our drive to help transform economies and end poverty. In 2016, we committed $420 million to 35 new projects. For every dollar invested by a PIDG business such as EAIF, the group expects to lever $23 of private capital (investment). And of that $23, an average of $8 will come from Africa’s private sector investors.”

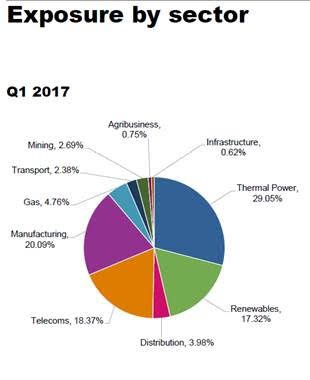

The energy sector currently takes 47% of this investment but telecommunications projects have benefited significantly; in the first quarter of 2017, telecoms accounted for 18.37% of EAIF investments. The infrastructure fund is rapidly heading towards its 80th project in Africa in which it has mobilised over $10 billion in private sector capital.

Africa looks to be on the edge of another period of growth and the fund can expect to be busy as smart infrastructure promoters look for smart backers.

The author is Jeremy Cowan, editorial director of VanillaPlus

Comment on this article below or via Twitter: @ VanillaPlus OR @jcvplus