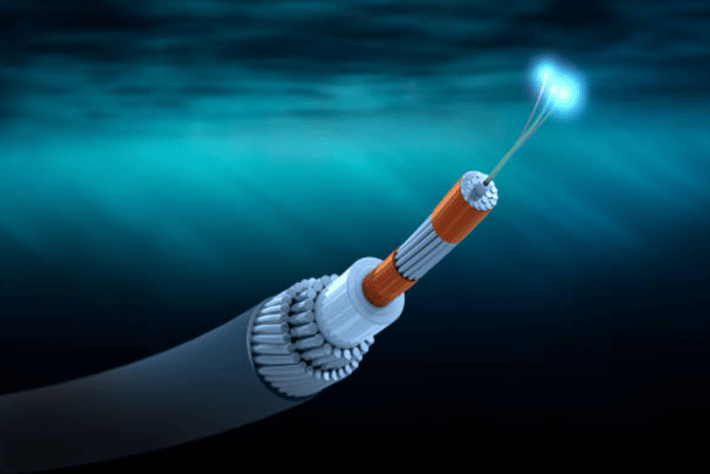

Broadcom Ltd and Brocade Communications Systems, Inc. have entered into a definitive agreement under which Broadcom will acquire Brocade.

Brocade is a provider in Fibre Channel storage area network switching and IP networking. The deal is worth US$12.75 per share in an all-cash transaction valued at approximately $5.5 billion, plus $0.4 billion of net debt. Broadcom expects to fund the transaction with new debt financing and cash available on its balance sheet.

Broadcom, with the support of Brocade, plans to divest Brocade’s IP Networking business, consisting of wireless and campus networking, data center switching and routing, and software networking solutions.

“This strategic acquisition enhances Broadcom’s position as one of the leading providers of enterprise storage connectivity solutions to OEM customers,” stated Hock Tan, president and CEO of Broadcom. “With deep expertise in mission-critical storage networking, Brocade increases our ability to address the evolving needs of our OEM customers.

In addition, we are confident that we will find a great home for Brocade’s valuable IP networking business that will best position that business for its next phase of growth.”

“This transaction represents significant value for our shareholders, who will receive a 47% premium from the Brocade closing share price on Friday, October 28, 2016, and creates new opportunities for our customers and partners,” said Lloyd Carney, CEO of Brocade. “Our best-in-class FC SAN solutions will help Broadcom create one of the industry’s broadest portfolios for enterprise storage.”

Lloyd Carney commented, “Having just completed the Ruckus acquisition, we were confident in our strategy, our team and our path forward. We were not looking to sell the company.

However, when Broadcom approached us with a compelling offer, we had an obligation to consider that offer, along with other alternative opportunities. After careful consideration, we concluded that Broadcom’s offer was in the best interests of our company and its shareholders. Our goal is to continue to serve our customer and partner needs.

“In terms of our IP Networking business, due to competitive overlap with some of Broadcom’s most important customers, Broadcom will seek a buyer for the business. We have built an attractive IP Networking portfolio, designed to enable customers to transform their networks into platforms for innovation. As we support Broadcom in its efforts to find a buyer, our goal is for the IP Networking business to continue to thrive and see to fruition its strategic vision,” Carney added.

Upon closing, the transaction is expected to be immediately accretive to Broadcom’s non-GAAP free cash flow and earnings per share. Broadcom currently anticipates that Brocade’s FC SAN business will contribute approximately $900 million of pro forma non-GAAP EBITDA in its fiscal year 2018.

Comment on this article below or via Twitter: @ VanillaPlus OR @jcvplus