The impact of the global financial crisis and saturation of telecoms markets across the globe has compelled operators and investors to look into more profitable revenue streams such as mobile content and applications. Based on these market trends, investors are shifting their valuation criteria from revenue growth to return on investment. This calls for operators to chalk out new plans and manage their biggest investment line item – network capex, explains Vinod Kumar.

Moderate to large carriers today have network investments after depreciation and amortisation in excess of US$50- 100 billion. With constant changes in technology, these networks are expanding at a feverish pace. Annual network spending at these operators is commonly in the range US$0.5-2 billion. Such is the case with AT&T, which announced its 2013 budget of US$8 billion for wireless and US$6 billion for wireline network expansions; increasing its overall network capex spending by 16% over 2012.

Moderate to large carriers today have network investments after depreciation and amortisation in excess of US$50- 100 billion. With constant changes in technology, these networks are expanding at a feverish pace. Annual network spending at these operators is commonly in the range US$0.5-2 billion. Such is the case with AT&T, which announced its 2013 budget of US$8 billion for wireless and US$6 billion for wireline network expansions; increasing its overall network capex spending by 16% over 2012.

According to a survey by PwC, more than half of the respondents at 78 fixed-line, mobile and cable telecoms operators with a collective annual capex of US$200 billion estimated that about 20% of their company’s capex is spent on assets that don’t recover their cost of capital.

While managing and allocating capital spend is heavily flawed, network capex management is considered to be among the most significant board-level issues for the majority of operators across the globe.

Why is the industry so inefficient with capex?

Today CSPs are spending huge sums of money on new network infrastructure which is not bringing in optimised returns. One of the main reason is insufficient visibility which includes lack of understanding asset dispositions, poor data integrity in source systems and failure to make use of intelligence directly from the network. Real need is often clouded by limited visibility of assets in the field and poor capacity planning. Gaps in accountability are another cause, where the accountability for an asset’s contribution to the bottom line usually erodes after purchase. Limited purchase controls and gates play a critical role, as much of the network spend is on auto-pilot, and is merely an attempt to stay ahead of the growth in traffic. A repeatable, sustainable and highly effective programme to educe capex also requires asset lifecycle governance which is not implemented in most of the telecoms companies.

Business challenges for a CSP

CFOs and senior finance stakeholders are typically confronted with continuously shrinking margins which have a subsequent impact on budgets. Intense pressure from the marketplace to provide increasingly capital-intensive products and services – such as mobile broadband – mandates continuous network growth and technology evolution for operators. These challenges are ultimately owned by two groups: Finance and Network Operations. From the finance perspective, the business problem that needs to be addressed is: How can we preserve capital and grow free cash in the business? From the network operations perspective, the challenge is: How can we ensure we are using all available assets at the utmost efficiency?

The capex solution: Subex ROC Asset Assurance

In most CSPs today, attempts are being made to manage these challenges. For instance, network planning typically has significant traffic data and statistics which are used for planning and budgeting. Similarly, supply chain commonly has systems that manage ordering, receiving, stocking and overall management of assets prior to deployment. What the operators lack, however, are monitoring and controls to help optimise the complete end-to-end asset lifecycle. For example, capacity management is required early in the asset lifecycle to monitor node resource consumption and resulting performance impacts. With this information, capital investment decisions can come off auto-pilot and become more targeted. After assets are deployed in the network, a view into stranded and unutilised assets which are candidates for re-deployment becomes essential.

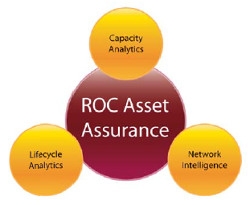

Network analytics applied at each stage of the asset lifecycle can result in significant capital savings annually for the operator. The capex problem requires complete, holistic views into current assets as well as the consumption and placement of those assets. This problem also requires comprehensive analytics that are not only descriptive – to show current states and trending, but also predictive, to accurately predict asset exhaustion, procurement triggering, necessary asset warehouse levels, impacts of failure and growth rates on sparing levels and retirement strategies.

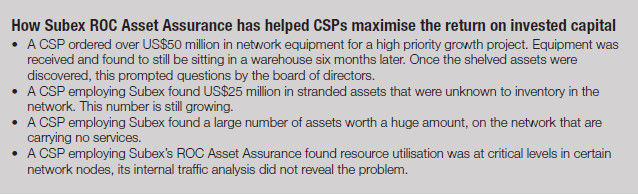

Asset Assurance is a new and exciting discipline which is garnering significant interest as CSPs turn their attention to managing and reducing capex. Subex’s ROC Asset Assurance is a pioneering solution to manage telecoms network assets across all dimensions of the asset life cycle and reduce network capex substantially. A complete programme of Asset Assurance encompasses continual monitoring and process controls at each phase of the asset lifecycle.

Why should CSPs care about asset assurance?

If CSPs are operating a legacy TDM network, migrating from 2.5/3G to 4G/LTE or even delivering IPTV and other services that require CPE, then ROC Asset Assurance should definitely be in their agenda for reducing capex significantly.

ROC Asset Assurance provides the CFO and finance stakeholders with a holistic, networkwide view of not only asset lifecycles, but also with an up-to- date tracking of capital spend versus budget, avoidance realized, and establishment of predicted capital needs based on network analytics.

As a comprehensive programme, ROC Asset Assurance provides CSPs with the ability to save millions of dollars in network capex along with helping discover, recapture and re-deploy stranded and unutilised assets. The solution enables the operator to track, manage and understand when assets will produce revenue. A comprehensive approach to Asset Assurance, factoring all these dimensions, will provide an operator with complete confidence that its network will grow to meet market demands while also guaranteeing that it receives optimal value for every dollar of capital budget spent.