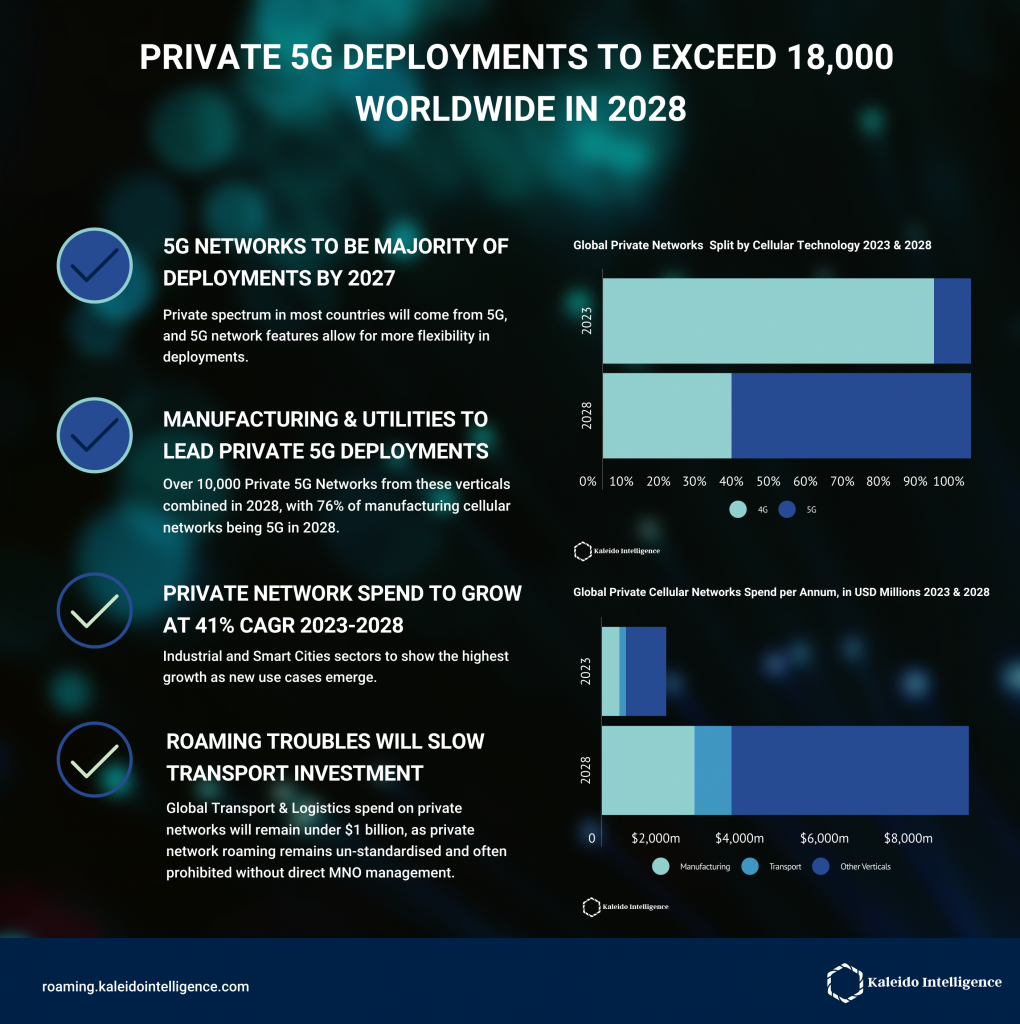

A new report from Kaleido Intelligence, a connectivity market intelligence and consulting firm, has found that after a slow start private 5G will accelerate in the coming years. These networks are expected to reach nearly 19,000 active installations by 2028, exhibiting a remarkable compound annual growth rate (CAGR) of 115% starting from 2023.

5G brings new capabilities and new spectrum

The new research, private LTE and 5G networks: 2023-2028, notes that enterprises are increasingly concerned about the ability of private networks to meet their specific needs, rather than raw network capacity. Historically, LTE (long-term evolution) has been able to provide many of these capabilities. However, the flexibility that 5G provides, particularly guaranteed quality-of-service through 5G network slicing, appeals to many enterprises. As a result, they expect most private networks to be 5G by 2027, with 69% of manufacturing private network sites utilising 5G in that year.

This is aided by the fact that many countries that are currently looking to assign dedicated private network spectrum are looking to do so in the 5G band, with the US and some northern European countries setting aside dedicated LTE spectrum for private networks.

Device shortages

Despite the greater flexibility of 5G, there will be some need for LTE networks, as the 5G device ecosystem is currently small, making it difficult to use 5G networks to their full potential, with many being used as FWA (fixed wireless access) or some other use case focused on routers and similar, rather than true endpoint devices.

“The device shortage is making some enterprises reluctant to deploy purely 5G networks, as they cannot fulfil the goals their users have for them” remarks research author James Moar. “LTE networks will continue to be relevant, but we expect higher 5G network growth in future, as more devices become available.”

Roaming remains complex

Many private networks currently deployed are for campuses, with few that require the ability to roam onto a public network. Kaleido believes this is holding back the sector in areas where mobility and connectivity continuity is required, and some jurisdictions (for example Germany) have specific restrictions on private network roaming. MNOs (mobile network operators) will remain a key part of roaming private network use cases, and the transport and logistics sector, most dependent on mobility, will remain under $1 billion (€0.94 billion) in value to private networks even by 2028.

Comment on this article below or via Twitter: @VanillaPlus OR @jcvplus