While mobile technologies get most of the telecoms marketing attention these days, recent announcements show there is still plenty left in the fixed line tank to drive new communications sales. Business technology journalist Antony Savvas charts the progress.

Cisco

Cisco, the company that used to pay for expensive international TV adverts to proclaim it “powered the internet”, has demonstrated in its year-end results that it still makes plenty of money out of it.

Cisco ended fiscal 2023 with Q4 revenue at $15.2 billion (€13.96 billion), up 16% year over year, and GAAP EPS (earnings per share) at $0.97 (€0.89), up 43% year over year. The total annualised recurring revenue (ARR) was $24.3 billion (€22.32), up 5% year over year, and product ARR was up 10%.

For the full year, ended July 29, 2023, Cisco posted sales of $57 billion (€52.35 billion), an increase of 11% compared to last time, with earnings per share at $3.07 (€2.82) GAAP, a jump of 9%.

Full year net income went up 7% from $11.8 billion (€10.84 billion) to $12.6 billion (€11.57 billion).

Although the guidance for the first quarter of this fiscal year was modest, with predicted sales increasing from $14.5 billion (€13.32 billion) to $14.7 billion (€13.5 billion), Cisco’s boss was rightly pleased with the results.

“This past year was a milestone year for Cisco with record performance in both the full year and Q4,” says Chuck Robbins, chair and CEO of Cisco. “We are seeing solid customer demand, gaining market share, and innovating in key areas like AI, security, and cloud. This momentum gives us confidence in our ability to capture the many opportunities ahead.”

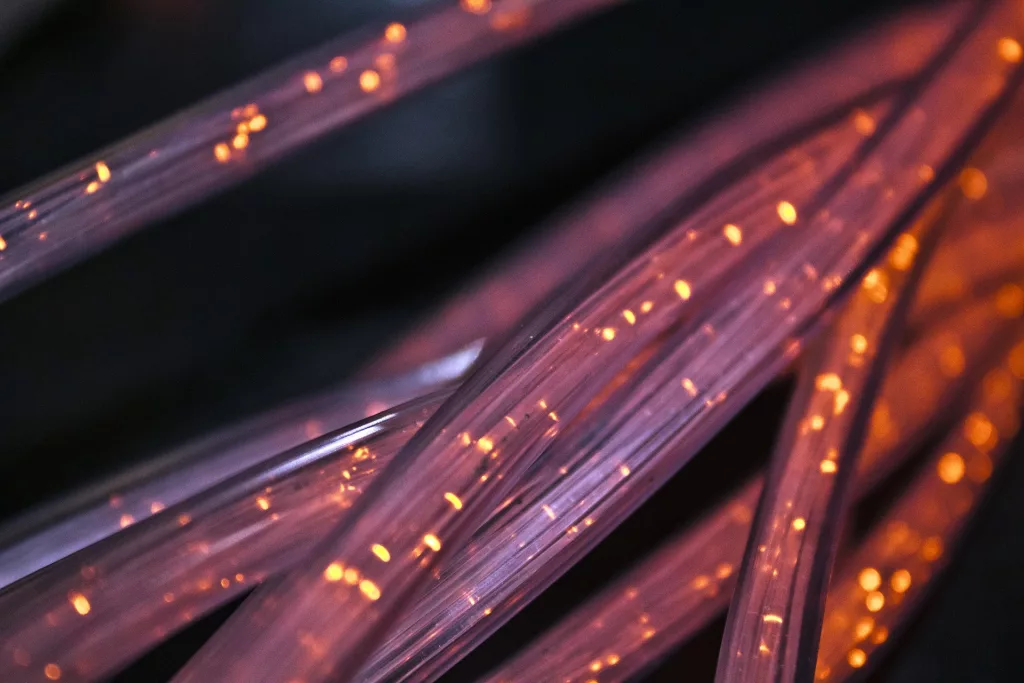

TV connectivity

Fibre broadband and TV services provider Liberty Global also demonstrated the value of the market in the ground with a significant outsourcing deal with Infosys, as it targets widened business.

Infosys already supports some of Liberty’s services, but this latest deal revolves around Infosys taking over the operations management and development of Liberty’s Horizon entertainment and connectivity platform and incorporating Infosys AI technologies to improve scalability and efficiency.

The five-year contract is worth $1.64 billion (€1.51 billion), with an additional three year option that could up its total value to $2.3 billion (€2.11 billion). In an age when multi-billion dollar IT services deals generally are now rare, this deal got my attention anyway.

Horizon is used by Liberty to deliver both live and on-demand content to 10 million TV customers worldwide. Interestingly, Liberty will license Horizon to Infosys, which plans to run the system for service providers outside of the Liberty Global Group.

This will “enable millions of new customers around the world” to “experience next-generation digital entertainment and connectivity services through Horizon for the first time”, says Liberty. And, of course, potentially provide both Liberty Global and Infosys with new revenue opportunities. Crucially, and in rather canny fashion, Liberty will retain all intellectual property for the Horizon entertainment and connectivity platforms.

Demonstrating the scale of the agreement, over 400 Liberty Global staff will be transferring to Infosys to help run Horizon going forward.

BEAD

The US government’s Broadband Equity, Access and Deployment (BEAD) programme is designed to create better communications for the country, and new American jobs as the world faces a patchy recession.

And it seems to be working, going by two fibre deals signed off with Nokia and Adtran last week.

States and infrastructure players seeking to participate in BEAD, and to grab some of the $42.45 billion (€38.99 billion) of available funding allocated for broadband roll-outs to unserved and underserved communities, are required to use equipment manufactured in the US.

Nokia says it is the first telecom vendor to manufacture fibre broadband optical modules in the US as part of the BEAD initiative. Partnering with Fabrinet, Nokia will produce multi-rate optical modules at Fabrinet’s facility in Santa Clara, California.

Production will start in 2024 and brings additional high-tech jobs to the country. The announcement builds on Nokia’s previous decision to produce broadband network electronic products in Kenosha, Wisconsin. Nokia is already a very well-established provider for broadband line connectivity in the US, so BEAD might seem like free money to the company to some, but good luck to it.

“Many in the industry have said that manufacturing optical modules in the US was impossible. We’re proving it can be done,” says Sandy Motley, president of fixed networks at Nokia.

Alabama

Adtran, in a move also part of BEAD, has announced the expansion of its advanced telecoms equipment manufacturing at its facility in Huntsville, Alabama, to “meet the growing demand for domestically produced network electronics”.

With a total investment of up to $5 million (€4.59 million), and the creation of up to 300 “high-quality, good-paying jobs”, the move advances Adtran’s “decades-long journey to make communications simpler and more affordable for millions of Americans”.

Adtran is increasing its current US production of optical line termination (OLT) equipment and preparing to “onshore” the manufacturing of optical network terminals (ONTs).

“As a leading US telecoms equipment provider, we look forward to partnering with state broadband offices and network operators across the country as they expand secure, high-speed internet access to millions of Americans,” says Tom Stanton, CEO of Adtran. “This expansion not only represents a strategic investment in Adtran’s growing workforce and manufacturing capabilities, but also demonstrates our long-term commitment to strengthening the domestic supply chain and securing communications networks with American-made equipment.”

President Biden’s predecessor Donald Trump said he wanted to “put America first”. Maybe the domestic manufacturing model he started, before BEAD was born, should be copied by other governments, whatever their other party political stances.

The author is Antony Savvas, a global freelance business technology journalist.

Comment on this article below or via Twitter: @VanillaPlus OR @jcvplus