In more than 25 years following telecom and tech markets, I have never seen such a crevasse separating new tech hype and operational business reality, says Ed Finegold, co-founder & CFO, Canteen Wireless. This big gap can impact aspiring telecom partners whether they are resellers, device makers, or application providers, because partner management automation is immature or non-existent.

Though partner management automation for telecoms is a fairly-well described concept in business support system (BSS) circles, new partners need to prepare for that automation to be absent and for partner management to be effort intensive. We find most often that what challenges new telecom partners most is not network complexity and certification. Instead, they find the operational lift is much heavier than they expected.

What’s missing?

What’s often missing is automation for onboarding, product catalogue ingestion, configure-price-quote functionality, and process visualisation. Interestingly, carriers’ sales teams will admit they are hurting for these kinds of modern tools just as much as their channel partners.

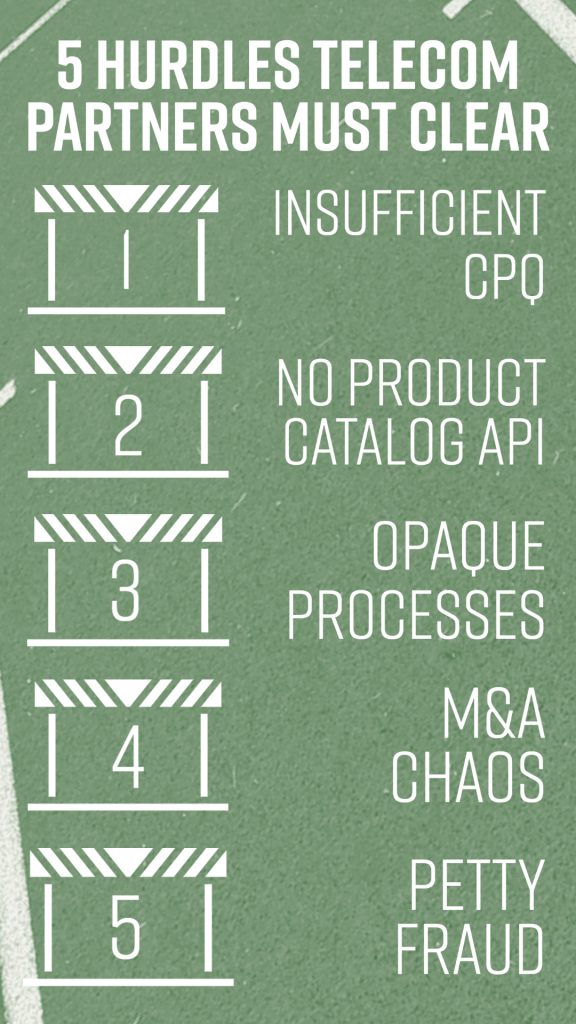

To provide some advanced scouting for any company that needs reliable partnerships with major telecoms to get to market, we offer five lessons, learned the hard way, that illustrate how major telecoms can struggle to support the partner ecosystems they are trying to cultivate.

- Bring your own CPQ: This one is frustrating because after covering configure-price-quote (CPQ) automation for nearly 2 decades, there remains a notable lack of effective CPQ tools that can create and sell mobility solutions to businesses. We are not saying they do not exist, but a partner should not walk into a carrier relationship expecting a handy CPQ tool to support pre-sales that represents the carrier’s product catalogue, much less a synthesis of catalogues from across the partner ecosystem.

- Don’t bank on catalogue APIs: It was probably 2014 when we first worked with a big box retailer that had made its product catalogue available via API to power an online seller community. For those who might bring such expectations to telecom B2B (business-to-business) channels, please prepare for disappointment. Carriers tend to lock down rate plan data or present it to partners in ways that machines can’t consume easily. Partners should prepare to devote some time and personnel resources to tackling PDFs and knowledgebases to mine for data, like rate plan and promotion eligibility info, if they want to factor that data into their product definition or sales processes.

- Expect opaque business processes: Imagine a scenario where a customer needs 50 hotspots for home workers, and 20 Internet of Things (IoT) SIMs for security cameras at their warehouses. You place this lucrative but, by phone company standards, unorthodox order. It disappears into the ether for risk assessment. Two days later, an order is approved for 20 hotspots and 5 IoT SIMs. You don’t know why and there’s no one to provide an answer other than “that’s what underwriting said.” This a deal killer scenario that practically defies belief, but it happened to us.

- Watch out for petty fraud: It is an ugly secret rarely discussed at Mobile World Congress happy hours that insider fraud is accepted as a cost of doing business. It’s a conundrum for telecoms who have large contact centre teams that experience high employee turnover, yet those customer-facing employees have access to sensitive systems and processes. Manual bits, like document-based order forms, are easy to exploit because they don’t control for access, logging, or editing. At the end of the month, if a staff sales rep is behind, rerouting an external partner order to their own quota is not out of the question. In the end, the customer will get their services, but the partner won’t receive their commission because of the re-route. It sounds far-fetched, but when it happened to us, our objection was met with a sincere apology and an admission that the problem exists.

- Beware M&A chaos: Headlines hit every week about one company buying another, but it’s a different view when your business is caught in the middle. When both your carrier partner and your distributor go through mergers at the same time, you’re suddenly George Clooney driving a fishing boat through two hurricanes to chase the cheque still owed from the petty fraud incident. Mergers & Acquisitions and reorganisations can brutalise networks of relationships within the carrier and create bad distractions, even for folks who are normally helpful and responsive. This makes it imperative for any partner to establish lines of communication to senior leaders to navigate change and keep working.

Just keep pushing

The most important factor in succeeding as a small partner with a huge telecom operator is simple persistence. Big company people get busy, they focus on the 80% on their plate they must get done, and assume if they ignore you, you’ll go away. So, don’t.

Keep calling. Keep pushing. Get the meetings you need. And build a partnership by networking with the people who are tasked with helping you get to market and make sales. And when those people move on, accept that you will have to do it again.

Our small team chased a delinquent commission payment first from a carrier, then a major distributor, for eight months, through two mergers, and against repeated attempts to shut down our efforts to collect. In the process, we had to rebuild a network that necessarily includes everyone from front line staff to C-level management. But I am convinced this is more normal than not and is the reality of working with large enterprise partners in a complex business.

If you’re an IoT or 5G device maker and feel you have your hands full with your own products’ complexities, please remember that your ability to overcome the sometimes-frustrating hurdles telecom partners will throw your way is likely to determine whether the rest of your business plan can come to fruition.

The author is Ed Finegold, co-founder & CFO, Canteen Wireless.

About the author

Ed Finegold is a global tech market analyst who founded Canteen Wireless, a US-based telecom reseller that helps technology developers to access mobile networks and build relationships in tier 1 carrier organisations. He can be reached at efinegold@canteenwireless.com

Comment on this article below or via Twitter: @VanillaPlus OR @jcvplus