Communications service providers (CSPs) will deliver more than 2.7 trillion business messages this year, rising from 2.5 trillion last year. Out of these, more than 60% will be attributable to mobile authentication, including one-time passwords (OTP) and multi-factor authentication (MFA). SMS messages provide a link or authentication code to a digital service; the value of SMS lies in its ubiquity.

In addition, interest in over-the-top (OTT) apps and rich communication services (RCS) continues to grow as a rich media alternative. However, this does lack the guaranteed termination of content owing to a high amount of regional fragmentation, reports Juniper Research

Mobile authentication continues to bring in revenues for CSPs

The COVID-19 pandemic has highlighted the need for a more secure means of authentication than the use of passwords. Providers of ecommerce and other retail services are now deploying a digital-first strategy. A digital-first strategy is now also being followed by network operators worldwide as a means of reducing the operating costs of physical retail stores and call centres, whilst introducing a digitalised form of customer service.

Europe and the Asia Pacific region represent some of the highest traffic for authentication, especially for OTPs. In addition, Asia Pacific has a high adoption of the GSMA’s Mobile Connect solution amongst stakeholders in the region. North America also uses mobile networks for MFA traffic, with many connectivity platform as-a-service (CPaaS) players launching services in these regions to capitalise on this growth.

However, recently, CSPs are facing increasing pressure from over-the-top (OTT) applications that are launching A2P services that seek to take this traffic, and the associated revenue, from the CSPs.

Why Rich Communications Services is a great opportunity for CSPs

This mirrors the trend in which CSPs gradually lost peer-to-peer (P2P) messaging traffic to these OTT apps over the last ten years. These OTT apps are far more agile than CSPs, and do not need to adhere to industry-wide specifications that can hinder development. Whilst this has accelerated the interest in RCS business messaging (RBM), CSPs have shown their lack of agility in comparison to OTT players. RCS represents the greatest opportunity for CSPs to develop significant revenue from rich-media messaging; however, at present, not all mobile network operators support RCS. Although this support is continuing to grow, enterprises will remain hesitant to transfer large portions of their business messaging traffic to RCS.

The deployment of an RCS campaign without the guarantee of the message being delivered in the intended format to all end users would mean that investment in high-traffic marketing campaigns will be unattractive.

However, authentication traffic is expected to remain on SMS for these three key reasons:

• Familiarity with the service: Enterprises are familiar with the processes of batch sending SMS messages. RCS adds an extra layer of complexity to these processes, including conversational elements, AI-based chatbots, and rich media capabilities.

• Guaranteed termination: As previously mentioned, RCS is not universal like SMS. As a result, authentication traffic is likely to remain over SMS. Whilst guaranteed termination is key, the speed of the delivery of the message is also important.

• Inexpensive rates: RCS is relatively more expensive compared to SMS. Given the aggregate costs of bulk sending, significant costs savings can be attained by placing this traffic through SMS.

Will flash calling disrupt A2P authentication messaging?

However, there is one potential avenue that operators must explore to retain application-to-peer (A2P) revenue: flash calling.

Flash calling is relatively nascent. However, it has significant potential to disrupt the A2P messaging space for authentication purposes. What is clear is that A2P traffic has a presence in the majority of markets. As a result, the impact from flash calling could be a global phenomenon, rather than being limited to a small number of geographical regions.

MFA is a key area of authentication and mobile identity. One common theme that is emerging is a digital identity solution that is progressive and versatile; driven by data and facilitated by technology, including application programme interfaces (APIs), machine learning (ML) and advanced verification services.

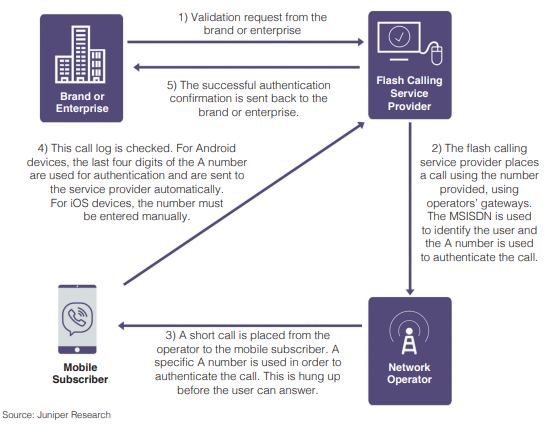

Figure 1 shows the process for flash calling:

Customer expectation is also a driver. Simplification of authentication services will be the catalyst for success of which authentication solution is widely used. From the perspective of the brand or enterprise, however, the differences between A2P SMS two-factor authentication (2FA) and flash calling are minimal, and thus the brand or enterprise will initially choose the most cost-effective.

However, these costs may rise if flash calling authentication traffic fails to authenticate the user, thus requiring more attempts to do so. Based on the billing mechanism between the service provider and the brand or enterprise, this may result in additional costs which will make A2P SMS two-factor authentication (2FA) more cost-effective.

Juniper Research recommends that service providers limit attempts to avoid this or implement single billing for application programme interface (API) calls to the same mobile subscribers over a short period of time, such as ten minutes.

What is flash calling and what is its monetisation potential?

Flash calling is a process in which brands and enterprises can utilise to authenticate areas of their relationships with clients.

Juniper Research defines flash calling as ‘an authentication process that uses mobile voice networks to authenticate users or actions. A missed call is placed, with the incoming number acting as the one-time password which can be processed automatically.’

Firstly, CSPs must begin auditing their networks to identify flash calling traffic. After this, CSPs have two options: monetising this flash calling traffic to generate a direct revenue stream or blocking the traffic to encourage the continued use of SMS. If left unattended to, the service may lead to substantial losses for CSPs who do not only fail to monetise this traffic, but will also experience a migration of A2P SMS 2FA traffic to flash calling services.

With the nascent nature of flash calling, many flash calls are likely to fail in the early stages of use. Flash calling providers must ensure that brands and enterprises are not charged for these failed calls. Low pricing or free traffic should be offered in order to entice potential brands or enterprises to use flash calling service providers. In turn, a path to a return on investment is demonstrable and will encourage further investment. However, implementation of this strategy must ensure fair usage policies and clear pricing information for commercial usage once the trial period ends.

This report first appeared inside VanillaPlus magazine. Subscribe here to access free, expert content.