The term techco has begun to slip into the telecoms industry vernacular over the past couple of years to describe how some telecoms operators are seeking to change their organisations, business models, customer relationships and the technology they deploy. However, there is no real consensus around what, precisely, the term techco means or which companies, or types of companies, communications service providers (CSPs) should be seeking to model, writes Mark Newman, the chief analyst at TM Forum.

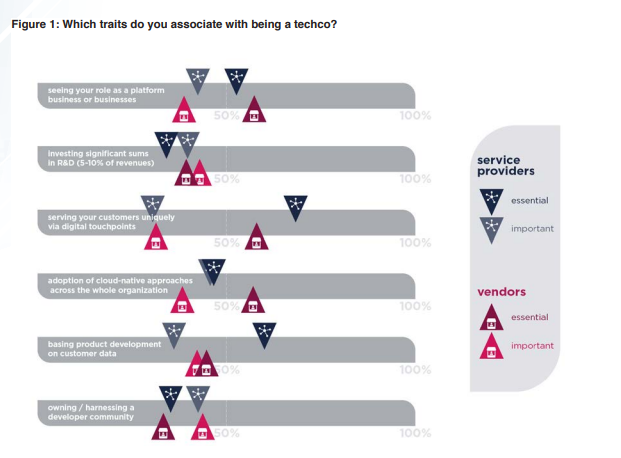

TM Forum conducted an online survey of 111 senior executives working in a range of roles across 66 CSPs and 46 countries. In the survey we asked our CSP and vendor respondents to consider some of the most important elements of being a tech company. These elements straddle the DNA of the telecoms operator organisation on the one hand and future telecoms operator business models on the other.

The first role we asked them to consider was as a platform business or businesses. A full 95% of CSP respondents and 96% of vendor respondents believe that being a platform business is either essential or important to being a techco. But more surprising, perhaps, is the fact that only 53% of CSPs and 58% of vendors consider it to be essential. This implies that 47% of CSP respondents and 42% of vendors believe it is possible, albeit unlikely, to be a techco without being a platform business.

Our respondents seem to be less convinced about the need for a techco to own and harness a developer community than they do for a techco to adopt a platform business model: 78% of CSPs consider it to be essential or important compared with 77% of vendors. Only one in three CSPs and vendors see it as being essential.

The attraction from a telecoms operator perspective of building a developer community around a marketplace is that it offers the prospect of massively increasing the size of its ecosystem and the number of products and services that embed telecoms operator connectivity. There is no single approach to how to make money from a developer community but, logically, it would involve charging developers to embed their (connectivity) application programme interfaces (APIs).

Telecoms operators first tried to build developer communities ten years or so ago, and at the time access to SMS APIs was the main attraction for developers. But new developer programme initiatives will be focused around 5G and edge computing. For example, US telco T-Mobile recently unveiled its DevEdge developer platform that taps into APIs and opensource technologies. Operators like T-Mobile are banking on such an approach to develop new B2B use cases.

Investing in R&D

Our survey respondents were not as convinced about the need to invest a significant proportion of revenues in R&D as they were in other traits of tech companies. Indeed, only 34% of CSP respondents deemed it essential compared with 40% of vendor respondents.

On this point it is interesting to compare the R&D expenditure of large telecoms operator groups, their main network suppliers and hyperscalers. The difference in absolute spend between telecoms operators and hyperscalers is staggering. In 2020 Amazon spent US$42.7 billion on R&D, Alphabet (Google) US$27.6 billion, Microsoft US$19.3 billion, Apple US$19.5 billion and Meta (Facebook) US$18.5 billion.

“Webscale network operators have, cumulatively, spent nearly US$1 trillion on R&D in the last decade,” notes Matt Walker, chief analyst at MTN Consulting.

In 2021, hyperscale network operators (HNOs) – MTN Consulting defines HNOs as “web-centric network operators who own and operate large multi-country networks based upon hyperscale data centres and submarine cables” – spent, on average, 10.2% of their total revenues on R&D. This dwarfs, both in absolute and relative terms, the R&D spend from telecoms operators which has remained relatively flat in recent years.

There is no way that CSPs will ever be able to start bridging the widening gap with hyperscalers in terms of R&D spend or, indeed, with other tech companies. Based on our analysis, the four hyperscalers – Google, Facebook, Amazon and Microsoft – spend 70 times more on R&D than the four CSPs that we have profiled: AT&T, BT, Deutsche Telekom and Telefónica.

So, why do hyperscale network operators spend so much on R&D and why do CSPs relatively spend so little? And if CSPs want to become techcos, does this mean they will need to increase their spend on R&D?

Given that operators’ revenues globally are largely flat, the only way that they would be able to significantly increase their R&D spend would be if they identified significant cost savings in the business that could be channelled into R&D.

In the past 20 years telecoms operators have reduced their R&D spend as they have outsourced their technology roadmaps and development to technology vendors and systems integrators. The products and services they have offered to the market have become a function of the capabilities of the products and services they have bought from vendors. This is what they are hoping to reverse by transitioning into techcos in an attempt to differentiate their technology from their competitors.

Understanding how and why hyperscalers spend so much on R&D helps to inform the discussion about what type of techcos many CSPs want to become. Hyperscaler investment in R&D spans a range of different areas of their business:

- Their data centre businesses (data centre chips, servers, power and cooling)

- Broader investments in their networks (network automation, traffic analysis, subsea-cable technology, streaming platforms)

- Investment in new product areas, some of which is highly speculative. This includes IoT operating systems, satellites, autonomous driving and new consumer services such as cloud gaming.

The payback from this investment in R&D comes in the ability to design and construct their own facilities, network elements and platforms. Specific examples of equipment that hyperscalers design themselves, rather than buying from third parties, include servers, switching gear (Amazon and Google) and, more recently, data centre chips. Indeed, the sustained strong growth in demand for their services and the demand to optimise technology for the specific services and capabilities they offer, coupled with geopolitical considerations and the inability to source technology from China, means that there is every prospect hyperscalers will seek to design more of the technology they use.

But it is not always about designing their own products. Sometimes it is more about influencing the vendor space and creating, or participating in, trade associations.

Hyperscalers’ R&D strategies would seem to have more in common with telecoms network and IT vendors than with operators. While hyperscalers are investing in R&D to help make better equipment for internet and cloud services, network and IT vendors invest in R&D to build better telecoms networks. But there is one key difference: hyperscalers do not sell their technology to other service providers; it is just for their own use. Network and IT vendors, on the other hand, sell their technology to any telecoms operators that want to buy it and, increasingly, directly to enterprises.

The leading telecoms network vendors – Ericsson, Huawei and Nokia – spend a similar proportion of their total revenues on R&D as hyperscalers. But the fact that their revenues are largely flat means that in absolute terms they are falling behind hyperscalers.

Digital touchpoints

Providing your customers with a digital-only experience is, perhaps, the most conspicuous facet of being a techco. As such, it is not surprising that 68% of our CSP respondents and 58% of vendors saw it as an essential trait of being a techco. A full 99% of CSPs consider it essential or important.

But techcos’ digital experience strategies are much more than simply a question of whether you communicate with your customers via a mobile app or a website on the one hand or a shop or a call centre on the other. A true digital experience is one where all the functions of the business are aligned with, and designed for, an optimal customer experience.

Such an approach can only be truly effective if it uses data generated by customer-facing systems to inform all aspects of the business. This includes product design and development, another common trait of techcos. Recognising that point, 96% of CSP survey respondents and 87% of vendor respondents said that basing product development on customer data is either an essential or important trait of being a techco.

For tech companies it is a given that the use of customer data is either the only or the main means of developing, testing, refining and launching new products and services. In a blog, video streaming platform Netflix describes at length the role of its Data Science and Engineering group. Many of the functions that it performs relate to the content it creates and commissions, based on how its customers consume existing services. And by effectively using customer data, techcos are able to trial new product and service ideas and concepts on a limited number of users and, based on their feedback, decide whether to go ahead with a full launch.

Cloud-native approaches

The adoption of cloud-native approaches for technology deployment is, arguably, the most important consideration driving operators’ endeavours to become techcos.

“I would say that what distinguishes a telco from a techco is that a techco is prepared to go right down into the components and, with their own in-house software engineering capabilities, develop flexible rules and data-driven components,” says George Glass, TM Forum’s chief technology officer.

Within telecoms operator IT functions, there is already a strong push to refactor existing applications and to take a componentised approach to new applications, to deploy them in the cloud and to change IT teams’ ways of working by embracing DevOps and agile software development.

Cloud-native approaches are much less mature in network divisions as a result of the technical complexity involved, the dominance of a limited number of end-to-end solution network vendors, the immaturity of the cloud vendor landscape and a lack of conviction from operators about the business benefits of cloud-native adoption.

What type of techco?

So we’ve seen that the term techco could be used to cover a broad range of different types of companies, with some or all of the traits we have looked at so far. Much of our analysis has focused on hyperscalers because, like CSPs, they are network operators with their own dedicated network infrastructure comprising data centres interconnected both nationally and internationally.

Other techcos may own some network infrastructure – for example they may host services in their own cloud – but in the vast majority of cases they are customers of the hyperscalers. Netflix, for example, which accounts for an estimated 15% of all downstream internet traffic globally, primarily uses Amazon Web Services.

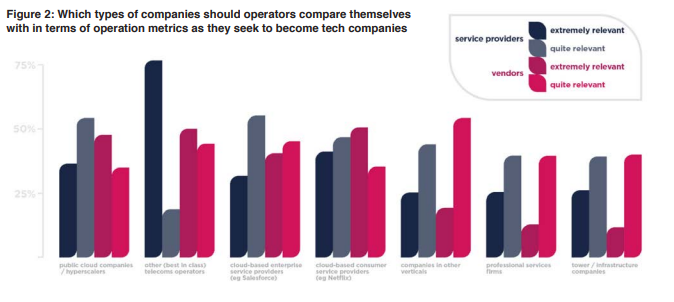

In our survey we asked respondents which types of company telecoms operators should benchmark themselves against in terms of operational metrics. We gave them the options of both traditional companies – other telecoms operators or companies in other verticals – and three types of techcos: hyperscalers; cloud-based consumer service providers such as Netflix; and cloud-based enterprise service providers such as Salesforce.

Unsurprisingly, our respondents considered benchmarks with other telecoms operators to be most relevant: 95% of CSPs and 94% of vendors said other (best in class) operators were extremely or quite relevant. Comparisons with hyperscalers ranked second, closely followed by comparisons with other types of techcos.

Two other benchmarking options which produced interesting sets of replies were professional services firms such as Accenture and tower companies. Three out of four CSP respondents (75%) and 87% of vendors considered that professional services firms were only quite relevant or not relevant. Such a high figure is, perhaps, surprising, given that many telcos are now seeking to build professional services teams and capabilities. The fact that a similar proportion of respondents also viewed tower companies to be only quite relevant or not relevant is also interesting given that many operators are seeking to realise the value of their tower/infrastructure businesses either through sell-offs or separate listings.

Comment on this article below or via Twitter: @VanillaPlus OR @jcvplus