Integrated SIM (iSIM) is the latest step in the evolution of SIM technology and presents appealing opportunities for product companies to make global devices that need out-of-the-box connectivity and ease of localised connectivity to national or regional connectivity providers. The iSIM can be designed into all products at the point of manufacture so a single variant can serve all markets. This has substantial benefits in logistics, warehousing, and balancing of supply and demand across different markets. iSIM also helps designers by streamlining development and accelerating time-to-market.

Simply selecting iSIM over the alternatives isn’t the end of the story. iSIM comes at a cost – for many deployment types and, although this is a modest incremental addition, for high volume offerings that have low price points, iSIM and the associated provisioning and management systems can be an expense too far. Organisations therefore must carefully consider when to adopt iSIM.

In addition to authentication to secure global networks, an iSIM can be relied upon due to the integration with a secure enclave as proof of trust. This opens up revenue opportunities in new streams of secure data. Future device use-cases will increasingly rely on trusted secure devices to assure the veracity of data transmitted and that the device identity has not been tampered with. This is perhaps the greater benefit of iSIM as it enables new business cases and IoT opportunities, writes George Malim.

The subscriber identification module (SIM) used to be a simple, easy-to-address part of device design. The SIM was accommodated within a plastic card with a universal form factor that could be inserted into any appropriately designed mobile device and used to identify the subscriber and enable charging for network usage. Although a simple concept that has matured and evolved over 30 years, traditional SIM usage involves substantial logistical challenges that include installing the SIM locally because of the need to use a SIM from a local connectivity provider. Plastic SIM means there is also inability to update or change service provider once the device is deployed without physically changing the SIM in the deployed device.

Plastic SIMs are cheap in terms of upfront cost, but inflexibility and maintenance and logistics costs start to add cost throughout the life of the device. The apparent low cost of plastic SIMs can mask their overall costs. Vodafone for example has reported publicly that by halving the size of the SIM card holder it has reduced the amount of plastic used to provide customers with SIMs by around 340 tonnes a year – equivalent to a reduction of 1,760 tonnes of CO2e. By eliminating the SIM card holder altogether even greater savings would be made.

eSIM and iSIM are already in the device and can be adapted over-the-air during the life of the deployment depending on the management system adopted or the usage of remote SIM provisioning (RSP).

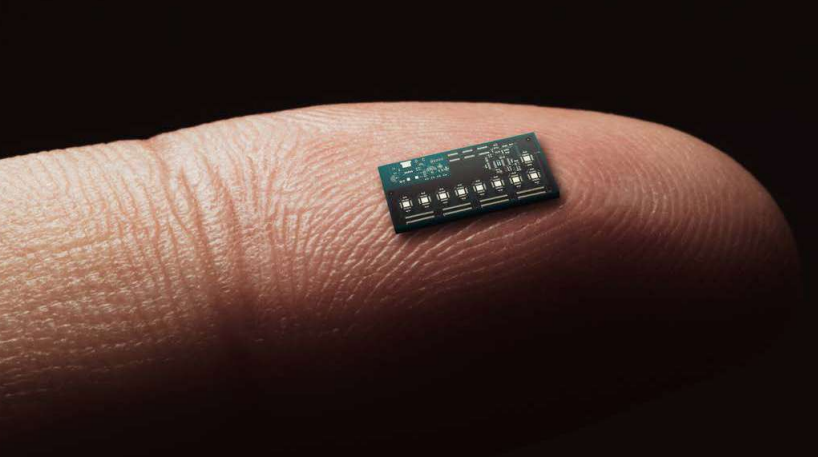

The integrated SIM (iSIM) moves the SIM from a separate chip into a secure enclave alongside the application processor and cellular radio on a purpose-built system on a chip (SoC). iSIMs are hardware-backed security, dedicated physical circuits rather than soft SIMs (or software). A secure enclave is hardware dedicated to protecting sensitive information that cannot be accessed. This in conjunction with a standards-compliant iSIM OS, gives iSIM it’s security assurance.

Unlike a plastic SIM it can’t be removed, so the subscriber identity is permanently tied to the device. This is poised to create a new market of opportunities enabled because the device identity and its communicated data can be trusted to be secure. Counterpoint Research estimates that iSIM-based cellular device shipments will exceed seven billion by 2030, demonstrating the fastest growth of any cellular-connected device.

The headline benefits of iSIM are that it consumes up to 70% less power than a discrete SIM, and is 98% smaller than an eSIM, measuring a fraction of a square millimetre. Further, depending on configuration of the iSIM operating system (OS), the secure enclave, process technology used and other optimizations, iSIM can deliver as high as a ten-fold performance enhancement over a discrete eSIM. The iSIM also reduces the bill of materials from three to one, with the iSIM bringing together the MCU, radio and iSIM OS running on a secure enclave into the module.

The headline benefits of iSIM are that it consumes up to 70% less power than a discrete SIM, and is 98% smaller than an eSIM, measuring a fraction of a square millimetre. Further, depending on configuration of the iSIM operating system (OS), the secure enclave, process technology used and other optimizations, iSIM can deliver as high as a ten-fold performance enhancement over a discrete eSIM. The iSIM also reduces the bill of materials from three to one, with the iSIM bringing together the MCU, radio and iSIM OS running on a secure enclave into the module.

Vincent Korstanje, the chief executive of Kigen, describes the current adoption status of iSIM as subject to the classic Amazon flywheel effect. First, the iSIM needs to be integrated into the radio chip, then the chip needs to be put into the module, and then the module needs to be selected by OEMs who create the products. Then, the mobile network operator will need to be involved to ensure the product has the right connectivity in the market in which it is deployed by creating a profile to go onto the iSIM.

“The more each of these steps happens, the faster you go around the circle and I think iSIM has now been around the circle two or three times so the momentum is growing,” he explains. “The other aspect is the maturing of the iSIM ecosystem. Companies like Sony Altair, Alif Semiconductor, and Sequans Communications have active iSIM implementation, and modules from vendors such as Quectel and Murata are leading OEM solutions on iSIM. We’re also seeing several mobile network operators coming on board with eight out of ten module makers already adopting iSIM – some are public with their products. Commercial deployments start with 5,000- or 10,000- unit batches but we’re increasingly seeing new use cases from customers who have never had cellular experience. This is a clear indicator how iSIM technology and the ecosystem approach is pulling in new players to take advantage of cellular for their IoT goals.”

The mobile operators themselves are starting to embrace iSIM with AT&T and Vodafone announcing iSIM offerings. MVNOs have also adopted iSIM with three-to-four of the top five MNVOs in North America, Europe and APAC publicly embracing iSIM with Kigen. In the last six months, Kigen has announced iSIM MNVO customers including floLIVE, Truphone, Soracom, iBASIS and Zariot.

“We are entering a new chapter of iSIM’s story,” says Korstanje. “We now have a range of evaluation kits and hardware options to test out which one is best suited for their use case. What’s exciting is this is done with not one company, but an ecosystem – so customers can advantage of deep industry expertise from multiple partners. This creates shared value for all ecosystem players, unlike the traditional value chain.”

Why iSIM?

The compelling advantage of iSIM is that it offers an extremely small form factor which makes it ideal for low-cost asset tracking and a new breed of devices that are coming to market, such as adhesive labels for tracking goods in transit. Small form factor and low power consumption are important drivers for iSIM selection. “iSIM solutions are compact and usable and they can reduce device power consumption,” confirms Loic Bonvarlet, the vice president of Product Marketing at Kigen. “The advantage with iSIM is that it’s existence can be relied upon due to the integration, which is essential for authentication and in-field activation. The device can be turned on and there’s out of the box connectivity.”

“If you need optimisation, it’s achievable with iSIM,” he adds. “Before you were limited by a slow SIM interface. But now you can optimise the integration between the cellular chipset and the secure enclave so that you can reach stronger security and performance levels and remove the performance bottleneck that you might have with a traditional SIM.”

Cost advantages

The scope and scale of this new market for secure, trusted devices is yet to crystallise, but eSIM and iSIM offer substantial cost savings over plastic removable SIMs. Recent research by Transforma Insights has revealed that, on average eSIM enabled devices cost 8% less to operate over the lifetime of a device than a plastic SIM and if that eSIM is part of an integrated module, the cost reduces by 11%. More substantial benefits come from iSIM, which is on average 13% cheaper than plastic removable SIMs.

The Transforma research revealed that while very low-cost plastic SIMs can be acquired for as little as US$0.10, more durable offerings are priced between US$1 and US$1.50, which includes US$0.5 for the SIM tray in the device. This is in contrast to an eSIM which has component costs of around US$2. The gap could be readily offset by the reduced logistics and maintenance costs of an eSIM in comparison to a plastic SIM.

iSIM cost advantages are little harder to quantify because there is no dedicated component cost. There is the notional cost of the secure enclave to consider within the chipset and the royalties charged for SIM OS functionality. Transforma estimates this increases the Bill of Materials cost by about US$0.50.

For situations where the business case can bear the slight increase in upfront cost of an iSIM, the repayments over the life of a service can far outweigh the initial costs. Consider the dollar amounts involved in being able to optimise connectivity and the flexibility of being able to shift operators as the location of the device changes. iSIM offers enormous potential especially for providers of mid-value and above global services because of the efficiencies it brings to manufacturing and deployment. Even further extension can be achieved by adopting RSP technologies that keep the iSIM connectivity optimised for the life of the device.

Scale would be the key disruptive force. Where iSIM comes in being a source of root of trust services is with securing data. Over the life of a device, if it can unveil new ways to use, exchange, and even trade data that is verifiable, it may spark off a true economy of trusted things. Examples exist today where iSIM-based consumer electronics, from connected washing machines to electric vehicle charging points, can become trusted sources of how the urban smart grid balances demand and supply.

“In general, iSIM is more economical because it is integrated” adds Korstanje. “Over time, it will become ubiquitous and there will be very few reasons to have a standalone SIM.”

iSIM use cases

Addressing the technical challenges of how to pack needed functionality and security in an increasingly compact size, lower bandwidth to extend battery life, and use novel connectivity networks have been the holy grail of IoT design. As discussed above, the costs of traditional SIMs were high for products with low price points and procuring suitable IoT connectivity needed significant in-house expertise. However, solutions such as Wi-Fi, LoRA, SigFox and others don’t have the same security assurances and resiliency of global cellular along with coverage. By addressing scale and cost, iSIM opens up a range of new use cases we did not know were possible before to a whole range of non-traditional players.

Kigen sees applications in asset tracking, especially in the transport and logistics market. “The container industry is well-equipped for container tracking, but you can have the same level of traceability down to the package level because we can now reach cost points where the business case is still justifiable,” explains Bonvarlet. “Efficient operations are becoming a priority on the agenda of all governments and cities. Being able to report on the condition and mileage for the carbon footprint or monitor key performance indicators from everything from trash collections to greenhouse gas emissions is a requirement. Being able to optimise asset usage is also important for public transport, for example, and I see iSIM fuelling the data that is needed to allocate assets and budgets.”

Bonvarlet foresees potential use cases where iSIM can enable asset tracking at a cost that aligns with a reduction in insurance premiums, for example, for some forms of transported assets. This type of real-world application will accelerate iSIM adoption and create a more mature ecosystem for iSIM that widens its appeal across many more verticals and use cases.

Secure identity

GSMA Intelligence has reported that 98% of enterprises what end-to-end solutions that protect data from the place of collection to the cloud, and this drives the GSMA’s IoT SAFE concept, of which secure identity is a fundamental ingredient.

The ability of iSIM to secure the device identity is a core part of its value proposition, as Korstanje explains. “The fundamental asset is the ability to update security because security is a continuously moving target,” he says. “Device identity is now the most important part of your security chain, starting at the chip level. It is essential to have ability to update to maintain security.”

This goes to the heart of the future of IoT. “iSIM is about opening the world of IoT for completely new players who need scale. Moreover, it’s about creating higher business value,” Korstanje adds. “It’s great to have all these devices connected, but what is IoT for? For me, it’s three goals: business transformation, enabling products as-a-service, and data trading.”

“To enable these goals, it’s really important to have trust built through the entire supply chain and that relies on secure identity,” he explains. “The iSIM now provides chip-to-cloud trust and security that allows people to know that the data originates from an authentic device, whether the device has been hacked or blacklisted, and if there is a need for the device to be updated. We know the keys are off the specific device and it can sign things and pull the whole trusted chain together to enable much more value to be extracted from those high-level services.”

iSIM, therefore, has the potential to create a large community within which actors can trust each other because of the secure identity that forms the foundation of the business chain. “We want to expand the usage of secure functions inside the chips and devices,” confirms Bonvarlet. “It’s the two sides of the coin – we have the chip-to-cloud as one, and the second is the trust-to-cloud use case. Hyperscale cloud providers have been key advocates, rightly appreciating the need for data to be verifiable and imposing the need for secure identity. Certificates that uniquely identify each party are required to onboard devices onto their IoT infrastructure. This has catalysed demand and raised much-needed awareness.”

Conclusion

IoT is evolving at a tremendous pace. Each use case has its own business logic and technical trade-offs to balance. No one technology can fit all or every type of IoT device. For those business transformation goals where companies are banking on connectivity being a radical innovation on which services can be built, there is a need to assess where and how connectivity adds value. This includes understanding what the value of secure data is when it is communicated in near real-time. This is where iSIM benefits outweigh any initial costs of adopting iSIM.

The compelling change is less about the enhanced flexibility and simpler logistics that iSIM offers and more about what iSIM enables by integrating secure identity into IoT devices. “With iSIM it’s not just another step in the hardware, it opens up a gateway to a new set of digital revenues that we haven’t even started to scratch the surface of yet. The potential lies in looking at situations in which cost-effectiveness and power and energy efficiency can play a part to liberate secure data revenue streams,” says Korstanje.

“Once you give people the tools to do that, you can start trading data because you can be assured of its legitimacy, you can pipe it through your big data cloud and rely on it,” Korstanje adds. “iSIM is often presented as an evolution of same SIM technology that has always enabled the mobile industry, but it actually presents a change in how it equips people to make powerful ideas and outcomes possible. That’s the promise of iSIM.”

Comment on this article below or via Twitter: @ VanillaPlusMag