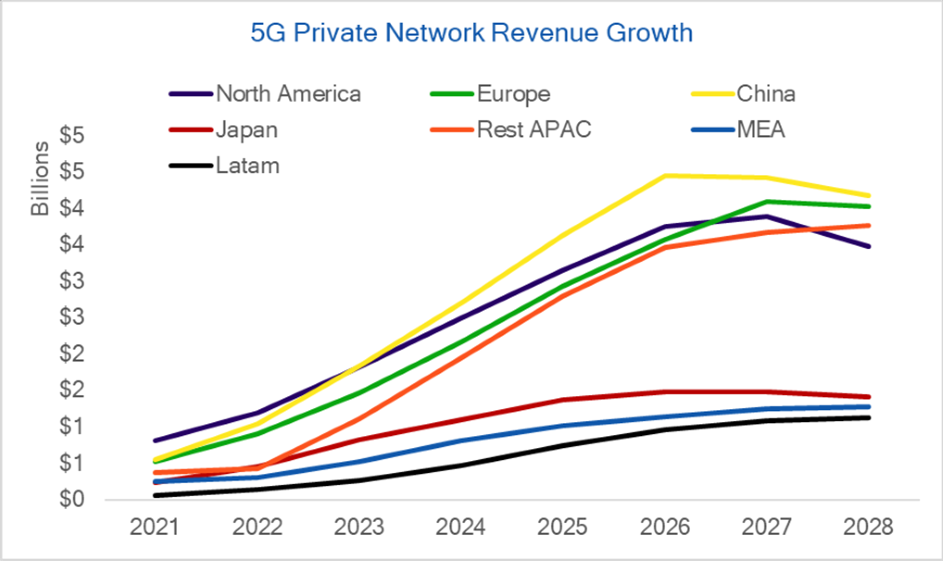

Private 5G network deployments will surge over the next few years faster even than public 5G, reaching a peak in 2027 when they will generate US$19.3 billion (€16.23 billion) in equipment sales, before subsiding after that as saturation approaches.

There will be a similar boom in deployment of enterprise WiFi networks around the latest 6E standard offering greater capacity and performance than the current generation, closer to 5G. However, that WiFi growth will be confined largely to North America and Europe, and will peak earlier in 2024, after which an increasing number of sites will swing to 5G for more demanding use cases.

These are key findings of the latest report, “Private Networks Driving Opportunities in 5G and WiFi” from RAN Research, the wireless forecasting arm of Rethink Technology Research. The forecast drills down into regions and vertical industry sectors, identifying manufacturing as a major driver for private enterprise 5G in line with the industry 4.0 revolution, but with strong growth across the board. Healthcare, transportation, energy and government stand out as other sectors where deployments of private 5G and WiFi 6E will take off faster than the average.

Cumulative growth in private 5G will be spectacular, with 26.6 million networks deployed around the world by 2028, up from 1.1 million in 2021. This growth will occur in all regions but will be especially striking in four countries leading the private 5G field now, the US, Germany, China and Japan. The report analyses each of those countries separately, with China the biggest, but the other three accounting for more networks per head of population, about the same in each case.

Of these four, China stands out for facing stronger regulatory resistance to private 5G where roll out is dominated by the three great state-owned monopolies, China Mobile, China Telecom and China Unicom. But strong upsurgence from the county’s enterprises, including government agencies as well as manufacturers, will open up the country’s enterprise 5G field to rapid growth.

While 5G will account for the lion’s share of the growth over the whole forecast period, there will still be a significant number of 4G private networks being deployed over the next few years. Similarly, on the WiFi front, the last generation 5 is dominant at present but it will be the latest 6E that takes over during the forecast period and offers an alternative to 5G for some of the emerging cases.

There will also be a revival of heterogenous networks combining WiFi and cellular under these two latest generations, as new AI based techniques finally deliver the smooth handover that has proved elusive for so long.

Private 5G networks will attract more new players into the mobile arena. Operators face competition not just from new service providers but also enterprises themselves bypassing them to build their own networks. The established technology providers themselves face a challenge from new providers coming in on the back of Open RAN.

For more Click here

Comment on this article below or via Twitter: @VanillaPlus OR @jcvplus