Who will become the Amazon of telecoms? Numerous industries have already discovered that pricing can be an effective strategic lever – now it’s time for CSPs to do the same, and to finally realize financial returns that match the actual value to their customers, write Linda Austin and Chris Yeadon

Today’s consumers increasingly perceive devices, applications and over-the-top (OTT) services to be the most significant elements of their telecoms experiences. Not surprisingly, some of the providers and manufacturers associated with these elements are making a fortune, while many communications service providers are experiencing declining average revenues per user and shrinking profits.

Today’s consumers increasingly perceive devices, applications and over-the-top (OTT) services to be the most significant elements of their telecoms experiences. Not surprisingly, some of the providers and manufacturers associated with these elements are making a fortune, while many communications service providers are experiencing declining average revenues per user and shrinking profits.

Perspective and perception

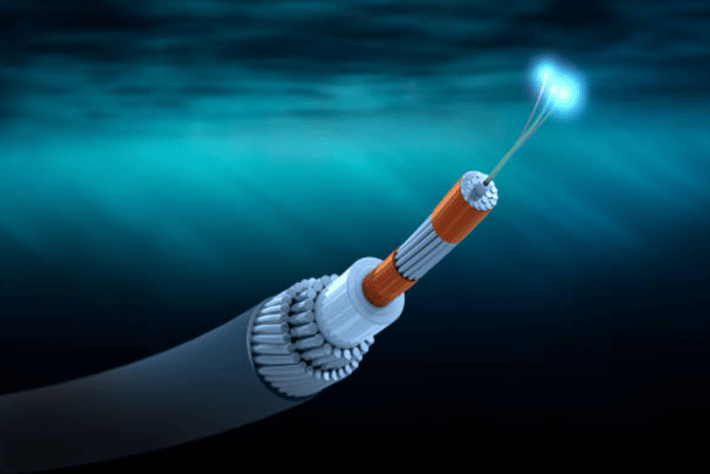

As a rule, consumers rarely think about the network unless it is not performing properly, and connectivity is increasingly considered as just another utility, like electricity or water. But in truth, the network represents far more value than any content that is being transmitted over it, or any device that taps into it. Without the network – and the significant investments that CSPs make in its infrastructure – those devices, applications and OTT services would be worthless.

So why aren’t CSPs making more money? It’s not for lack of trying. Many have embraced innovations in both products and customer service, and are now adopting business-model innovations to help them deal with evolving ecosystems. But by themselves, these approaches still aren’t enough.

Changing the game

It’s common wisdom that one cannot consistently time the stock market; likewise, merely lowering prices does not provide a sustainable

competitive advantage, and often leads to fatal pricing wars. It’s also well known that insider information can change the game. CSPs have unique, legal access to insider information in the form of the consumer, application and network data traversing their networks. Until now, traditional telecoms systems couldn’t adequately capture or analyse this data to support pricing innovation, nor implement that innovation, so there was little incentive to develop pricing innovation as a strategic lever. As a result, CSPs have not fully realized the financial rewards from the differentiators that they control and that drive value in the consumer’s experience.

However, technology that enables such capabilities has developed rapidly in recent years. Today’s integrated, real-time, analytics-driven support systems – coupled with software-defined networking, network functions virtualisation and cloud technologies – can make CSPs as nimble and opportunistic as their IPbased OTT counterparts.

This means that the time has come to begin thinking differently about how telecoms services can be priced and sold. Other industries have already discovered that pricing can be an effective strategic lever. CSPs can – and should – do the same, and finally realize financial returns that match the true value of their networks.

Rethinking CSPs’ role in the value network

In many ways, CSPs today are in an enviable position. They have an active, ongoing relationship with consumers. They support those consumers through customer relationship management systems, call centres and, increasingly, through self-care portals. Through their billing systems, they also have a trusted financial relationship with consumers. They have the ability to price and package end-to-end services that OTT players cannot match, including connectivity, end-to-end control over policies and QoS, and convenient charging and billing services for movies and m-commerce. All these and more are legitimate assets in the digital services value network that impacts the consumer experience.

What if you were to break down those assets into the greatest number of individual value components representing potentially chargeable events? What if you could assemble them, even on the fly, into personalised offerings and experiences that consumers are willing to buy, and then price them for the greatest profitability?

This is the essence of what we call experience-based pricing – pricing that is dynamically personalised according to the consumer’s need or experience, and based on what an individual user values most while consuming a service at a given point in time or location. Experience-based pricing is the sweet spot where value is maximised for the consumer at a profitable level for the CSP. It matches the needs of the consumer and the requirements of the combination of device and service being used, along with other factors such as location, to provide the optimal consumer experience.

For example, high-quality video or TV delivery requires more network capacity than simple web browsing. How much is a consumer willing to pay for the optimal experience of watching a once-in-a-lifetime event, at their location, on their device?

Tailoring the consumer experience to this level of granularity means managing the network at the same or a similar level – and today’s systems and technologies provide the CSP with that capability. The resulting agility and capacity to personalise the experience contextually makes the CSP more valuable to consumers and more attractive as a partner to application developers and OTT service providers. It ultimately translates into increased revenue and higher profitability derived from the consumer, and potentially from the partner too.

Is experience-based pricing worth it?

We are not suggesting that CSPs simply raise prices. At its most basic level, experience-based pricing is about moving beyond current innovation around the pricing structure to include innovation around the pricing level and capturing the known units of value that comprise the consumer experience, such as ondemand speed boosting and yield optimisation, to give just two examples. These are familiar to most CSPs and are relatively easy to implement with nextgeneration systems that are analytics-enabled, operate in real time and are driven by a centralised catalogue.

The next – or possibly concurrent – step is finding hidden events in value networks for which consumers would be willing to pay. This value discovery fuels pricing-level innovation based on context. Here is an example from another industry. Like all airlines, Virgin Atlantic always had some rows in coach with more leg-room than others. It always had seats near the main exit, from which it was faster and easier to deplane. But it wasn’t until it realized the consumerperceived value of those features that it began charging a slight premium for them – and many consumers have been happy to pay more for the extra space or quick getaway. Are there similarly chargeable value elements waiting to be discovered in operators’ current services?

Pricing innovation can take many forms. In the US, Netflix has sought deals directly with Comcast and Verizon to assure QoS and a consistent experience for its streaming video services. CSPs could therefore make additional profit by directly offering optional levels of QoS to the consumer as well, and by providing the optimal experience based on the consumer’s context. The consumer could be charged more (or less), according to perceived need, and the service can be packaged and conveniently billed along with other services. This is not the same approach as turbo-boost add-ons – it utilises analytics to identify the unique circumstances of how, where and when a specific consumer is using a specific service, and offers varying levels of value accordingly. Think of turbo-boost combined with yield optimisation – CSPs are familiar with yield optimisation to capture value from excess capacity, but yield optimisation applied to a turbo-boost scenario results in additional value capture in a condition of constrained capacity.

Pricing innovation can take many forms. In the US, Netflix has sought deals directly with Comcast and Verizon to assure QoS and a consistent experience for its streaming video services. CSPs could therefore make additional profit by directly offering optional levels of QoS to the consumer as well, and by providing the optimal experience based on the consumer’s context. The consumer could be charged more (or less), according to perceived need, and the service can be packaged and conveniently billed along with other services. This is not the same approach as turbo-boost add-ons – it utilises analytics to identify the unique circumstances of how, where and when a specific consumer is using a specific service, and offers varying levels of value accordingly. Think of turbo-boost combined with yield optimisation – CSPs are familiar with yield optimisation to capture value from excess capacity, but yield optimisation applied to a turbo-boost scenario results in additional value capture in a condition of constrained capacity.

To realize the full potential of experience-based pricing, CSPs will need an ongoing process to discover the uncaptured value within their value network. Such value discovery requires a commitment to digging deep, to using analytics to understand what the consumer values, and then to capturing and monetising that value. It can be a challenge to develop the organisational mindset and processes required, but to realize the financial rewards of experience-based pricing fully, it is necessary to make pricing strategy a part of CSPs’ organisational culture, and to look continuously for ways to increase – and profit from – perceived value to consumers.

The pricing model and beyond

What if CSPs could change the pricing model in at least some parts of their business, according to the experience provided? As an example of pricingstructure innovation, General Electric (GE) traditionally sold jet engines at cost in order to make a better profit through expensive maintenance contracts. Customers had little choice but to go along, although most were not happy with the arrangement. So GE changed its pricing model, and now sells usage rights to new engines, which include spare parts and maintenance. Customers only pay for the actual time an aircraft is in use, which means GE is highly motivated to keep engines in excellent repair. The result has been a rise both in profits and in customer satisfaction.

Pricing model innovations need not be quite as dramatic as those of GE. For example, mobile operators are launching pricing that better aligns with what consumers value, including no-contract options with a financing plan for the device. Ultimately this creates a win-win for CSPs and their customers.

This feature is an excerpt from an article first published in the Ericsson Business Review. To view the entire article, visit: http://bit.ly/1ywnv6M