Monthly ARPU (average revenue per user) combined across both mobile and fixed broadband is set to fall by 4.2% from €7.48 in 2022 to €7.16 in 2027. This, despite telcos spending a fortune on new 5G and all-fibre networks. Business technology journalist, Antony Savvas asks whether the communications market for telcos is sustainable?

According to industry analyst Omdia, total worldwide revenues from mobile and fixed broadband services will grow 14% between 2022 and 2027, to reach €1.2 trillion, but at the same time it reported the troubling ARPU decline above.

Permanently-spinning hamsters

It’s almost as if communications service providers (CSPs) are in a permanently-spinning hamster wheel of trying to address the demand for ever-increasing connectivity speeds, while never seeing a margin-busting return for their efforts.

We’ve seen the same thing happening over the last 20-plus years with 3G, 4G, Wi-Fi, ADSL over copper and shared/contended FTTH (fibre-to-the-home) services: the returns simply don’t seem to be improving for the companies putting the costly deployment effort in.

According to Omdia, 5G will account for 5.9 billion subscriptions in 2027, equivalent to a population penetration of 70.9%. And consumer residential fixed broadband subscriptions delivered via fibre will exceed 1 billion subscriptions by 2027, which equals a household penetration of 41.9%.

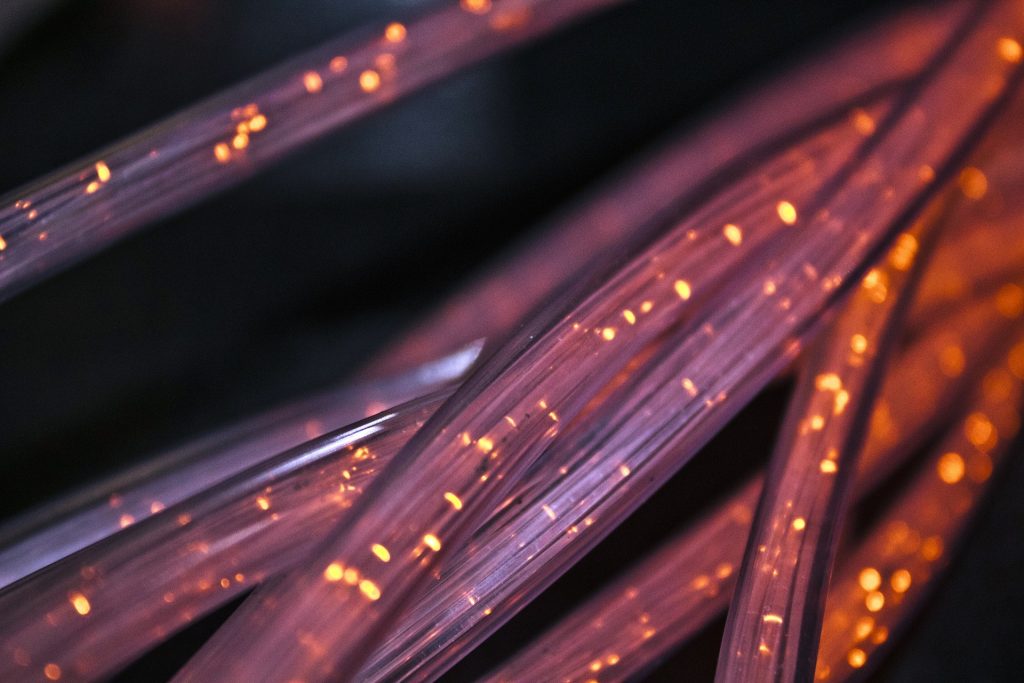

The telcos’ rush to further expand their reach to bandwidth-hungry consumers was further illustrated this morning. Vodafone has agreed to form a joint venture with Altice, to invest €7 billion in rolling out a fibre-optic network to 7 million homes in Germany over a 6-year period.

The new FibreCo venture will see Vodafone Germany own 50% of the company and Altice the other 50%. FibreCo will start to operate in H1 2023, subject to the approval of regulators, and will concentrate on connecting homes that are part of large housing associations.

“We are proud of our long-standing relationships with housing associations and pleased as a trusted provider to bring more connectivity options for tenants,” said Nick Read, Vodafone Group chief executive. “This significant infrastructure investment supports the country’s social, economic and digital development and the broadband ambitions of the German government as part of Europe’s Digital Decade targets.”

Vodafone Germany says it is not providing FibreCo with “any minimum revenue or volume commitment” from the alliance, but it seems like good window dressing for local and national politicians aiming to prove to voters they support better connectivity.

Unwilling to pay more

But Omdia says of the global fixed broadband market: “The transition to fibre has had a “net positive impact in most cases” as the technology offers a “much-needed step-change in home broadband quality of service on the back of the pandemic.” However, it warns, markets with high fibre penetration are seeing a “significant drop” in ARPU, such as in France, Spain and China as competition intensifies. “There isn’t a clear monetisation path for fibre customers once they have transitioned,” says Omdia.

And of mobile markets, it says “it is now evident that 5G will not be sufficient to offset ARPU decline” as “customers are unwilling to pay more for it. Unlimited data and video streaming services bundled exclusively on 5G contracts have had some success, but this only gives the industry the illusion of a 5G ARPU uplift”.

As I have previously mentioned in this column, I pay TalkTalk £27.50 (€31.80) per month for a 1Gbps all-fibre connection to my home and nothing else on top. I’ve had the service for well over over three years, and, fortunately for them, I’ve never had to call them once for any extra support, apart from when the connection failed right at the beginning of the annual contract, which originally cost £25 (€28.90) per month.

TalkTalk offers call and entertainment packages over this line, but they haven’t had a bean from me over and above the connectivity cost, in all my time with them.

Similarly, with my O2 SIM-only connection to an old 4G smartphone, the only extra cash they get from me is when I sometimes pay £6 a day for unlimited call and data roaming when in the US (it’s still free roaming with O2 across Europe, despite Brexit).

At the moment, I have no interest in 5G connectivity myself, as often there is free Wi-Fi somewhere nearby if I really need it to very rarely download or stream larger pieces of content.

Younger consumers?

I know younger consumers often have different requirements, but they are usually very adept at finding free connectivity when they need it, including sharing each other’s spare data. There are youngsters who will purchase “must-have” extras of course, but they don’t seem to be high-enough in number to turn the telcos’ fortunes around.

Omdia research director, Ronan de Renesse, says: “People don’t buy technology, they buy fun and exciting new experiences. The network is the bedrock on which innovation and creativity can flourish like 4G and mobile apps. But it is not just up to operators to solve the ARPU growth challenge, rather it is the rest of the digital services ecosystem.”

If that’s the case, the only way telcos are going to make any real money is to severely up the price of their connectivity, but who will be brave enough to move first in the present economic climate, with millions of consumers being forced to reduce their connectivity and digital entertainment costs?

The author is Antony Savvas, a global freelance business technology journalist.

Comment on this article below or via Twitter: @VanillaPlus OR @jcvplus