As 5G arrives, private networks start to gather momentum and new applications enabled by artificial intelligence (AI), machine learning and software-based network control transform telecoms. VanillaPlus caught up with Sam Barker, the head of analytics and forecasting at Juniper Research, to understand where the opportunities lie for communications service providers (CSPs).

VanillaPlus: CSPs continue to need new sources of revenue and to increase revenue from existing services. Is it fair to say the enterprise or business-to-business market has been overlooked amid the excitement over potential 5G consumer revenue? Isn’t it the reality that the real money in telecoms comes from enabling communications for enterprises?

Sam Barker: Network operators’ revenue comes from multiple sources, however they all generate revenue streams from their network infrastructure, including voice, messaging, Internet of Things and international roaming. Whilst the majority of revenue is generated from costs levied on mobile subscribers, it is more evident than ever that CSPs must now explore the B2B markets to grow revenue.

The traditional mobile pillars of SMS messaging and peer-to-peer (P2P) voice calling are in decline. Although the global pandemic brought about a change of consumer habits, with mobile commerce growing quicker than forecast out of necessity, and voice calling seeing an upturn in lieu of face-to-face interaction, the general trend suggests that over-the-top (OTT) messaging and calling services offered by third-party providers will continue to impact CSPs’ revenue.

However, there are other revenue streams that CSPs must now focus on: mobile commerce, mobile identity, carrier billing and application-to-peer (A2P) voice functionality all offer tangible alternative revenue opportunities for CSPs that put the cost onto the enterprise. Indeed, Juniper Research’s reports into areas including A2P Messaging, Flash Calling, CPaaS and Conversational Commerce, all expose a single trend; that scaling up CSPs’ revenue involves increasing B2B services.

VP: How do you see the future of business messaging developing as hybrid working becomes standard, regulation rebuilds trust in messaging in general and customers and prospects increasingly find messaging an acceptable method of conducting business?

SB: As with all digital services, authenticating users and transactions is becoming increasingly important. The move to a hybrid working environment is accelerating the need for these new layers of security. SMS, as a technology, provides the perfect platform for many of these digital service providers to authenticate users by sending an SMS to a mobile phone number. Through the pandemic, enterprises have been able to see the advantages of investing in digital authentication services and the level of investment appears set to continue.

Mobile authentication involves sending the user a verification code over SMS – an essentially universal technology. Whilst the technology does lack the security of the other channels, as it lacks end-to-end encryption, it still remains a valuable proposition for enterprises. The mobile SIM card is used as a tool to verify identity that can enable legally binding authentication for new user accounts and payments. Indeed, these users’ certificates are stored on the CSP’s SIM card, which are then accessed via a PIN code.

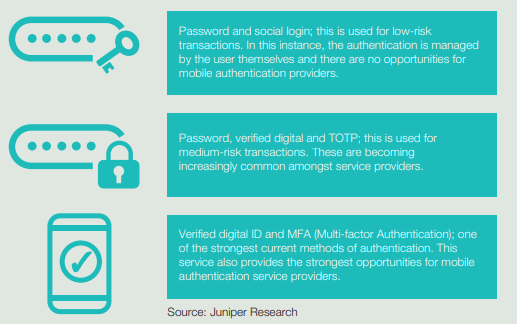

In doing research on CSPs’ reliance on authentication for SMS, we anticipate that more than 60% of total SMS business messages sent in 2022 were for authentication purposes. Adoption of SMS authentication has been accelerated due to the pandemic, and the increase in hybrid working scenarios has greatly enhanced the need for this level of authentication. In addition, there are many methods in which the enterprise can complete authentication. These are shown in Figure 1.

Examples of mobile authentication processes

The COVID-19 pandemic has accelerated the development and user adoption of digital services, which has driven the uptake of mobile authentication services by enterprises. Juniper Research notes that the speed of digital adoption has increased due to the pandemic, with new services – such as digital virtual assistants – developing as a result. Through the pandemic, enterprises have been able to see the advantages of investing in digital technology with authentication, and the level of investment appears set to continue.

VP: What about the resurgence of voice communications – is trust in voice returning, are users turning to telephony again or is voice dominated by conferencing apps? How do you see telephony reinventing itself and having relevance for the current generation?

SB: It is imperative that mobile operators develop new revenue opportunities in order to ensure the success of their mobile voice services. There are many new areas Juniper Research has identified as key to increasing voice-based service revenue for operators, such as flash calling, programmable voice, contact centre-as-a-service (CCaaS) and voice recognition services.

In addition, voice firewalls are used to identify potentially fraudulent voice traffic to further the profitability of voice channels. Owing to the development of VoLTE and voice-over-5G (Vo5G), unlike SMS traffic, voice traffic adds a degree of complexity. This is due to these technologies requiring various different network planes to carry IP-based traffic. Without a comprehensive voice firewall, CSPs will not be fully monetising this resurgence in voice traffic the market is currently experiencing.

It is not only the enhanced complexity of voice traffic that encourages this use of voice firewalls, the rise of A2P communications will also cause an increase in the amount of IP-based voice traffic. Furthermore, this increased traffic will correlate to an increased prevalence of fraudulent activity. To protect this resurging voice revenue, it is essential that CSPs invest in these solutions to not only monetise A2P voice traffic, but also protect P2P voice traffic in areas where this remains an important service.

However, investing in new voice services is also important. In early 2022, voice players collaborated to provide a proof of concept for 5G interactive calling. Considering the increasing usage of Vo5G, network operators must capitalise on this momentum by not only developing, but also deploying, interactive calling capabilities. As mobile operators are already in competition with these OTT apps, we expect that CSPs will continue to offer advanced functionality to reclaim some of the P2P traffic lost, whilst increasing the value of its existing A2P services.

By 2026, our research forecasts that there will be nearly 2.5 billion Vo5G users worldwide. The launch of 5G standalone networks will provide an increased speed but reduced latency to end users, which will improve the potential of new voice calling services that allow operators to supply new levels of innovation for IP based telephony services.

VP: How will CSPs encourage the return to voice in telecoms?

SB: The underlying theme in the telecommunications market is CSPs’ focus on B2B revenue. Voice will be the same. The most prominent method of doing so will be through the implementation of CCaaS. Contact centres provide communications between companies and their consumers, and CCaaS solutions enable companies to enhance and upgrade their protocols in their control centres in any way they choose and with almost immediate effect. CCaaS is a service that merges cloud-based contact centre infrastructure with contact centre processes, and we expect this to play a significant role in the increasing usage of omnichannel communications strategies to centrally manage inbound and outbound communications for enterprises.

CCaaS is often an ideal solution for many contact centres, because it allows for scalability, as operational needs change daily. As CCaaS provides flexibility, this allows brands and enterprises to keep investment costs low whilst the capabilities of customer support are expanded. Previously, on-premises contact centre solutions meant that deploying new avenues of communication was often complex and time consuming. Voice will obviously play a major part in CCaaS operations, and CSPs will provide the underlying connectivity for voice channels.

CCaaS requires moving a contact centre infrastructure to the cloud, which will allow for the easy adoption of new functionalities and technologies. These technologies, including AI and automation, will allow voice cloud solutions to utilise voice AI in CCaaS; enabling users to view all calls and digital conversations in real-time, whilst also monitoring call routes and clearing. CCaaS platforms must work with CSPs to negotiate wholesale traffic agreements, from which CSPs can benefit financially. The launch of 5G networks and increasing reliance on software-based network functions means that these new voice functionalities can be implemented more efficiently, and innovation over voice channels will accelerate to meet the needs of CCaaS users.

Another technology that CSPs can use for voice revenue is flash calling, sometimes called A2P voice. Flash calling operates in a similar fashion to SMS business messaging; utilising a user’s phone number to authenticate a user. However, this is done via an unterminated voice call, rather than a terminated SMS message. In addition, rather than using a code displayed in the content of the SMS message, flash calling uses the A number itself as a code.

However, at present, there is not a significant number of CSPs who are actively monitoring or auditing their networks for this category of traffic. As a result, monetisation opportunities are being missed on a wide scale. Last year, Juniper Research anticipated that over 60 million flash calls were made globally and that figure could rise to 128 billion.

However, given the increased complexity in using the A number to authenticate the user or transactions, fraudulent players will need to take extra steps to avoid the use of flash calling platforms and the subsequent cost. It is of note that at present, brands and enterprises do not pay for official flash calling traffic, as the owner of the network, the CSP, can charge a premium for this traffic, if it can be identified by voice firewalls.

One of these new services enabled by higher levels of virtualisation is programmable voice. Programmable voice is the ability to make, control, receive and monitor calls via voice application programme interface (API) software. These voice APIs enable an application to connect to an operator network, but they also allow the app in use to control voice services, such as call recording and audio conferencing. Having these services is key to competing with the rise of OTT apps and the innovation they are able to bring to the market. Indeed, focusing on the B2B market for voice will enable CSPs to create new revenue by charging enterprises for A2P voice services.

VP: What does conversation commerce mean to Juniper Research and where do you see the opportunities for CSPs here?

SB: Conversational commerce is the process by which end users of conversational devices are able to make use of them for commerce purposes, including retail and banking. Conversational commerce is being driven by the rising interest in omnichannel communication and retail.

The omnichannel experience is being extended further through new developments, such as social commerce. eCommerce has the potential to move towards increasing the availability of – physical – products in real-time; linking brands to their consumers with fewer intermediaries. From these enterprises’ viewpoint, ensuring they cover all channels in which customers wish to answer is essential; a failure to do so will lead to missed monetisation opportunities yet again. Indeed, there are a multitude of technologies that CSPs will support that will be pivotal for the omnichannel communications business model.

A key technology that Juniper Research has identified is rich communication services (RCS). The biggest hurdle the technology faces is a high level of regional fragmentation of adoption; to enable a user, both the handset and the CSP need to support RCS for business communications. This enables messaging platforms, which work with enterprises, to identify and authenticate the user, as well as allowing CSPs to identify the RCS business messaging traffic.

In addition, RCS vendors need to ensure that they can accept as many different payment methods as possible, as preferences for these change regionally too. RCS vendors must mitigate this fragmentation by considering these regional disparities and partnering with leading payments vendors on a region-by-region basis, or risk suffering from a disparate regional portfolio themselves.

We expect that overall payments acceptance will broaden, somewhat driven by merchants’ desire to accept as many payments as possible. However, the regional disparities are not likely to diminish to any significant degree, especially amongst different payments mechanisms.

VP: Do you think CSPs will be able to generate the revenue they need from business messaging, voice telephony and conversation commerce? What do they need to do in order to maximise their opportunities in these areas?

SB: The telecommunications market has grown to become largely resilient; the focus for CSPs must be on utilising their existing network to generate new revenue or increase the size of existing revenue streams. As previously mentioned, CSPs are now focused on services that levy the cost on enterprises, rather than consumers, to generate revenue.

For messaging revenue, CSPs must continue tackling the issues of grey route messaging over their networks. By using grey routes to masquerade A2P SMS messages as P2P, fraudsters lower the cost to terminate the traffic. The onus is on the CSP to distinguish A2P from P2P traffic; many network operators are implementing traffic control measures, such as firewalls, to identify potentially fraudulent activity and subsequent revenue leakage.

To foster confidence in conversational commerce, there must be an increased level of convenience for the end user. If these services fail to provide users with reasons to start using conversation commerce, they will continue to use established commerce channels. However, these brands and enterprises will be largely unconcerned with the eventual method of payment. From a brand’s or enterprise’s viewpoint, they must ensure that they cover as many possible communications channels with their customers as possible, to maximise sales or service revenue.

However, for those players handling the payment of conversational commerce transactions, there must be an evaluation of regional variations of differing preferred payment methods. Indeed, there are numerous payment methods that have established themselves across varying regions. Brands and enterprises, especially those working in a multinational context, will look to partner with payments providers who can offer the most in-depth portfolio of commerce payment methods.

Comment on this article below or via Twitter: @VanillaPlus OR @jcvplus