Telco cloud is moving on as a concept to encompass modern multi-cloud operational environments.

The conversation about telco cloud has continued for more than a decade and communications service providers (CSPs) are showing greater willingness than ever before to run even critical systems from the cloud.

Increased familiarity with cloud offerings has grown CSPs’ appetites for cloud as the operational benefits feed through and concerns about ongoing control and security have been allayed.

However, CSPs are no longer looking at these only to improve their own operations, they’re also looking to generate new revenues by becoming multi-cloud service providers themselves, writes VanillaPlus managing editor, George Malim

What is multi-cloud?

Everyone understands that private cloud, enterprise cloud, public cloud and edge cloud all exist and form the IT foundation of various services, many of which can and are provided by CSPs.

However, different clouds traditionally have been viewed in isolation. For many applications and services, this separation can’t continue as edge clouds feed data to private clouds to enable everything from IoT to digital workspaces.

This new multi-cloud platform brings together clouds of all types and CSPs can participate, create, monetise and assure enterprise and consumer services ranging from hybrid workspaces to network capacity on-demand.

Why multi-cloud is a trillion-dollar opportunity for CSPs

The prize for CSPs if they get this right is that they insert themselves alongside the cloud hyperscalers – Alibaba, AWS, Google and Microsoft – as the providers of cloud services, not simply cloud infrastructure in the form of their networks. This truly is an opportunity to take share in the next trillion-dollar market as opposed to gaining incremental revenues from the traditional CSP business of selling wholesale infrastructure to the hyperscalers. The trillion-dollar market is realistic.

According to a recent whole cloud forecast from IDC, total worldwide spending on cloud services, the hardware and software components underpinning cloud services, and the professional and managed services opportunities around cloud services will surpass US$1.0 trillion in 2024 while sustaining a double-digit compound annual growth rate (CAGR) of 15.7%.

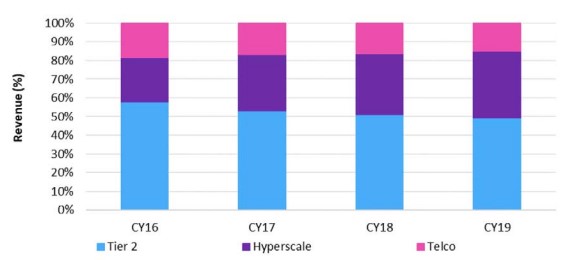

However, the trend for off-premises IT is towards the hyperscalers as Figure 1 illustrates. Data from research firm, Omdia, shows hyperscalers inexorably winning share from both CSPs and tier two cloud providers as their offerings become more widely available and more widely trusted.

Figure 1, because of the timespan covered, refers more to the single cloud era than the emerging multicloud era which may have more opportunities for CSPs. The software-oriented, virtualised new landscape means this isn’t necessarily a head-to-head battle. Just as hyperscalers use CSP infrastructure to enable their business, CSPs can use hyperscalers’ resources to support their customers and service offerings. They’ll pay to use that infrastructure in the same way as hyperscalers pay to use theirs but they will retain the opportunity to generate revenues from enterprise customers directly for the cloud services they provide.

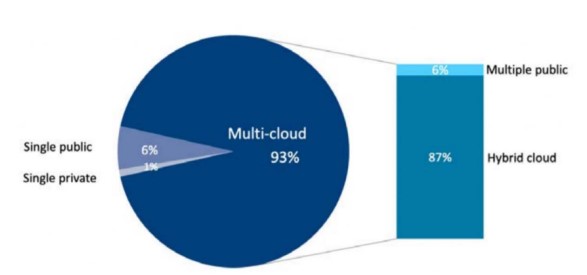

Encouragingly, Figure 2, suggests that the multicloud, hybrid cloud message has got through with 93% of respondents to a Flexera survey of enterprises with more than 1,000 employees stating their strategy is multi-cloud. This is demonstrative of a willingness to operate multiple clouds and to accept that these are provided from different types of providers, whether hyperscalers, tier two cloud providers or CSPs in future.

CSPs are preparing the ground with telco cloud revenue set to grow to US$29.3bn by 2025,

according to ABI Research. The company projects revenues will grow from US$8.7bn in 2020 at a CAGR of 27% with growth led by cloud infrastructure investments in virtual network functions (VNFs), managed and network orchestration (MANO) and cloud native functions (CNFs).

This level of cloud infrastructure investment is suggestive of CSPs’ commitments to not only become cloud infrastructure providers but also to harness growing capability in 5G network slicing and multi-access edge computing (MEC). All three of these technologies demand vast capital expenditure but sit neatly together as the enabling infrastructure for a cloud service provider.

ABI Research expects 5G network slicing to create US$8.9 billion by 2026 at a CAGR of 76% but points out that while this is only a small percentage of CSP revenues it is symptomatic of a growing market poised for further growth. The important question is to what extent CSPs will be able to achieve the goal of becoming cloud service providers. Ability to do so among CSPs will vary widely according to how advanced they are in their digitalisation efforts and the extent to which they roll-out 5G core networks and adopt cloud-native principles.

CSPs vs Hyperscalers – who will win?

A further challenge is that CSPs don’t have a clear field in which to establish their cloud service presence. The hyperscalers are also positioning themselves with telco-specific offerings such as AWS Wavelength and Microsoft Azure Edge Zones.

Therefore, while it appears the battle lines are being drawn for CSPs to come from the network to fight the hyperscalers while the hyperscalers travel in the opposing direction, the reality is that both types of organisation will continue to collaborate using each other’s infrastructure where most efficient. The difference for CSPs is they may avoid being confined to the role of infrastructure providers.

The trillion-dollar market is for the future. Today, a lot more development needs to happen as enterprises continue to move from on-premise IT to cloud environments. For many, multi-cloud is conceptually a step too far, although that will change as familiarity increases.

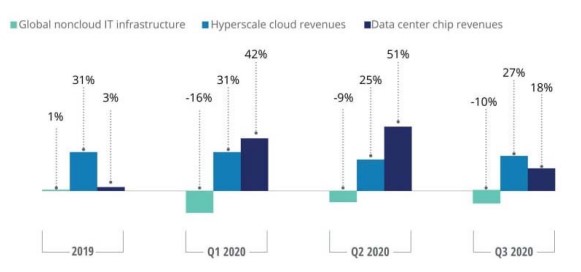

This is borne out by an April 2020 survey of 50 CIOs by consulting firm Deloitte which found that respondents expected to see the proportion of total workload done on-premise drop from 59% in 2019 to 38% in 2021, a reduction of 41%. Respondents also expected public cloud’s proportion of total workload to grow from 23% to 35% in the same timeframe, with private and hybrid cloud reaching 20% and 7% of workload, respectively. This shift in workload is reflected in IT expenditure as detailed in Figure 3.

Why hyperscale isn’t hyped – multi-cloud revenues for the 2020s

The five largest hyperscale public cloud providers that disclose segmented revenues saw their combined revenues grow by 31% in 2019 to US$94bn, Deloitte reports. Revenues for 2020 are likely to be more than US$125 billion, increasing to more than US$160bn in 2021, the firm projects.

As of mid-2020, there were 541 hyperscale data centres globally, with 26 added in the first half of 2020 and another 176 are planned over the next few years. All of these data centres need chips. Though chip spending and cloud revenues are not perfectly correlated, they are connected in the long run, with growth in chip revenues usually being a leading indicator: The chips need to be bought and installed in the data centres before the cloud revenues start flowing. On this basis, the buoyant chip market is indicative of strong cloud growth.

Who does what in a multi-cloud service?

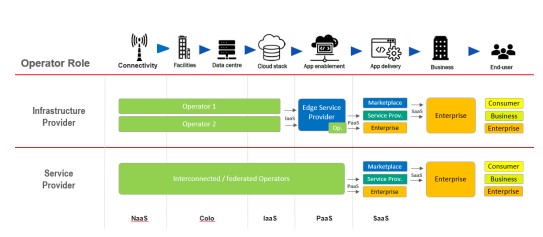

The essential elements of a multi-cloud service are illustrated in Figure 4, which sets out the service chain from the connectivity to the end user. This illustration explores the role of the CSP as an infrastructure or service provider but CSPs can go and occupy application delivery and business functions further to the right of the depiction to provide a complete or end-to-end offering.

These functional areas illustrate how CSPs have been building their connectivity expertise, adding data and cloud capabilities over the preceding decades to get to the stage they’re at now. An important stimulus for CSPs in this operation is the emergence of MEC and

the edge cloud. CSPs are well placed here because their networks extend to the edge whether to gateways or facilities near to the edge. These put them in a natural position to provide support to edge devices and facilitate processing, analysis and communication of data at the edge. Further integration of CSPs with applications adds completeness to their offerings and, crucially, puts them in that higher revenue service portfolio they long to offer.

Opportunities for CSPs as cloud service providers

The GSMA describes scenarios where the CSP is an infrastructure provider and as such offers the edge connectivity, computing and storage infrastructure. An edge service provider – often a CSP’s customer – may use this edge infrastructure and provide aggregated edge platform services to the market and could also provide a marketplace of applications to enterprises.

CSPs have an opportunity to become a sales channel of the edge service provider’s services, selling solutions directly to enterprises. However, this confines them to the role of a reseller, missing high value parts of the service offering. CSPs as service providers deliver edge connectivity, infrastructure and edge platform services directly to the market. They may interconnect with other CSPs and edge service providers to provide access to edge services beyond their own infrastructure and network footprint. CSPs that act together can offer a federated edge cloud service direct to enterprises and potentially to other service providers.

In this scenario, CSPs have control of more of the edge cloud value chain and can derive more of the new revenues from it. Similarly across the entire multicloud environment, CSPs can co-operate with hyperscalers or compete with them according to the assets they have and the capabilities they have to address market needs.

An important consideration here is that in the short term at least, hyperscalers are not in a battle to the death for market supremacy with CSPs. They certainly want to address and control the higher value aspects of the service chain as much as possible. However, in many cases, CSPs are well-positioned and have market advantages. In those cases, hyperscalers will partner with or be customers of CSPs. The challenge to CSPs in relation to that is they lose the potential to have direct cloud relationships with enterprise customers and, ultimately, hyperscalers may construct the assets and network infrastructure they need to compete with CSPs. The battle ahead is multi-faceted, reflecting the nature of multi-cloud utilisation and deployments.

An overview of the multi-cloud market

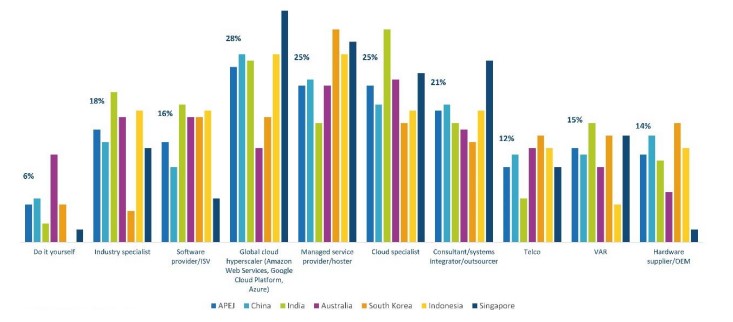

The relative novelty of this market means several different types of organisations are looking to participate in the multi-cloud market. As Figure 5, which covers the Asia-Pacific excluding Japan (APEJ) market, illustrates there are nine significant types of service provider targeting multi-cloud implementations in addition to organisations that are doing it themselves.

Among these, IDC reports CSPs are being looked to by around 12% of organisations, hyperscalers by 28%, cloud specialists by 25% and managed service providers/hosters by 25%. This shows hyperscalers are being more widely considered while CSPs are less on organisations’ radars. This will be a challenge for CSPs to overcome as they build their multi-cloud capabilities and bring more offerings to market.

The simultaneous competition and collaboration between different providers is at an early stage and future tables of this type are likely to include fewer market participants. Some CSPs are aiming to take a greater role in the multi-cloud landscape, starting from their position of networking strength. IDC defines the multi-cloud telecoms environment as an external digital lever for CSPs to provide enterprises with required key performance indicators, such as latency, bandwidth or jitter via a public cloud or cloudified internal systems, to enable scalability, faster go to market and improved customer experience. The provision of this multi-cloud ecosystem with end-to-end orchestration, seamless lifecycle services and secured and automated billing systems meets enterprise requirements and positions CSPs as ubiquitous cloud network providers alongside hyperscalers.

For CSPs looking to provide services across the multicloud environment, as opposed to those looking to provide networks and cloud support infrastructure, this is an opportunity to redefine the business of telecoms and provide high-value services directly to customers. For the infrastructure providers, this is another opportunity to participate in a large-scale, capital intensive sector in which revenues will commoditise over time.

This report first appeared inside VanillaPlus magazine. Subscribe here for exclusive access to the top Telecoms IT reports.