2020 saw a unique combination of events that will have lasting impact on the telecom industry – and not all negatively. Industry initiatives to establish a more ‘open’ RAN gathered considerable momentum. Francis Haysom, principal analyst at global research and consulting firm Appledore Research Group, argues that 2021 will be a critical year in which Open RAN really begins to change the shape of the telecom market.

2020 was a breakthrough year for Open RAN. Meaning, that at the start of the year, it could still be seen as something of an ‘interesting’ effort – potentially important, but years away. By the end of the year however, it was being cited as a critical part of strategies by CEOs from major vendors and operators alike. Online conferences were among the best attended (and most actively participated) of the year.

Does Open RAN really deserve all the attention? And into 2021, will its momentum be sustained?

I believe the answer to both questions is Yes – with some qualification.

Understanding Open RAN

“Open RAN” is now an umbrella term that covers a number of inter-related initiatives with a shared purpose to increase openness (that is, disaggregation of previously combined subcomponents) within the RAN, enabling (among other things):

- more flexibility in communication service providers (CSPs’) choice of equipment to meet a variety of different end-customer needs

- a more diverse and competitive RAN vendor landscape

- faster, template-driven rollout of new RAN (especially in rural or developing regions)

These programs are also seeking to enable the increased deployment of intelligence within the RAN, promoting lower operational cost, and faster innovation.

With roots in separate initiatives going back to 2018 and earlier, in 2020 a combination of commercial, technical, and political pressures acted as a catalyst giving a major boost to the Open RAN cause. Vodafone, Telefonica, Deutsche Telekom, Rakuten, Orange and DISH all made significant public announcements referencing commitments to deploying open RAN in live networks in 2021.

From the start, Open RAN has been strongly led by operators, who feature in leadership positions on most of the Open RAN initiatives. Most notable among those is the Open RAN Alliance, a consortium founded in 2018 by five communications service providers, but by the start of 2021 comprising some 27 operators and over 200 vendors. Also significant is the Telecom Infra Project (TIP) which sees Facebook join major CSPs in driving deployments of ‘open’ infrastructure (mobile RAN is just one thread of TIP).

The operator leadership of Open RAN reflects the strong commercial drivers that led to its creation and continue to steer its progress. Not only lower costs for RAN rollout and upgrade, but just as important: faster introduction of new features and services across entire networks.

How will Open RAN deliver these benefits?

Open RAN vs Conventional RAN

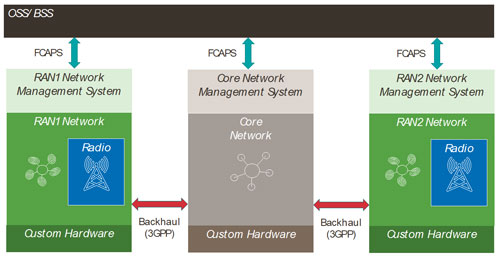

The success of mobile telephony has been fundamentally driven by global standardisation of functions and interface. Yet in the Radio Access Network (RAN) the process of standardisation and interoperability in many ways has gone in reverse, with increasingly proprietary integrated solutions from an ever-declining number of major suppliers.

Traditional (that is, proprietary) RAN solutions are designed with the intention that a CSP will deploy a single-vendor, vertically integrated RAN solution nationally or regionally, integrated via 3GPP backhaul interface standards with a core network management solution (NMS).

Source: Appledore Research

And with good reasons. Adoption of a single RAN provider nationally can currently pay dividends in terms of new service introduction. T-Mobile in the Czech Republic was able to deploy a national cellular IoT solution through a simple software upgrade of their single-vendor RAN. This is not possible for CSPs with a multi-vendor RAN because of the need to coordinate multiple RAN solutions and to integrate these RAN solutions to provide a national IoT solution.

Traditional RAN consists of standalone base stations, each with its own dedicated infrastructure at the site. Each base station would be separately managed, with processing dedicated to that site. This means that:

- With mobile users each base station needed to be sized for the perceived maximum users and traffic, with processing power being underutilized most of the time.

- With each base station separately managed there was also a need to coordinate frequency reuse between neighbouring cells.

- Supporting infrastructure for a base station, like cooling and power, needed to be replicated at each site and sized appropriately.

With the growth of mobile networks there has been a large increase in the numbers of cells and base stations. The infrastructure to support this, if it were based on dedicated base station functionality at every site, would not scale efficiently. For this reason, major equipment vendors introduced distributed base station architecture. By initially separating out the Remote Radio Head (RRH) from the Base Band Unit (BBU) the manufacturers were able to centralise BBU processing for many cell sites with connectivity to multiple RRH using fibre (fronthaul).

With the advent of virtualisation, the Base Band Unit (BBU) processing has increasingly moved from custom hardware to sit on virtualised infrastructure or to sit on the radio head itself. However, the connectivity between BBU and RRH remained proprietary and the BBU infrastructure, whilst now virtualised, remained proprietary. The RAN remained a proprietary integrated solution.

This meant that upgrade paths always favour the incumbent supplier. This is particularly the case where the supplier aims to reduce the cost of upgrade by building in reuse of existing infrastructure. Many 5G business cases today only work because of the ability to reuse LTE baseband and radio infrastructure, with card swaps and software upgrades.

Security and geo-politics have exacerbated pre-existing commercial concerns over vendor lock-in. The lack of options (in most cases one of two) has spurred CSPs (and governments) into serious efforts to open up the RAN and encourage new vendors to enter the market.

Enter Open RAN

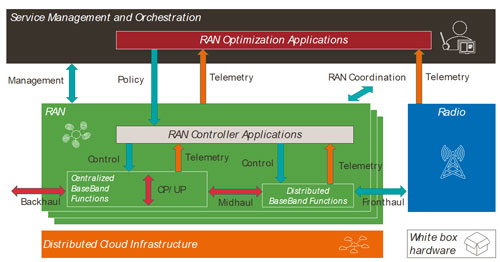

Open RAN exposes (opens up) the proprietary interfaces between RAN components, thereby offering the possibility for greater choice of individual components (and more critically, vendors for each component).

The key components and interfaces of Open RAN are shown below (those from 3GPP in red, those from the O-RAN Alliance in blue). This diagram focuses on what the interfaces and functions are achieving, rather than specific interface and component names.

Source: Appledore Research

The return of systems integration

The single largest new market opportunity in Open RAN will be systems integration. Appledore expects this to comprise around 30% of multi-vendor Open RAN spend. More than any other part of the market, this is likely to see the greatest competition: not only between established equipment vendors with services arms, but also software integrators, as well as operators themselves reselling their own experiences as proven blueprints.

Some pioneering CSPs will continue to drive the pace of Open RAN by doing their own systems integration. Since comparable work was only previously done within the R&D of large vendors, this represents a new area of risk for CSPs relative to conventional RAN rollout.

However, with Open RAN, Systems Integration takes on a new and wider role. It’s important to remember than Open RAN rollout is not only largely about software, but that it is about software that is replacing proprietary hardware. That matters because it means that the role of a systems integrator in Open RAN is not limited to assembling software components, but to supporting the lifecycle of development, test, subsystem integration, validation, test and assurance for RAN capabilities.

As such, opportunities exist for vendors with RAN equipment test and assurance expertise to adapt their expertise into Open RAN, as much as for traditional software SIs to expand into network lifecycle territory. The good news for operators is that there are vendors with both skill sets out there. By definition, this is one example of OpenRAN widening diversity and choice.

Open RAN ecosystems

Open RAN prompts discussion of establishing of viable (politically, technically, economically) ecosystems, and the need for new, specialist entrants in the RAN supply chain. While we believe this is possible, we also believe that Open RAN ecosystem clusters will need to start forming rapidly. Aspiring vendors should work to develop specific relationships that work well, rather than hoping that the badge of ‘Open’ alone will ensure success.

Operators and vendors will need to also invest in an Open RAN ecosystem of more than technology. Open RAN will require system integrators that can integrate and prime open RAN solutions to many, with economies of scale. Similarly, Open RAN will require network deployment capabilities that match those of the established RAN equipment vendors. If operators want Open RAN to be a success, then they will need to find approaches that can enable both of these. New Open RAN vendors must recognise that they cannot achieve success by themselves. They will need to actively work on building partnerships with others beyond just technology: choose friends and create ecosystems.

Adoption of Open RAN architectures and standards we believe is inevitable. Traditional RAN vendors will need to modify their behaviour to meet operator demand for openness. However, in doing this they ultimately have the opportunity to potentially strengthen their position as integrated suppliers with innovative suppliers of open RAN functions as part of their integrated offer.

Summary

Open RAN has the potential to fundamentally transform mobile networks by:

- Fully introducing software centric, cloud native design and implementation processes to a critical part of the network

- Opening up the RAN to a wide range of network innovators and disrupters

- Increasing the opportunity for automation and ultimately autonomous networks

Open RAN is still at an early stage, though making rapid progress with powerful and committed sponsors among the operator and vendor communities.

Operators and vendors alike must also recognise that Open-RAN is fundamentally about enabling new network software ecosystems. Standards will be important but are secondary to this aim. Rakuten, seen as the leader in Open RAN adoption does not in fact use the O-RAN alliance fronthaul standard for 4G, instead developing its own standard between radio units and baseband. Operators must not allow Open RAN to become a standards definition led process that only delivers benefit when a standard is fully agreed. Operators must actively participate in sponsoring “plugfests” and other forms of collaborative development. They should also consider taking this a stage further with early-stage trials of principle for innovative RAN services.

The author of this article is Francis Haysom, principal analyst at global research and consulting firm, Appledore Research Group. Appledore provides insight for the telecommunications industry with a particular focus on cloud management. Haysom brings to the role more than 25 years of senior-level industry experience in the telecoms and software sector.

For details of all the company’s reports, including Open RAN – Opening the RAN Ecosystem for Competition and Innovation, go to:

https://appledoreresearch.com/research-reports/latest-reports/

![]()