One of Newton’s famous laws of physics states that for every action there is an equal and opposite reaction. One of the dreams of businesses and their financial backers is that for every investment action there should be a return that is at least the equal of the sum invested and hopefully significantly greater.

Quantifying those potential returns before committing to any investment is a challenge faced by business decision makers all over the world every day, says Martin Hamilton, VP SaaS at MDS Global. They might typically begin by asking themselves this question: Is this an investment we have to make? They are also likely to weigh up the consequences of not making that investment versus its possible returns and benefits.

Because those buyers are unlikely to simply accept the reassurances of potential vendors looking to seal a particular deal, we asked the research and analysis team at STL Partners to take a detailed look at the impact a digital BSS solution could have on the everyday operations of a service provider addressing the enterprise business market.

What’s the financial impact of a digital approach to BSS?

We gave STL a completely free hand to question international service providers, to dig into the detail of their current business models and operations, and to analyse across a range of practical and operational areas the potential financial impact of a digital approach to BSS.

At a time when average revenues per account are declining, any measure that claims it can cut costs and boost revenue is certainly going to be welcomed. At the same time, the claims will also be viewed with caution. Being able to show exactly what can be achieved, by what methods, and in which areas of a service provider’s operation all supported by quantifiable numbers detailing the exact effect on overall profits helps to advance the conversation and inform business decision-making.

STL’s research analysed the impact digitising business support systems could have on business profitability across five key operational areas real-time billing management, automated service configuration, partner and wholesaler relationships, customer data analysis, and account management.

Real-time billing management

Some 60% of the operators believed that real-time billing management was the area where a digital approach could make the biggest impact on their profitability. That was more than three times the number who placed automated service configuration in first place.

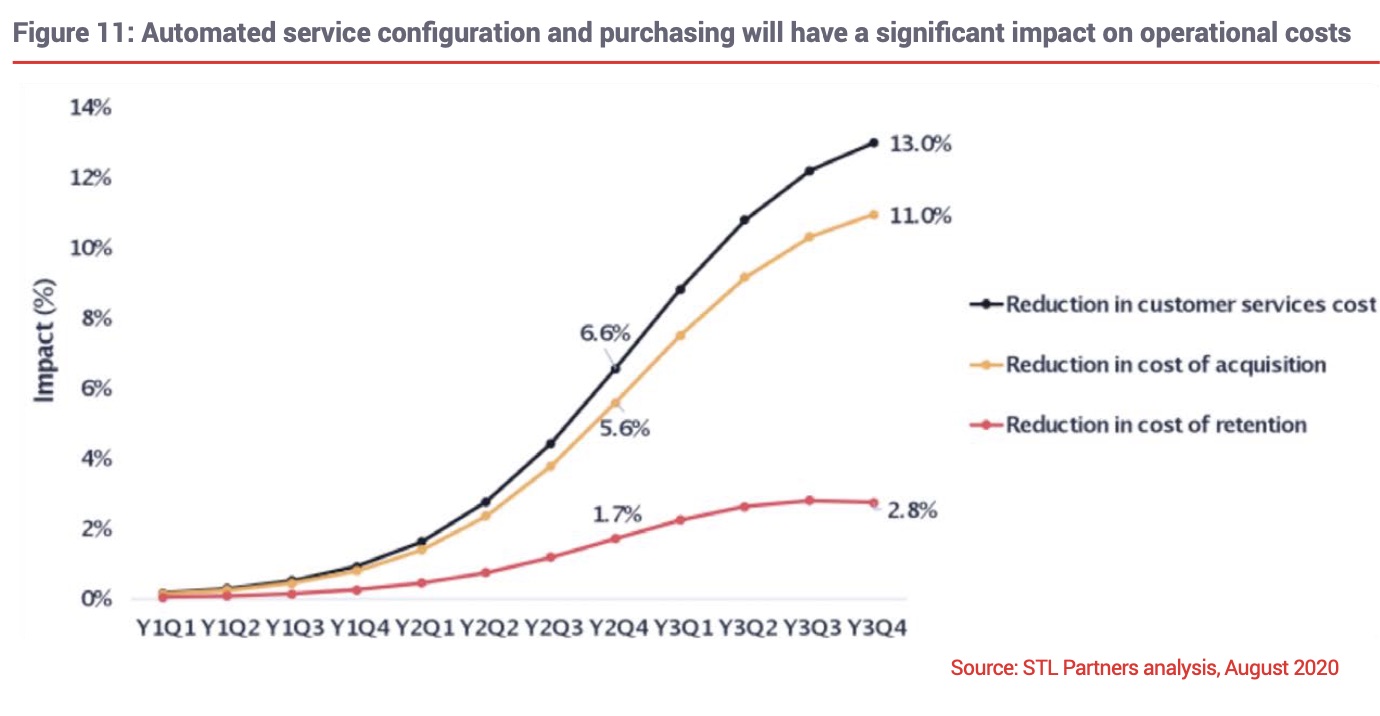

However, STL’s analysis produced some very different answers. For example, it revealed that while real-time billing management would reduce the cost of a provider’s customer service operation by around 6% over three years, the introduction of automated service configuration could more than double those savings to 13% over the same period.

In addition, STL also found that automating service configuration would deliver measurable savings in sales and general administration expenses (SG&A), and in the cost of goods sold (COGS).

Automated service configuration

Automated service configuration would work by giving controlled, but open, access to the digital BSS system and enable an enterprise customer, or one of the provider’s channel partners, to self-select and personalise the level of service required. The digital system would then automatically configure the service, price it in terms of operational cost, and issue a quote. If the customer accepts the quote, the system can then invoice for it and provision it automatically.

Automating the CPQ (Configure, Price, Quote) process in this way, both for customers and channel partners, creates a true zero-touch enterprise customer provisioning capability. STL estimate that automating CPQ and service provisioning can contribute to savings in SG&A expenses of around 9% a year, on top of those savings in the customer service operation.

It’s also worth remembering that in many countries, more than 90% of businesses are small or medium-sized enterprises (SMEs). It would be impossible for a service provider to offer tailored solutions specific to each enterprise customer. Switching to an automated, self-service, solution is the only way to deliver this level of flexibility which can then serve to boost revenues by attracting new customers and resellers. STL’s estimate was that, in addition to the savings achieved, automated service configuration and purchasing could deliver a 2.4% annual boost to service provider revenues.

There is that ‘return-on-investment dream’ of cutting costs and boosting revenues. However, STL’s report does not highlight one single big saving or revenue boost from a digital approach to BSS. Instead it considers the combined effects of marginal gains across each of the five areas studied.

Overall, it concludes that the adoption of digital BSS techniques for operator enterprise services could realise an EBIT profitability increase of between 2.7 and 4.1 percentage points over a three-year period. For a typical service provider with an historic EBIT profit rate of around 10%, the mid-point, or expected, return of 3.4% would represent a profitability boost of more than 30%. I think those operators and decision makers familiar with Newton’s Laws would regard that reaction as very acceptable.

To download the full report Click here.

The author is Martin Hamilton, VP SaaS at MDS Global.

About the author

The author Martin Hamilton is VP SaaS at MDS Global. He manages MDS Global’s SaaS business. Martin has more than 20 years’ experience in telecommunications, encompassing operational transformation, technical delivery and solution design. Martin has held key positions at Telefónica (UK) and TalkTalk (UK), at both a technical and a business level. Martin’s overall focus is on customer success. Outside of tech, Martin’s spare time is filled with 5-a-side football, the occasional jog and holidaying with a growing family.

Comment on this article below or via Twitter: @VanillaPlus OR @jcvplus