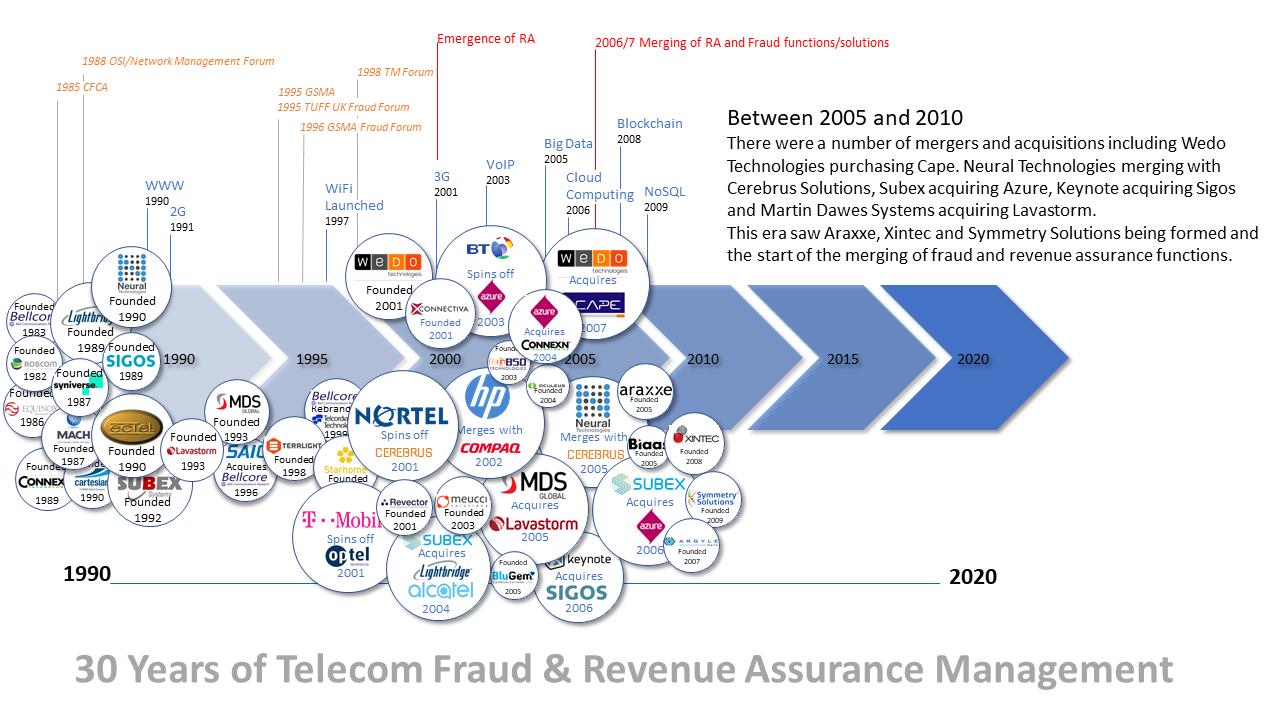

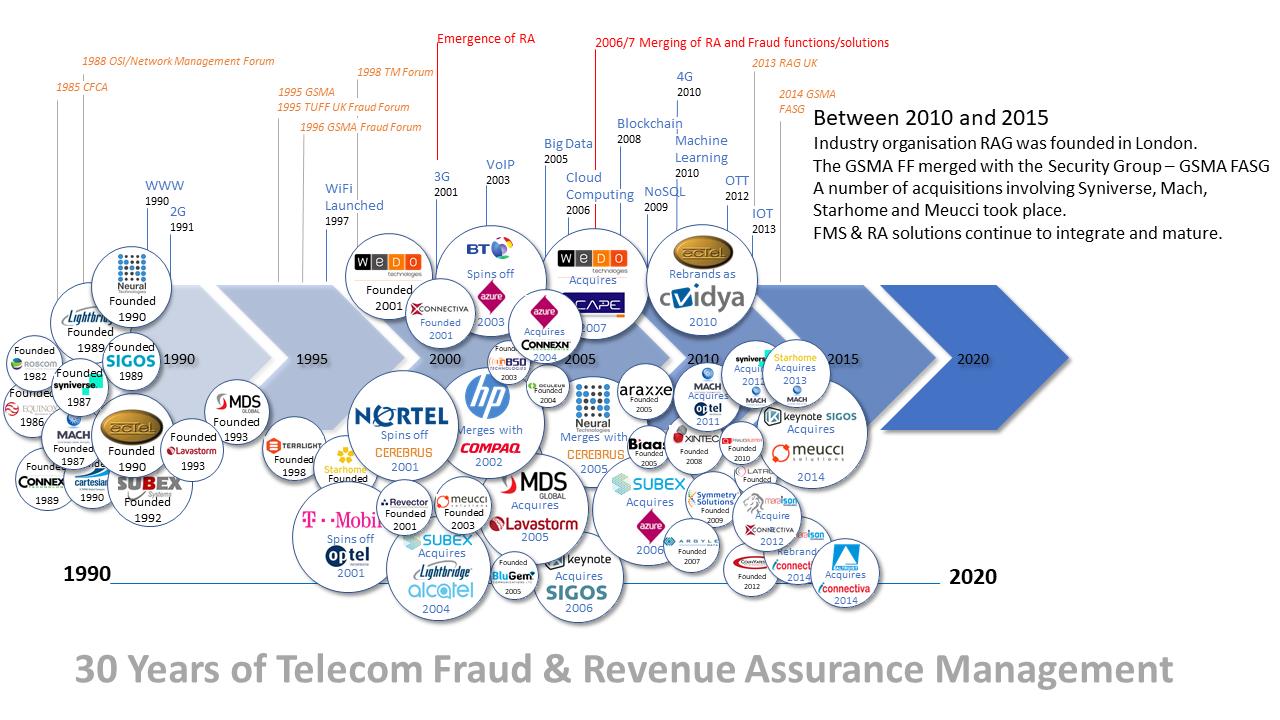

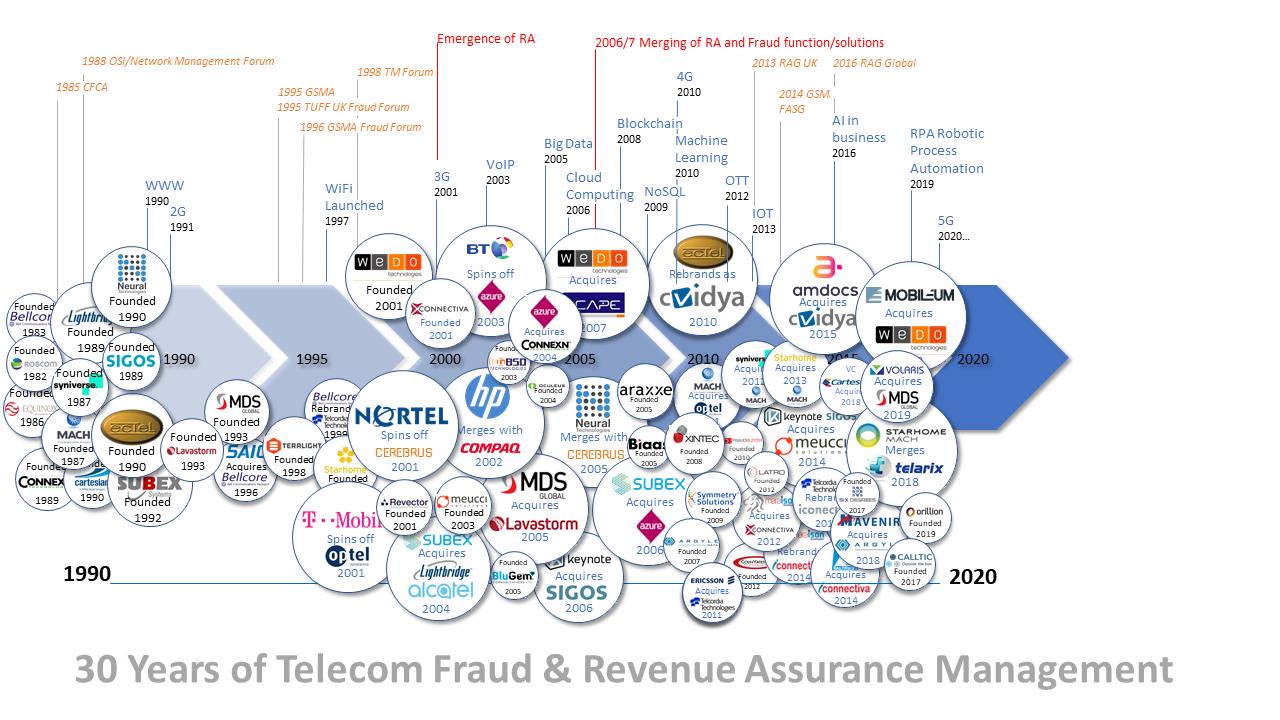

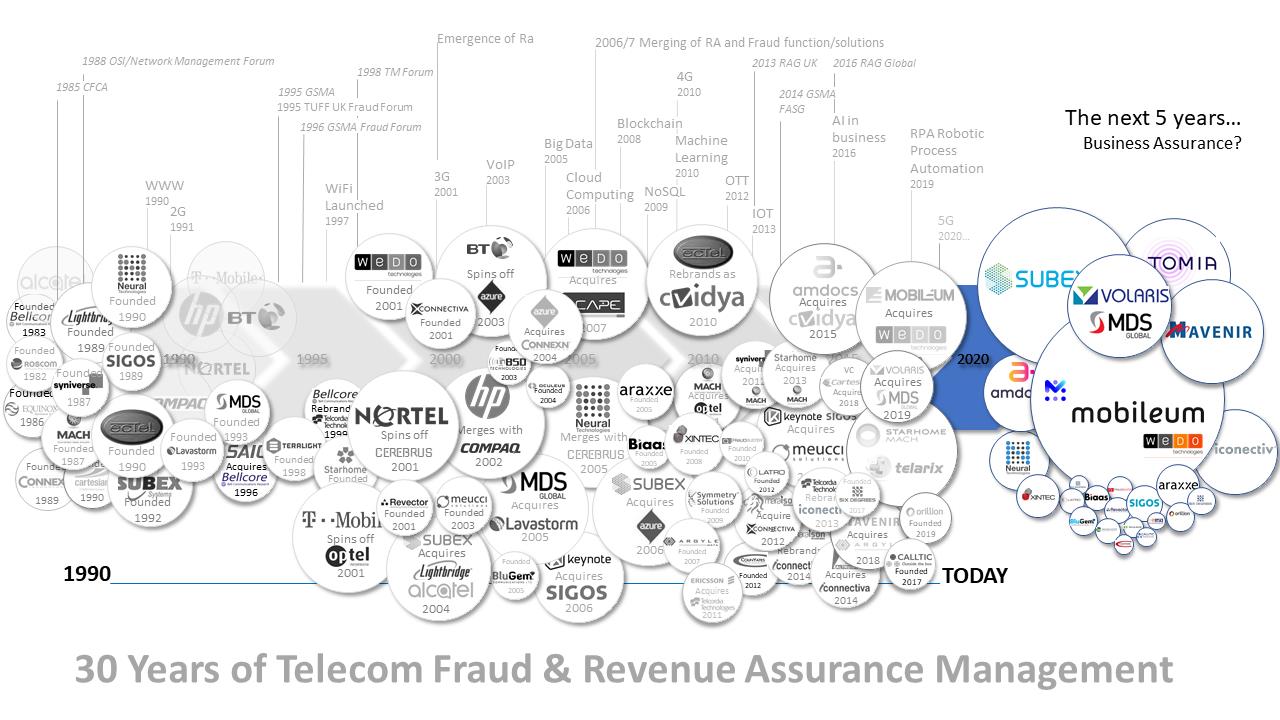

During 2005 and 2010, the emerging term revenue assurance become more prominent, with every telecom service provider having a revenue assurance function in some form. Fraud and revenue assurance departments slowly and steadily started to merge and consolidate responsibility, people and processes. This in parallel drove the risk management vendors to look at integrating their own fraud and RA offerings into a combined solution, says Luke Taylor, founder & director at LATeral Alliances Ltd.

Of course, apart from the ‘big 5’ there were a number of vendors looking to compete in the same playing field with the likes of Connectiva and Xintec showing their mettle and increased their presence with wins with tier 2 and 3 service providers in Africa and Middle East.

There were also start-ups, niche players and small businesses that competed for the risk management business, some focused on specific issues such as roaming fraud, simboxing, PABX abuse, etc. Companies like Revector who joined Sigos and Roscom in offering test call generation (TCG) services, reached well over a hundred carriers at their peak to detect bypass and simbox fraud. Revector which was one of the first to foray into sim box detection was joined by the likes of Meucci, Bluegem, Araxxe and latterly in the last decade Latro and Fraudbuster.

Revector once a big fish in a small pond became a small fish in a big pond. Today with CLI Spoofing and security / proximity solutions, Revector has diversified their product portfolio and customers to include government agencies and regulators. Latro are looking at revenue assurance and IoT and broadening their offerings.

Sigos are hard at work on building a M-IoT testing network across the globe. Blugem have focused on quality of service. Sigos acquired Meucci in 2014 to consolidate the market. Recent start-up CallTic, founded in 2017 by ex Meucci founder, successfully achieved a €1.5 million series A funding in 2020.

We also saw some changes in the industry forums with Risk & Assurance Group (RAG) being founded in London by Cartesian. The GSMA Fraud Forum after twenty years supporting the industry merged with the GSMA Security Group to become the GSMA Fraud and Security Group (FASG). Today the RAG has extended its reach from purely a UK based organisation with events hosted around the world, focusing on both fraud and revenue assurance.

Today, in 2020 we are left with only Subex and c from the original ‘big 5’ companies. Subex as previously mentioned has had its issues, with atmospheric expansion and a number of risky acquisitions that stretched themselves a little too far financially, today Subex with its large customer base has started to focus on risk management in the IoT and Smart City arena.

Subex Secure IoT security solution leverages a honeypot network that combines physical devices and device emulations to generate IoT / ICS signatures. The honeypot is a computer security mechanism set to detect, deflect, or, in some manner, counteract attempts at unauthorised use of information systems.

Neural Technologies, who have predominantly grown organically with a couple of acquisitions of distressed assets, have never really competed with the revenues and customer base of Subex or WeDo Technologies and today are focusing their intentions on data integration more than risk management. A very late adopter of revenue assurance capabilities, their customer base is predominantly fraud management installations.

Today we see the move to a solely IP-based infrastructure, the CSP becoming the utility provider with the likes of Over The Top providers (OTT) like Netflix, Facebook, etc. reaping the rewards on top of their considerable investments.

5G deployments are becoming more and more prevalent around the world, Internet of Things (IoT) after a false start has grown steadily, virtual SIMs / eSIMs, connectivity will flourish as 5G networks steadily launch. 5G infrastructures will be different from the more traditional past generations of telecommunications. Voice will be over IP and a by-product; data will be king.

Who will be responsible for fraud in this new paradigm?

What will the revenue assurance issues be?

Will security become a necessity with all fraud and assurance providers?

What is the future of Fraud, or is it business assurance?

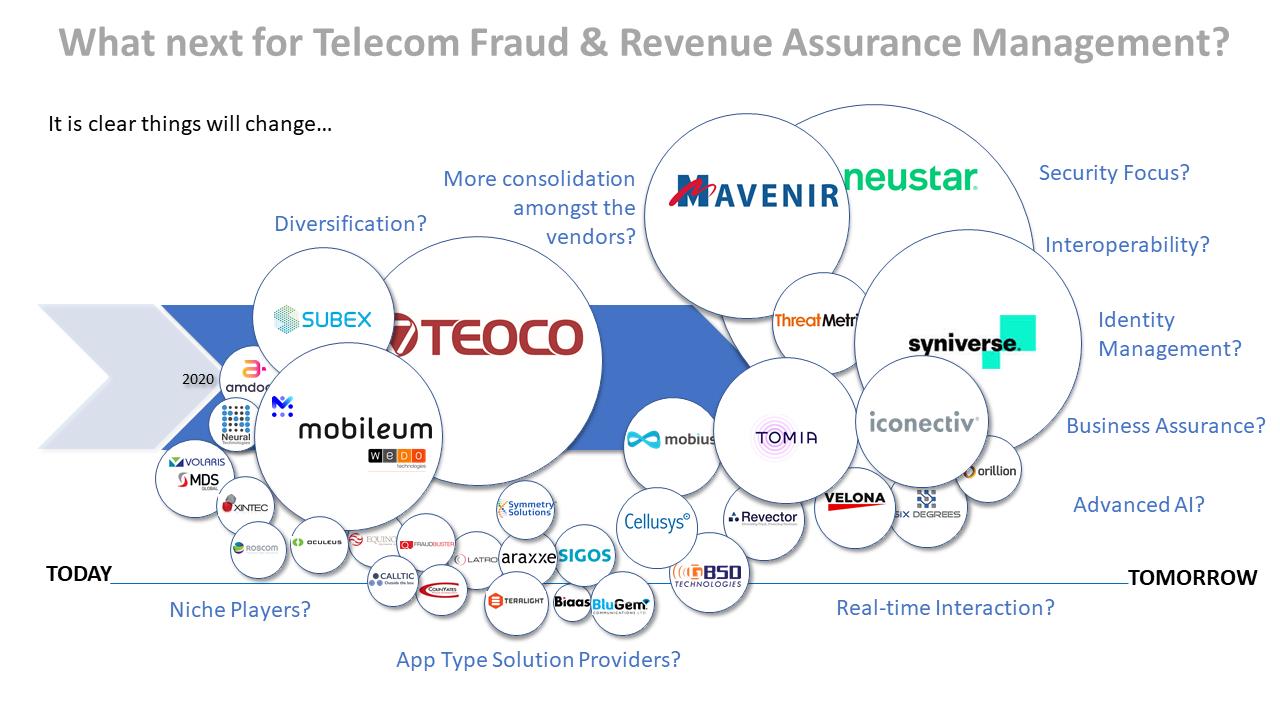

Will there be further consolidation in the industry?

Will new players appear, will legacy providers disappear?

We are seeing different companies attending, sponsoring industry forums, like Teoco, Neustar, Mavenir, Tomia, Threatmetrix who have expanded their offerings through acquisition and innovation.

Niche players, new and old such as Symmetry Solutions, GBSD and start-ups like Orillion are finding customers looking for quick and efficient deployments to show tangible benefits and value. Are the days of large ‘do it all’ solutions that can do everything except make the tea, but cannot be deployed quick enough to meet the fast-paced changes in the telecoms industry?

Will collaboration, consortiums be a common theme to ensure vendors can provide a comprehensive offering to meet the needs of the telecommunications service providers tomorrow and in the future?

Thirty years have flown by, there have been significant changes within the industry, dramatic changes in technologies and bigger expectations from the end user.

Today we see consolidation within the industry, what will occur in the next year, next 5 years, the next decade, the next thirty years…?.

The author is Luke Taylor, founder & director at LATeral Alliances Ltd.

Comment on this article below or via Twitter: @VanillaPlus OR @jcvplus