By now we all either foresee as providers or perceive as customers our dream of faster, smarter, more convenient, transformative digital world becoming a reality with 5G, but the key question is ‘how’ & ‘when’.

Communication Service Providers (CSPs) are thinking beyond providing baseline connectivity, ‘where’ is going to be their place in future ecosystem value chain and ‘what’ are their monetisation options. Report by Praveen Gundkal, business consultant at Tech Mahindra Ltd’s Telecom and Network team.

The road to CSPs 5G monetisation is not free of challenges

- The capital investment required in spectrum, radio access network, enhanced packet core (EPC) and IT infrastructure will be substantial.

- Organisations will have to adjust and transform, with Gartner estimating that 35% of roles in operators will be either new or redesigned.

- Creating effective monetisation opportunities will be essential to ensure maximum return on both capital and organisational investments.

- Dealing with legacy enterprise stack, lack of clarity on 5G potential use cases and understanding new customer base will be key.

COVID-19 pandemic impact also now to be taken into consideration: ‘The New Normal’

- Telecom is one of the most essential services and sectors at the time of this global pandemic. It has been a key enabler in helping government and businesses in timely communication, tracking and helping implement work from home.

- CSPs will have to gear front-end packages, services and customer acquisition funnel to meet the demand. This will create a demand for new set of operating models, content consumption, assisted ecommerce where CSP will play a vital role.

- CSPs will need to rollout their business continuity plans, contingency plans ensuring call centres, NOC are functioning in order to keep services stable and running.

- CSPs are expecting sharp drop in new subscribers and increase in current capacity from existing customers – voice network.

- A larger focus is needed for the small and medium-sized business (SMB) and Enterprise segment which will look to explore options to grow business – explained further using ecosystem and business models.

- A disrupted global supply & chain is going to impact handset manufacturers in fact leading manufacturers are closing down their centres in certain countries.

Point of view on how CSP can monetise from enabling 5G technology

Three areas below will give us a holistic view of what needs to be done to have an insight into CSP approach to monetise from 5G enablement –

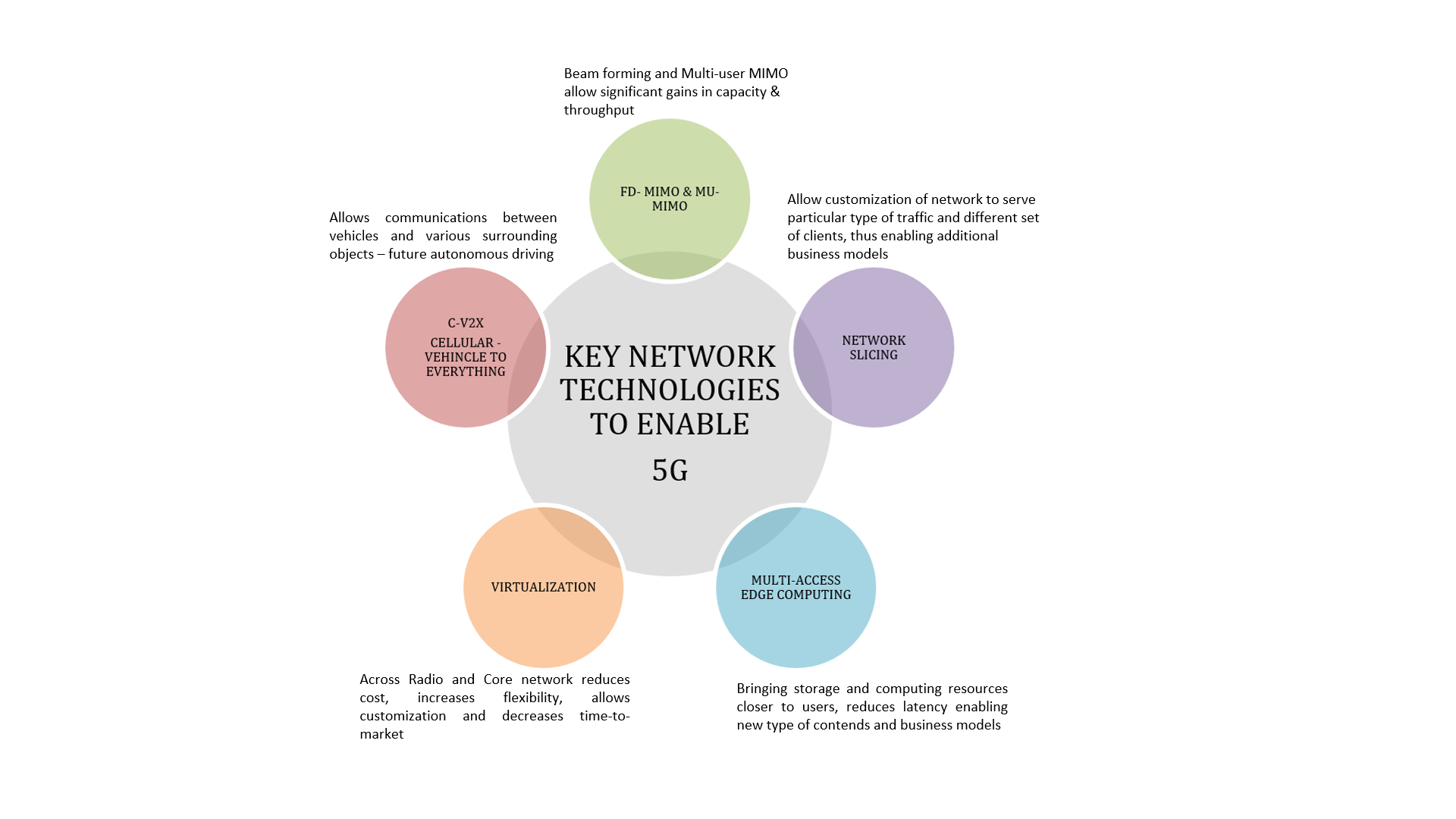

A) Pre-requisites to enable 5G technology as a service

B) Business operational framework – Getting the ‘RIGHT’ business model

B) Business operational framework – Getting the ‘RIGHT’ business model

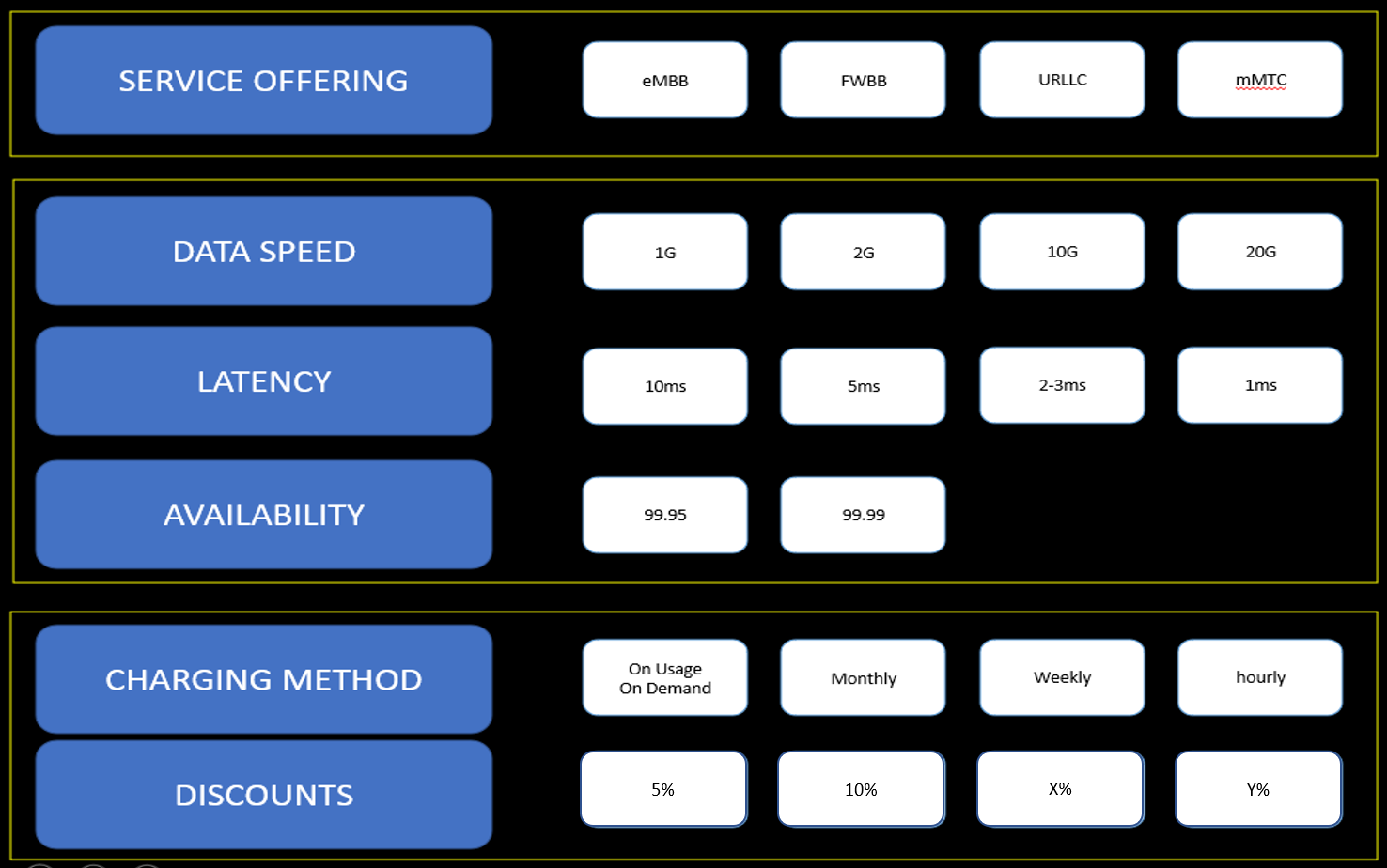

Communications service providers (CSPs) worldwide are under considerable competitive and financial pressure. This necessitates discussions about future business models, and for many operators talk quickly turns to the potential role for 5G in tapping new sources of revenue. An equally crucial aspect to 5G monetisation is having a clear business case for CSP offerings. But to build such business cases, CSP must first gain a clear understanding of the business models available to them. Every business model will require an understanding of what use cases the service will leverage, as well as how it will be monetised. So, the road from use case to monetisation must move through a clear understanding of the business models.

There are three main 5G Monetisation business models:

Business-to-consumer (B2C): This model will focus on offerings that leverage the 5G network to strengthen service offerings to end customers, such as fixed-wireless and content, and will also include increasing bundling of partner services. Monetisation elements of these offerings include QoS-based data, goods and subscriptions, such as content, media and partners.

Business-to-business (B2B): This is a large area of potential growth for service providers with opportunities to monetise embedded connectivity, managed connectivity and virtual network functions such as security. Service providers will have the opportunity to expand their relationships with enterprise to facilitate intelligent operations and automation as well as the potential to integrate partner solutions in their offerings. They can also leverage advanced use cases such as augmented reality (AR)-guided technical support.

Business-to-business-to-any (B2B2X): This may be the biggest potential growth area for operators. The flexible, virtual nature of 5G networks will enable service providers to equip application developers and device manufacturers with embedded connectivity and virtual network functions as a service, in order to power their products. This provides service providers with the opportunity to offer wholesale services that leverage open platforms for customers to onboard themselves, equip themselves with services and then settle with the operator easily and efficiently.

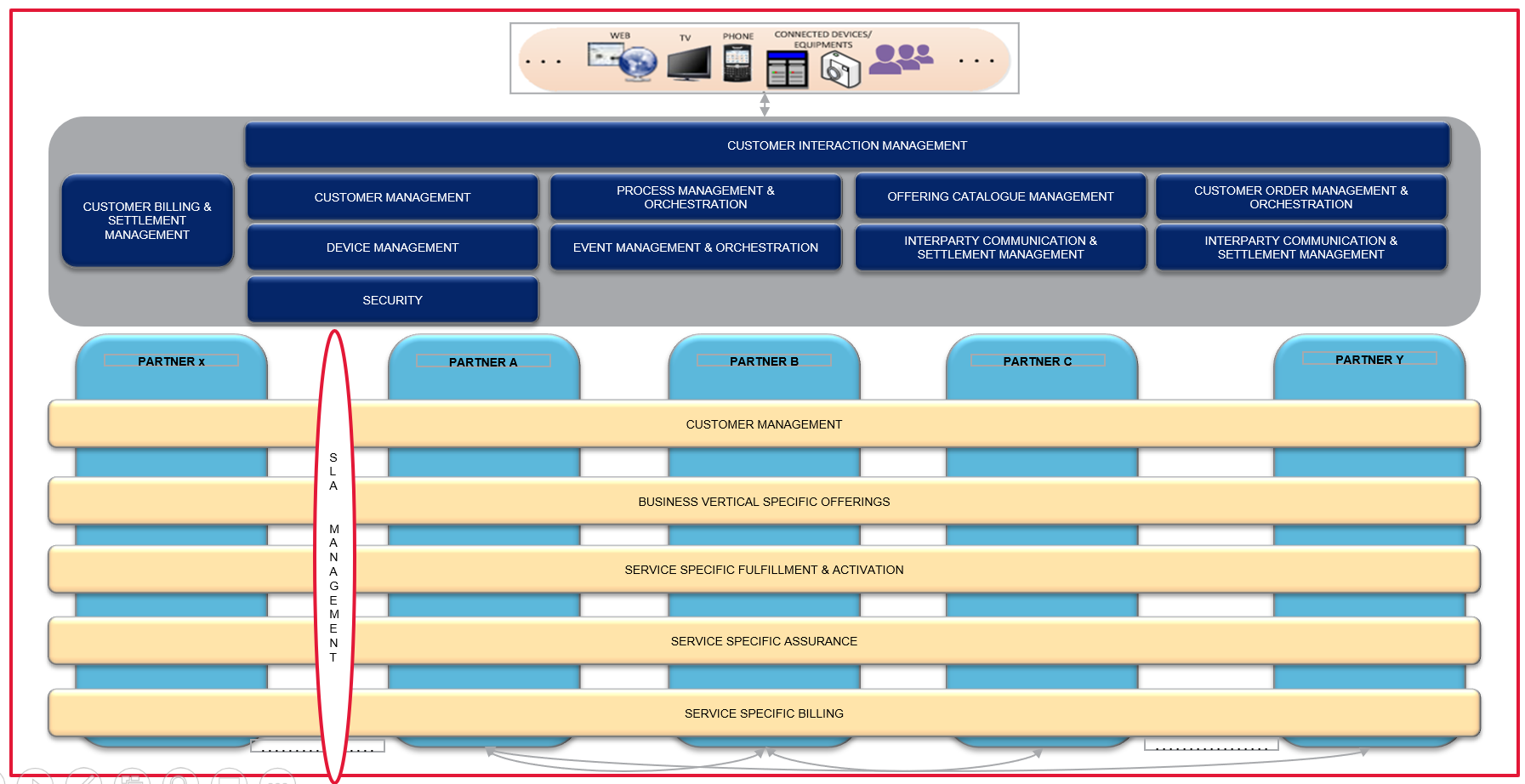

Proposed Business Operational Model High Level 0:

This is a skeleton business model on how CSP need to approach in order to create an efficient eco system per enterprise vertical for realistic monetisation achievement.

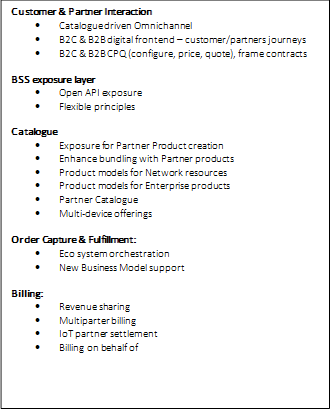

OSS/BSS capability readiness: CSP should be in a following position with OSS/BSS so that they are capable to leverage 5G potential in the right way to monetise and provide required CeX.

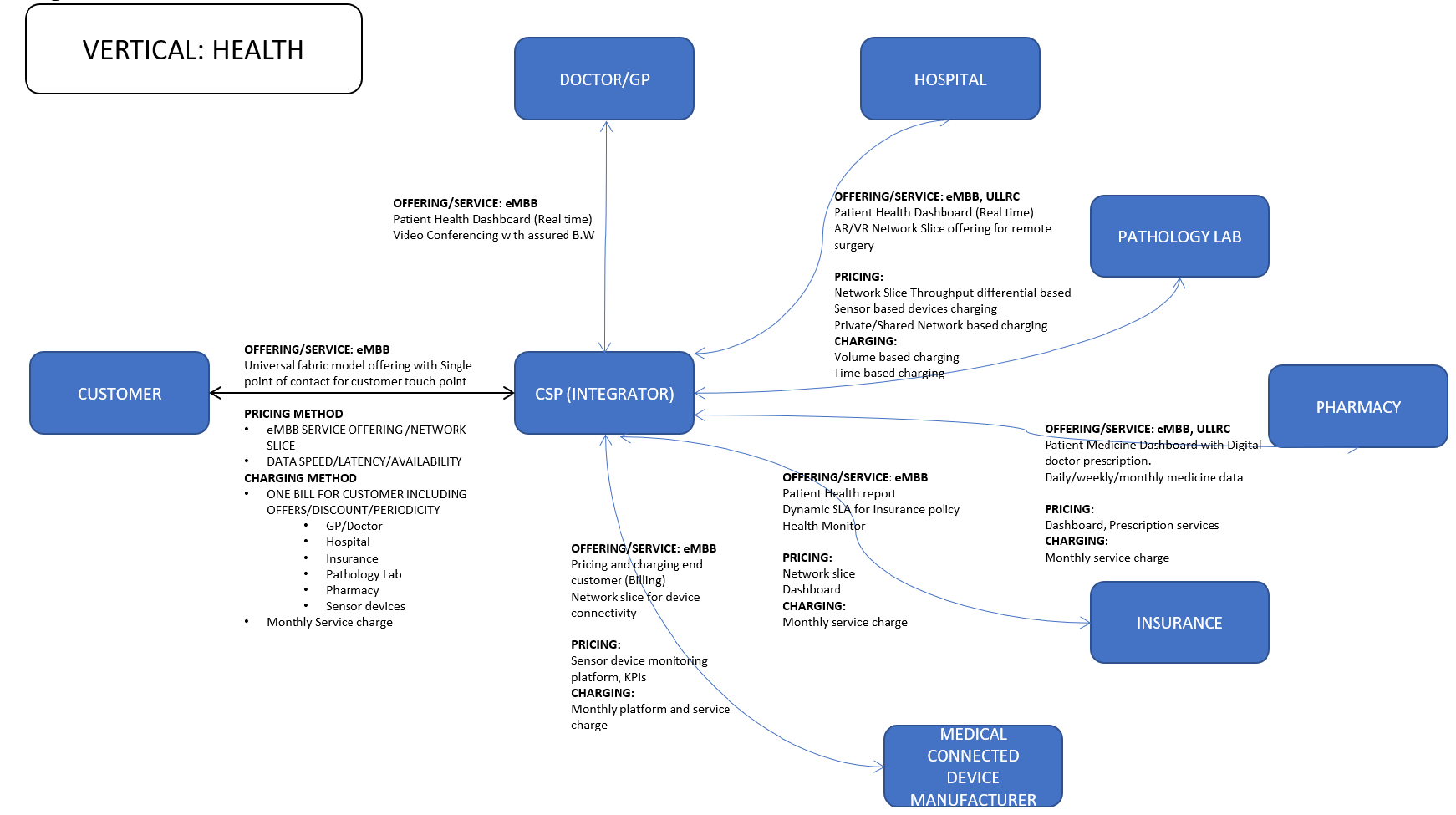

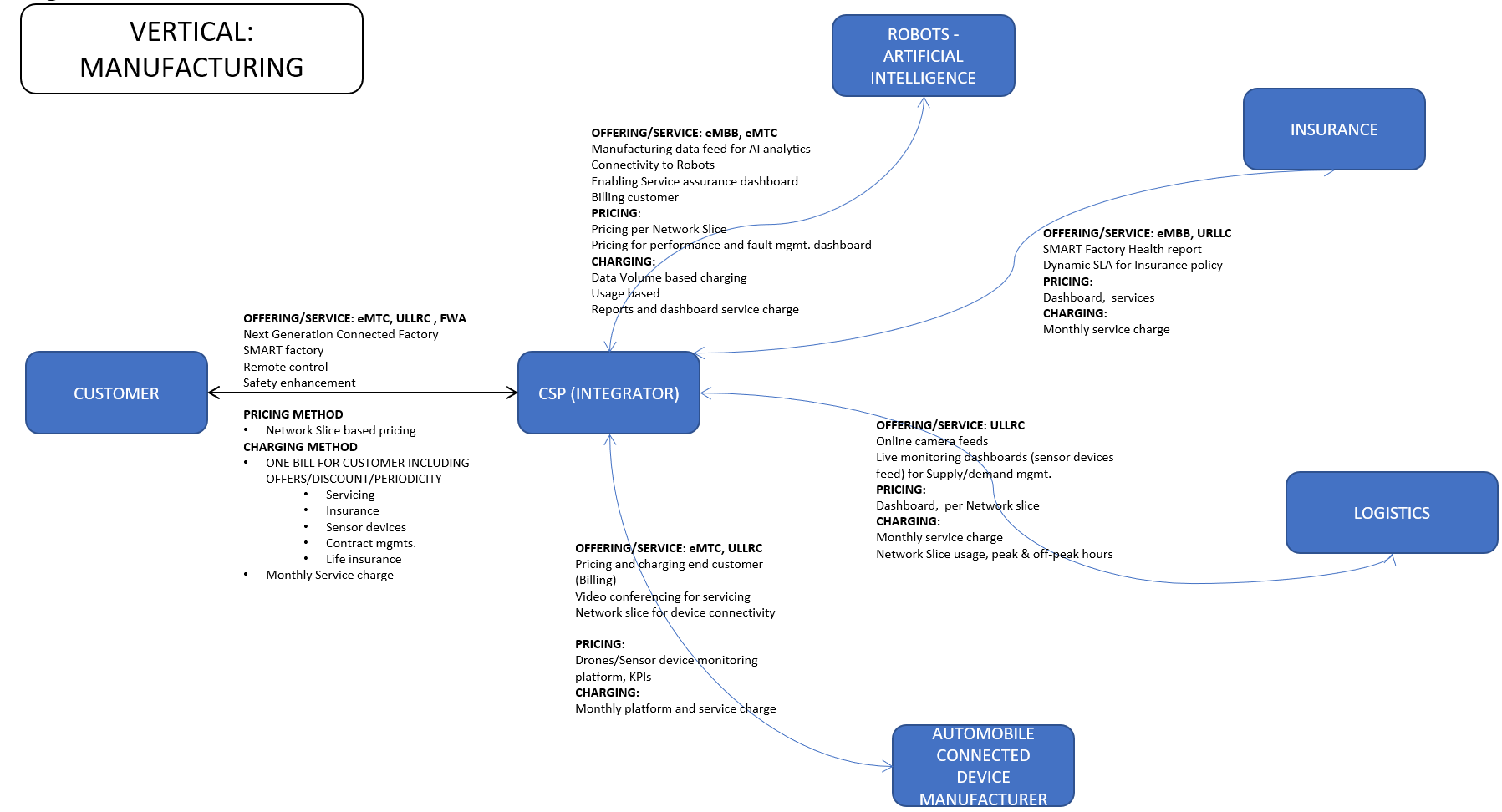

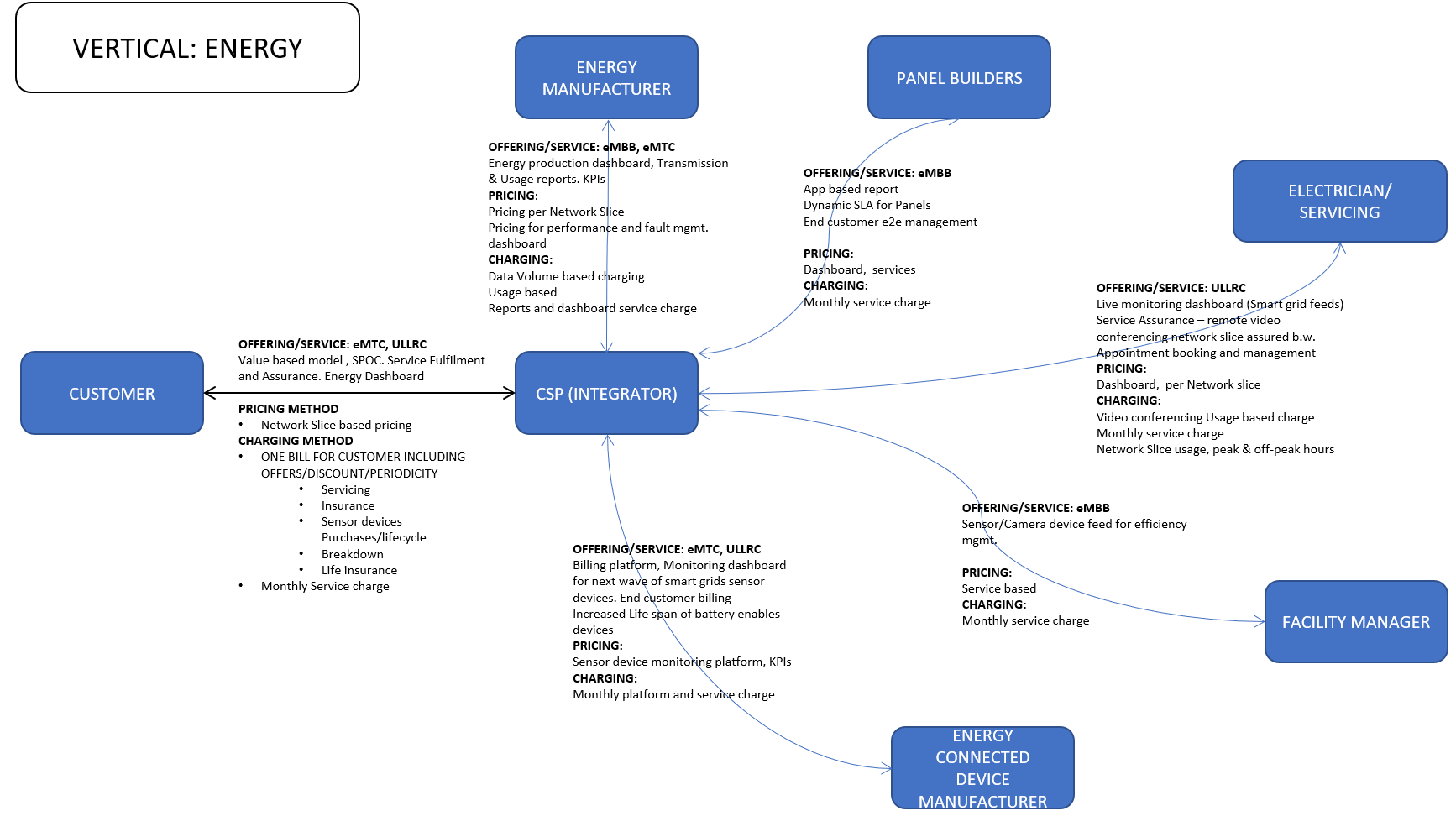

C) Future eco-system addressing business verticals

There will be expected customisation per vertical but in general operational model approach suggested in Figure 2 above is likely to follow. Verticals will have their specific demands like for example Gaming, Tourism, Real estate using AR/VR services requires real-time ultra-low latency service with assured B.W whereas B2C segment required high speed data and content services.

Below is a high level view of 3 key verticals provided for reference on what will be an ask in future from value fabric model perspective and how the verticals will have a requirement to be provided with an eco-system to maximise 5G technology potential, enabling next level for services for end customer and in turn possible monetisation options available through various routes (customers & partners) of handled and managed correctly by CSPs with necessary support structure in place.

Fundamentally, it is very clear that in future CSP will monetise on basis of partnerships and not on assets alone.

The possibility for Telecom Providers is to move from network provider to Integrator in a phased manner.

The authors are Praveen Gundkal (business consultant) is part of the Business Excellence (BE) practice at Tech Mahindra Ltd and Dr. Anand Singh is contributor and reviewer.

About the author

The author, Praveen Gundkal (business consultant) is part of the Business Excellence (BE) practice at Tech Mahindra Ltd. within the Telecom and Network team. He leads Network Portfolio as Service Design lead for CSP in UK and is responsible of Network capability launches. Currently engaged in the launch of 5G capability. He has taken part in a range of telecom projects in Europe and South East Asia. Praveen holds a bachelor’s degree is Electronics & Telecommunication.

Dr. Anand Singh is contributor and reviewer. He was formerly executive director in AT&T and Distinguished Member of Technical Staff at Bell Labs. He was responsible for providing Solution Engineering/Architecture for Software Defined Network/New Services and Network. Anand has 31 years of telecom industry experience in technology and business transformational programs, merger & acquisition, and strategic leadership in Advanced network & services and Emerging Technologies / Services. Anand is currently the Global Practice head in Tech Mahindra.

Comment on this article below or via Twitter: @VanillaPlus OR @jcvplus