In the second of a two-part article, Job Baldry, the marketing director of Infinera, explains that while 5G offers capacity, existing cellular networks rely heavily on fibre optic links to connect cell towers to the core network.

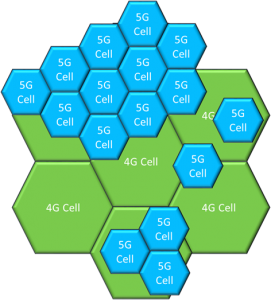

Although high speed wireless can bridge the gap when time or cost makes it impossible to lay fibre, the only technology to consistently support 5G’s surge in demand and quality of service will be fibre. Each cell of a capillary 5G network is far smaller than a typical 4G, but there are so many of them and the applications so demanding the total bandwidth demand in the transport network will be massive.

Figure 2: 4G and 5G cell coverage

It is therefore necessary to extend fibre as close as possible to the small cells in order to meet this demand. This fibre-deep evolution will not be achieved by simply multiplying existing fibre equipment and building it out into the metro space as needed – that would be a colossally expensive operation both in terms of real estate and equipment costs. Instead there will be a need to install many more compact and power efficient network nodes, wherever they can be economically accommodated. This could include remote telecom huts, street cabinets, cupboards or cell sites – locations quite unsuitable for housing racks of equipment that is optimised for a controlled telco environment.

Selecting suitable equipment will no longer be a simple matter of asking a preferred supplier to meet the required performance levels, it will be necessary to look much more closely at the specifications to see if devices are sufficiently rugged, compact and power efficient to survive where space and power supply are limited, and temperature and humidity levels more extreme. With a massive increase in the amount of fibre installations, commissioning and operating expenses will also soar, unless extra care is taken to choose the most compact, reliable and easy to maintain optical equipment.

Optical equipment suppliers are well aware of these challenges and are developing solutions more suitable for fibre-deep networking. The latest access optimised units can deliver 100Gbps at a mere 20 watts, packing over 400Gbps into one standard rack unit – about eight times the density of previous generation equipment.

What’s more, the industry has been working to bring the International Telecommunications Union’s (ITU) vision of autotuneable WDM-PON optics up to the performance levels required to support the reach and capacity requirements of 5G networks. This eases the pressures of commissioning and maintaining extensive dense wave division multiplex (DWDM) optical networks by replacing the technicians’ burden of determining and adjusting wavelengths at every installation. Autotuneable technology will automatically select the correct wavelength without any configuration by the remote field engineer enabling them to treat DWDM installations with the same simplicity as grey optics.

Pressure on the transport network

This far denser 5G access environment, even with greater intelligence located towards the edge, will put heavy pressure on the upstream infrastructure. In between times of change, buying patterns tend to stabilise towards the convenience of familiar, single vendor provision. With the shift to 5G we are already seeing greater competitive pressure between mobile operators, and between wholesale operators hosting 5G transport services. This is forcing buyers to demand higher performance, greater efficiency and more demanding specifications – driving a shift towards more aggregated best-of-breed solutions.

Higher performance is not all that is needed, there other significant changes taking place as 4G networks evolve towards 5G. Datacentre technology, such as spine leaf switching and network slicing, will increasingly migrate to the transport network to provide the flexibility to support more distributed intelligence and the need for MEC. Where 4G started with high performance dumb pipes connecting cell towers to the core, we are now evolving, towards a more flexible software-defined transport architecture.

As well as greater capacity, there are other demands that will not be met by many existing optical solutions. Among the refinements required for 5G, carrier aggregation enables the use of several different carriers in the same frequency bands to increase data throughput, rather as CoMP makes use of neighbouring cells. These solutions require new levels of synchronisation precision, as well as low latency. Mobile operators now buying equipment need to look closely at the specifications to ensure that they are not investing in systems that will become obsolete as 5G rolls out. There are already some nominally 4G mobile transport networks that meet the demanding 5G synchronisation and latency specifications.

5G-readiness is an ongoing development, and we can expect more early announcements of 5G services on the basis that they meet 5G speeds or other criteria, without providing the full 5G mobile service. Like owning a Ferrari, it’s a combination of marketing hype and status. Providers and nations are understandably keen to demonstrate 5G way ahead of the timescales favoured by the 3GPP standards body.

Major sporting events, with their massive global TV coverage, offer a stunning opportunity for operators to showcase their 5G capabilities. The 2012 London Olympics were the first smartphone Olympics, where spectators could simultaneously view the games close-up on their handsets. The 2020 Summer Olympics in Tokyo and the 2022 Winter Olympics in Beijing will vie with each other to highlight the way these nations are driving mobile 5G, as Europe once drove 3G and North America drove 4G. Europe and North America are also looking to showcase 5G, such as Elisa’s recent announcement of what is claimed to be the world’s first commercial 5G service in Finland. By 2022 we can expect there could be a significant number of Beijing Winter Olympics spectators using 5G virtual reality devices to spectacular effect.

Meanwhile mobile operators need to work steadily towards these capabilities with 5G-Ready mobile transport that an optimise 4G networks today and provide the high performance required for full 5G in the future. Operators can avoid investing in soon-to-be obsolete mobile transport technology, by seeking advice from experts at the leading edge of optical network equipment and design.