Telecoms operators worldwide are focused on transforming their businesses in order to become digital service providers (DSPs). Each operator has unique requirements and must take a personalised route to digital transformation. One of the core aspects of this transformation is a change in the way that operators engage with their customers across various customer touchpoints.

Operators’ strategies for these transformations must include:

- well-defined digital experience objectives with long-term plans for their execution

- an understanding of the competitive landscape so that digital functionality can be prioritised

- an ability to assess and measure their progress as they take digital initiatives.

Analysys Mason’s Digital eXperience Index (DXi) research is designed to support operators with the above aspects of their transformation initiatives. It focuses on helping operators to understand the competition in local and global markets, and assesses operators’ current maturity and progress.

Furthermore, because all operators take digital initiatives, the DXi research identifies the functional capabilities that operators can focus on to differentiate themselves within their markets. This article outlines the DXi study and provides learnings and insights from our research on operators in the Asia–Pacific (APAC) region

Operators that provide greater engagement functionality through their digital channels score highly in Analysys Mason’s DXi assessment

Operators need to adopt a ‘digital-first’ strategy as consumers are increasingly using digital touchpoints for customer engagement. This is no longer restricted to a specific demographic but is widespread, as reflected by the increase in smartphone handset penetration worldwide. However, most operators lack clarity on the functional capabilities and characteristics that they must enable on their digital channels.

Based on our understanding of consumer preferences, as well as a detailed understanding of functional characteristics and technology maturity, we created the DXi assessment tool to score various features based on their importance in affecting consumers’ digital experiences. These features were classified under marketing, sales or customer service, thereby capturing the entire customer lifecycle, and the emphasis was placed on prominent digital channels, led by operators’ primary smartphone apps (see Figure 1).

Figure 1: Overview of the Digital experience Index’s research criteria

The DXi research highlights the push for digital experience by operators in APAC, but few are adopting a ‘digital-first’ approach

In the first phase of our DXi research, we focused on the APAC region and covered 7 countries and 21 operators. 1 Our analysis highlights that operators are making progress in enabling greater engagement capabilities on digital channels.

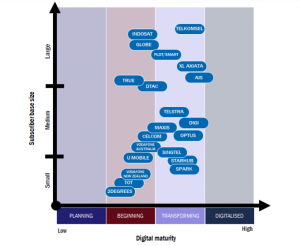

We placed all of the operators studied in the ‘beginning’ or ‘transforming’ stages of their journey, based on their DXi scores (see Figure 2); none have entered the ‘digitalised’ zone as yet.

Our research highlights that the smartphone apps of nearly all operators in the APAC region offer

- the ability to view usage information

- the ability to purchase basic top-ups or bundles

- the delivery of ecommerce offers from third-party businesses (such as retail outlets or restaurants).

The above features demonstrate that operators are enabling digital engagement. However, very few operators have adopted a ‘digital-first’ strategy, that is, one that moves customers to digital channels and focuses on improving in-app engagement functionality. For leading-edge operators, a digital-first approach includes enabling advanced functionality such as message-based support within the smartphone app (as used by Digi and Optus), the ability to purchase new services (implemented by Spark and XL Axiata) and the offer of personalised deals based on customers’ usage (Optus has enabled this).

Very few operators have enabled these capabilities. In addition to these, operators also need to improve the performance of their apps in order to achieve digital-first status. End-user reviews on smartphone app stores are a reflection of app performance, and in our study, only DTAC averaged 4 or more (out of 5) on both Apple’s and Google’s app stores.

Most operators scored highly in our DXi assessment for their websites, as these have historically been the primary self-service channels, and as such, operators have enabled them with advanced engagement capabilities. However, customer service features, such as live chat agents, were used by only a few operators despite their ability to reduce customer effort and improve customer experience.

Figure 2: Analysys Mason’s Digital experience Index, Asia–Pacific, 2018

The successful use of virtual assistants and chatbots is another capability that can truly differentiate an operators’ digital experience. Our DXi research indicates that nearly two thirds of operators in the APAC region are experimenting with virtual assistants, with most focusing on customer service. Telkomsel in Indonesia was the only operator in our study that had addressed all three capabilities of interest (customer service, sales and marketing) with their virtual assistant ‘Veronika’.

Our digital experience research is ongoing

In addition to undertaking studies on digital experience maturity, we are also correlating our DXi findings with insights from Analysys Mason’s Connected Consumer Survey, to highlight how a rich digital experience can support operators’ business objectives. For example, our preliminary findings suggest that consumers’ intention to churn decreases with an increase in operators’ digital experience maturity. We plan to continue publishing reports as new insights are generated

We are currently working on assessing operators’ digital experience maturity in other regions of the world. All of our findings from this research will be published in the Digital Experience programme.

Comment on this article below or via Twitter: @VanillaPlus OR @jcvplus