Mobile operators have a significant opportunity to offer LPWA solutions, but competition will be intense. The leaders have decided which technology to support – for example, AT&T has opted for LTE-M, Orange uses LoRa and LTE-M and Vodafone has gone for NB-IoT.Many other operators, especially smaller ones, have yet to make a firm commitment, but some challenger operators are planning to deploy different technologies to the market leaders. This article, based on our detailed report on approaches to LPWA, examines the options they face and the factors that will affect their decisions.

For the traditional mass-market smartphone opportunity, the technology upgrade path, through flavours of 2G, 3G and 4G, was clear. IoT is a new market and the old rules do not always apply. There are clear benefits for operators willing to take a risk on an alternative strategy from the leaders. This article examines the options they face and the factors that will affect their decisions, says Michele Mackenzie, principal analyst and Tom Rebbeck, research director, Enterprise & IoT at Analysys Mason.

Operators have three main approaches to LPWA technology choice

Mobile operators have three main options to consider when choosing an LPWA technology. They are as follows.

- Follow the leader: The challenger operator chooses the same technology as the market leader. For example, if the leading operator is launching LTE-M then the challenger would do the same.

- Choose an alternative to the leader: The challenger operator chooses a different technology to that of the market leader. For example, if the leader chooses LTE-M then the challenger will deploy NB-IoT.

- Wait and see: The challenger operator waits for a winning technology to emerge before committing.

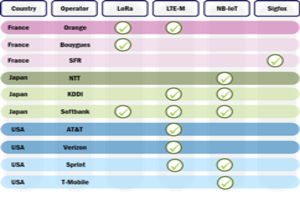

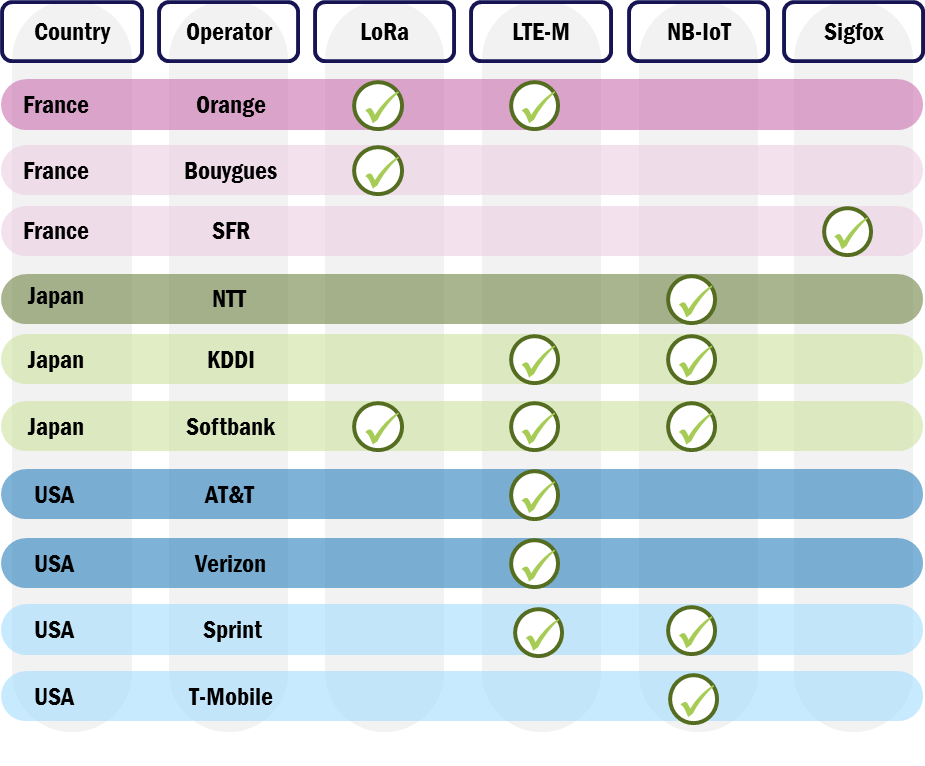

With LPWA, challenger operators have an opportunity to differentiate. Figure 1 illustrates some of the technology choices that leading and challenger operators have made. There is currently no clear trend on the approach that challenger operators are taking; some follow the leader, others do not.

Some of the advantages for challenger operators to deploy a different LPWA technology are as follows.

- The alternative technology will be better suited to particular use cases. It is uncertain how large the differences between NB-IoT and LTE-M will be in terms of price and performance, but if NB-IoT does have clear price advantages or longer battery life than LTE-M, it will be more attractive for some applications such as metering. This could benefit T-Mobile USA. Moreover, challenger operators could benefit enormously if their chosen technology is used for a mass-market proposition. For example, if LTE-M is used by a future Apple Watch, KPN would be in a strong position in the Dutch market compared with its competitors, T-Mobile and Vodafone, which are focused on NB-IoT.

- An alternative technology could open up the enterprise market. Most challenger operators have a limited presence in the enterprise market. An alternative technology with clearly differentiated performance could help open new enterprise opportunities.

- It should reduce competition based purely on price. If all three/four operators offer the same network technology and coverage, strong price competition will be inevitable. Different technology options should put some limits on this price competition, which may benefit all operators.

- The operator may be in a better position to support multi-country contracts.Deutsche Telekom will be able to offer NB-IoT connectivity across all its countries, while Orange can offer LTE-M everywhere it is present. This would not be possible if the operator followed the market leader in each country it is present. Large operator groups, like Vodafone, may also generate some cost synergies from deploying the same technology in all countries.

A strategy that involves selecting an alternative technology also has disadvantages for challenger operators:

- Advantages may only last a short time because it is relatively inexpensive and quick for competitors to upgrade their existing infrastructure to support the same technology

- Big opportunities may be missed, for example, if the strongest area of demand is for NB-IoT-based solutions and they only offer LTE-M

- Local developers may focus on the technologies offered by the leading players

- They may end up supporting a redundant technology.

Naturally, these disadvantages are inverted if the challenging operator chooses a different technology from that offered by the leading operator.

Should LPWA operators wait and see?

Operators also need to consider the consequences of being late to market if they adopt a wait-and-see approach. The appeal of waiting is clear: the existing enterprise base is limited and NB-IoT or LTE-M are relatively quick to deploy.

However, operators with ambitions to play a role in IoT risk foregoing a valuable learning experience in the early LPWA market and the opportunity to capture some of the early demand. Bouygues Telecom, KPN and Swisscom all gained valuable expertise by entering the market early with LoRa, which should help them when developing 3GPP IoT networks.

Challenger operators should consider a fresh approach to LPWA technologies

Challenger operators that are developing strategies to enter the LPWA market should carefully evaluate the benefits of adopting a different technology to the market leaders. Differentiation in the LPWA market will be critical given low connectivity revenue and heightened competition from proprietary LPWA players.

This may require a bold strategy but could pay dividends by differentiating the proposition and allowing challenger operators to compete on more than just price.

The authors of this blog are Michele Mackenzie, principal analyst and Tom Rebbeck, research director, Enterprise & IoT at Analysys Mason.

Comment on this article below or via Twitter: @ VanillaPlus OR @jcvplus