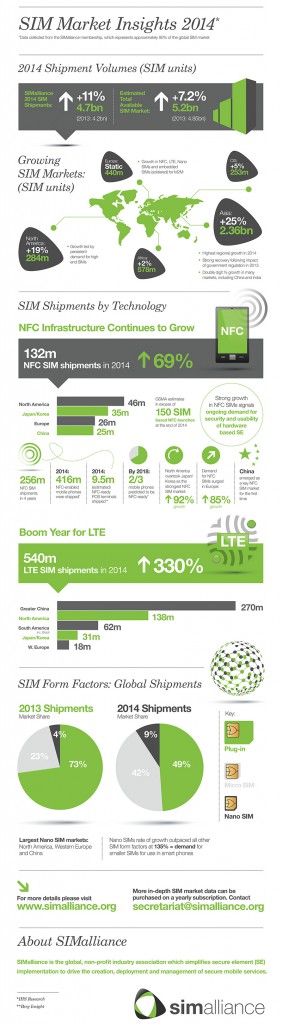

The SIMalliance membership, which represents approximately 90% of the global SIM card market, has reported an 11% year-on-year increase in SIM unit shipments in 2014. The total volume of SIM cards shipped by SIMalliance members in 2014 was 4.7 billion, rising from 4.2 billion in 2013. SIMalliance members estimate that the total available market for SIM cards has also increased by 7.2%, from 4.85 billion units in 2013 to 5.2 billion in 2014.

Asia saw the highest regional growth, with 2.36 billion units shipped in 2014 representing a 25% year-on-year increase. As anticipated, the region made a very strong recovery following the impact of government regulation on volumes in 2013, with many individual markets – including India, which was particularly affected last year, and China – reporting double digit percentage growth. Continued market expansion is expected across the region throughout 2015, fuelled in part by the sustained roll out of 4G networks via a growing number of mobile network operators, and the resulting demand for LTE SIM cards.

In North America, shipments rose 19% to 284m in 2014, thanks to persistent demand for high end SIM products. Continuing migration to 4G networks in the region led LTE SIM volumes to increase by over 110% across the year, while advances in secure element (SE) based NFC deployments, including successful initiatives in Canada, resulted in NFC-enabled SIM volumes rising by 92%.

In North America, shipments rose 19% to 284m in 2014, thanks to persistent demand for high end SIM products. Continuing migration to 4G networks in the region led LTE SIM volumes to increase by over 110% across the year, while advances in secure element (SE) based NFC deployments, including successful initiatives in Canada, resulted in NFC-enabled SIM volumes rising by 92%.

Shipment volumes increased across the Commonwealth of Independent States (CIS) and Africa by 5% and 2% respectively, while the market in Europe remained static yet technically progressive, buoyed by increased volumes of NFC-enabled SIMs, LTE cards, nano SIMs and M2M SIM shipments.

Globally, the growth trend for NFC-enabled SIM shipments, which has now been evident over the past four years, continued throughout 2014, as units soared by 69% from 78 million in 2013 to 132 million units.

- Based on SIMalliance shipment data, for the first time North America outperformed Japan/Korea and became the strongest NFC SIM market in 2014, with shipments jumping 92% to 46 million.

- Japan/Korea was the second NFC SIM market with 35 million units.

- Demand for NFC SIMs surged in Europe; units shipped rose by 85% to 26 million.

- China emerged for the first time as a key NFC SIM market, with reported shipment volumes reaching 25 million units.

The rapid rise in NFC-enabled SIMs throughout 2014, signals continuing demand for the security and usability benefits that hardware based SEs can deliver in NFC deployments. GSMA estimates suggest there were in excess of 150 SIM based NFC launches at the end of the year.

Further evidence that the NFC market has gathered substantial pace in the past twelve months can be found in the continued consolidation of the infrastructure which enables wide-spread and mass market NFC transactions. IHS estimates that 416 million NFC-enabled mobile phones were shipped in 2014, and units are predicted to rise to 1.2 billion – or two out of three mobile phones – by 2018. Berg Insight estimates place the number of NFC-ready Point of Sale (POS) terminals that were shipped last year at 9.5 million.

Globally, LTE SIM shipments enjoyed another boom year, with volumes rising 330% to 540 million. North America (138 million units) was superseded by Greater China (270 million units) as the LTE SIM market in 2014, thanks to China’s mobile network operators (MNOs) acquiring millions of LTE subscribers as they continued to roll out access to 4G networks. LTE cards shipped in China were localised solutions based on regional standards. South America including Brazil (62 million units) and Japan/Korea (31 million units) also saw large increases, them to become the third and fourth strongest LTE markets respectively. Western Europe’s LTE volumes also grew solidly (18 million units).

Once again, Europe was the major contributor to a 106% increase in the number of shipments of embedded SIMs (soldered) designed specifically for M2M applications. Volumes also grew significantly in Asia. The figures indicate a strong future opportunity for embedded SIMs in the burgeoning global M2M market, particularly in key industries such as automotive and energy/utilities.

Growth in the market for nano SIMs held strong at 135%; this rate of growth outpaced all other SIM form factors, reflecting an increasing demand for smaller SIMs for use in newer models of smart phones. As a percentage of the entire SIM market, nano SIMs grew from 4% in 2013 to 9% in 2014. Multiple markets expanded their nano SIM volumes in 2014, yet the largest markets were North America, Western Europe and China.

SIMalliance chairman, Hervé Pierre, comments: “The data released by SIMalliance today gives a powerful insight into the current good health of the SIM industry. A 7.2% market expansion, together with an 11% uplift in SIMalliance member shipments across 2014, shows that despite regulatory, economic and market maturity challenges continually faced by individual countries, the SIM industry is thriving. Innovation across the marketplace is driving an evolution in SIM products and the industry continues to ensure that current and future business requirements are front of mind. The SIM continues to be the most widely distributed secure application delivery platform in the world and today’s announcement highlights that the platform is growing even further. It’s positive news indeed for the industry.”

With specific reference to the NFC market, Hervé comments: “Last year’s growth in NFC-enabled SIM shipments shows that demand is strong in this market. With the launch of Apple Pay, 2014 was a progressive year for the entire NFC ecosystem and all signs indicate that the NFC market will enjoy continued growth throughout 2015 and beyond. The future NFC landscape will certainly consist of SE-MNO and eSE-OEM models, together with hybrid deployment models, and the co-existence – even convergence in some cases – of different NFC technologies opens up unlimited opportunities for all NFC stakeholders. The continued expansion of the NFC market is welcomed by SIMalliance as it will serve to further expedite growth in the whole SE market.”

SIMalliance members represent approximately 90% of the global SIM card market. Members include Eastcompeace, Fundamenture, Gemalto, Giesecke & Devrient, Incard, Kona I, Morpho, Oasis Smart SIM, Oberthur Technologies, VALID, Watchdata, Wuhan Tianyu and XH Smartcard (Zhuhai) Co. Ltd.