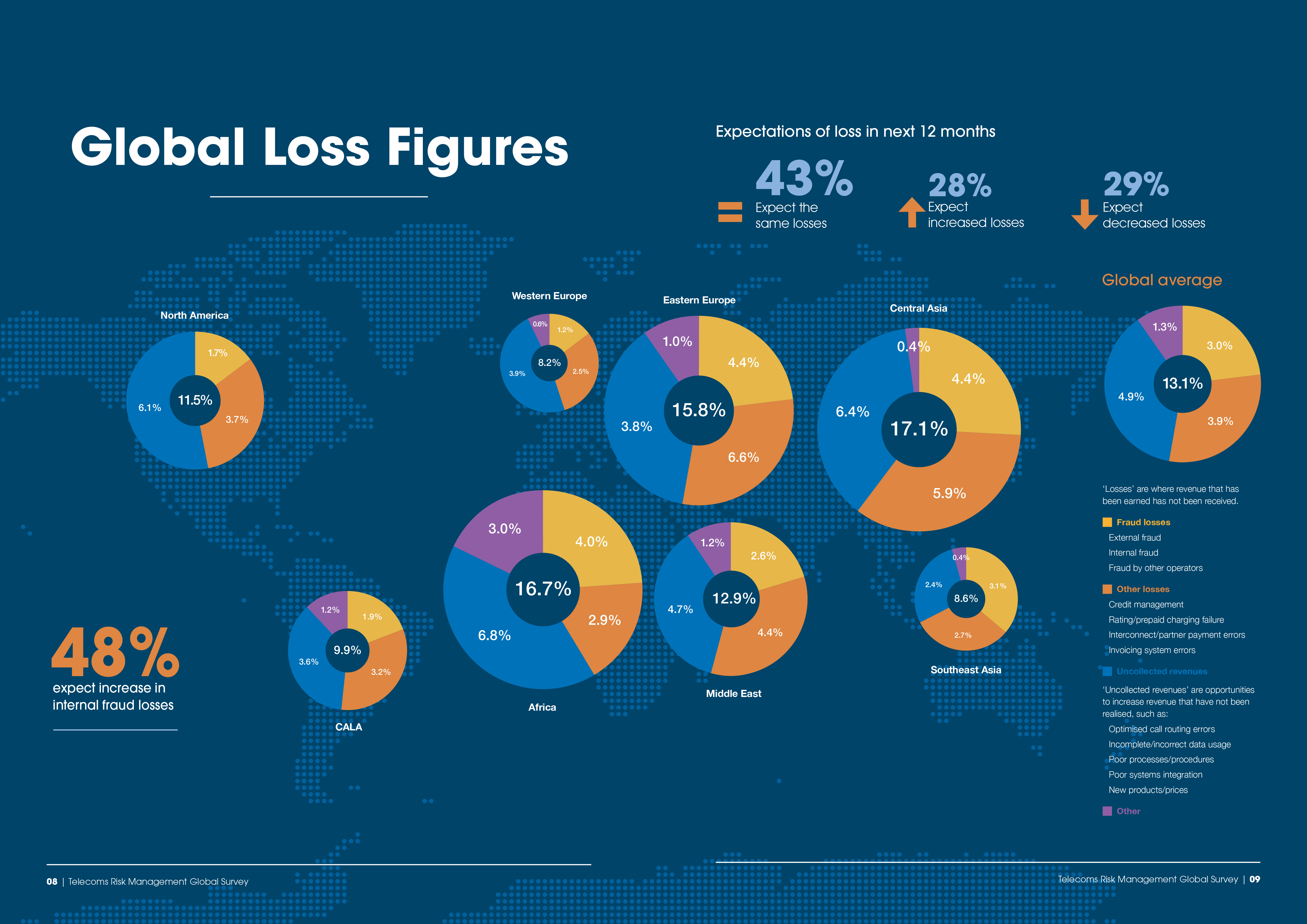

Neural Technologies has announced the results of its Telecoms Risk Management Global Survey 2016. Telecoms operators face an estimated global average loss of 13.1% or US$294 billion* resulting from uncollected revenue and fraud.

More than 100 telecoms fraud experts completed the survey which reveals that revenue loss varies widely by region, with Central Asia seeing 17% losses compared to a relatively modest 8% in Western Europe. Hard revenue losses – such as external fraud, bad debt and internal fraud – totalled 6.9%, (equivalent to approximately $155 billion) with missed revenues, for example sub-optimal call routing, poor processes and incorrect data usage, accounting for the remaining 6.2% ($139 billion).

Chief commercial officer, Luke Taylor, commented: “The Neural Technologies Telecoms Risk Management Global Survey 2016 has given us a valuable snapshot of the telecoms industry from the operators themselves. The main findings include the fact that, in more than 50% of companies surveyed, the CFO is the most senior individual responsible for fraud, credit risk and revenue assurance – which reflects our understanding based on talking to many CSPs in the past few years, so the buck really stops there, and we think that CFOs will find the report particularly useful.”

“In addition, when it comes to managing risk, our respondents cited ‘knowledge sharing’ as equally important as the ‘underlying systems.’ Neural is keen to encourage the exchange of information between peers and this was an important discussion at our 2015 User Forum. The telecoms sector is significantly expanding its services around the world with faster broadband, 4G/5G roll-out and more connected devices. Our survey reveals that new services create both new revenue opportunities and risks for operators and the challenge is to secure the upside and minimise the losses,” Luke Taylor added.

Neural Technologies’ solutions empower organisations to minimise financial risk to their business, providing comprehensive risk management capability in the areas of application risk, fraud, credit risk, customer attrition, collections and revenue assurance.

* Dollar figures based on Estimated Global Revenues from CFCA 2015 Industry Survey.

To request a copy of the Survey Report, visit www.neuralt.com/globalsurvey2016 or for further information email info@neuralt.com

Comment on this article below or via Twitter: @VanillaPlus OR @jcvplus