In Europe and North America most countries have now completed their switchover from analogue to digital terrestrial TV, with the resulting 700 or 800 MHz spectrum allocated by auction to Mobile Network Operators (MNOs).

Although a number of African countries will not complete the digital switchover before the original 17th June 2015 target, many African Telecommunications Union members have started the switchover and will soon be able to simultaneously allocate the 700 and 800 MHz band Digital Dividend (DD) spectrum once the details have been finalised at WRC-15 in November.

This DD spectrum is very attractive for MNOs for rural coverage and indoor urban penetration, as the number of cell sites required is much lower than at higher frequencies. However, the network will still require a significant investment for any operator on top of any licence and spectrum fees. For many European MNOs, the DD has been one of the key drivers to enter into network infrastructure sharing arrangements. CapEx and OpEx savings from network sharing are maximised if implemented before rolling out new technology, and will typically be at the higher end of the 25-40% range.

In any market there are usually numerous network sharing options in terms of potential partners, geographical scope, technical scope, and sourcing. There will also be a set of future scenarios that must be considered; the outcomes from the DD spectrum awards, potential operator consolidation and, in some cases, a new entrant. The value of the DD spectrum will vary considerably across these sharing options and future scenarios. Thus network sharing strategy and spectrum strategy are intrinsically linked and have a significant impact on the Enterprise Value of an MNO.

All the sharing options and spectrum scenarios need to be evaluated objectively in a comprehensive business case in order to identify the most attractive partner, ideal scope/approach for sharing and spectrum bidding strategy – but timing is critical. If an MNO does not quickly develop its integrated network-sharing and spectrum strategy well in advance of any spectrum auction or allocation, it risks the savings being sub-optimal or even non-existent in the case of a three-player market.

Developing such a strategy has become increasingly difficult with the availability of more frequency bands and new technologies, coupled with the explosive growth in mobile data traffic seen in more developed markets. As the number of combinations of sharing options and future spectrum scenarios grows rapidly, good traffic forecasts become extremely important.

A best-practice approach has the following features:

- Traffic forecasts: built on local, historical information but factoring in the knowledge and benchmarks from other markets; such forecasting requires a high level of expertise supported by a good database.

- Spectrum scenarios: taking into account the current situation and identifying all future possibilities, including any potential operator consolidation or new entrant; experience from other markets is critical to ensure that every scenario has been identified and the technology roadmap described in sufficient detail.

- Network sharing options: with more than 75 passive and active RAN-sharing deals completed worldwide, just about every possible sharing option has been implemented somewhere; a deep understanding of these deals is important in order to develop a realistic set of options and an estimate of their potential benefits.

- Business modelling: requires the design, build and test of an integrated commercial, technical and financial model to evaluate the multiplicity of spectrum scenarios and sharing options. Better still is to use an existing, purpose-built, tried-and-tested model such as Coleago’s to save time, improve quality and reduce risk.

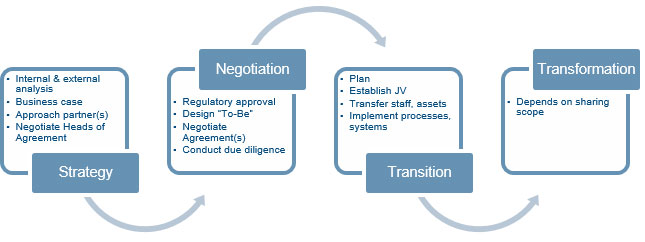

If this approach is adopted, the deliverables and next steps will be to determine the spectrum bidding strategy and valuations, with and without network sharing. After this it is possible to determine the network sharing strategy and, if attractive, negotiate a Heads of Agreement with the preferred partner before it is too late and the advantage is lost.

By Chris Buist, Director, Coleago Consulting